The China New Economic Research Institute and Alipay jointly issued the first “Post-90s Savings Report” in July 2019. The report shows that 92% of the post-90s, people born between 1990 and 1999, have a surplus with their salary every month, and 80% of the people manage the surplus. By comparing their Yu’e Bao, Alipay’s monetary […]

Yu'E Bao

Yu'E Bao, or “leftover treasure” launched in May 2013 by Tianhong Asset Management (51% owned by Ant Group), is an investment fund making money from interbank market as the Chinese government caps deposit interest rates on bank accounts.

Yu'E Bao was previously part of Alibaba Group and is now part of Ant Group and managed by Alipay. Its size was RMB200 million (USD 32.44 million), the biggest money-market fund in China and one of the biggest in the world.

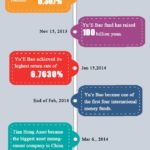

It offers users a higher rate than deposit rate of about 3.3% in the bank and the convenience of instant withdrawals. Yu’E Bao fund users surpassed 30 million in November 2013, fund size reached 100 billion yuan (USD 16.32 billion). It was the first Chinese money fund over 100 billion yuan, ranking 51 in the world.

It hit 185.3 billion yuan (USD 30.06 billion) by the end of 2013, accounted for 6% of fund market and became the largest single fund in China.

Yu'E Bao took the global lead for assets under management in 2017, but has recently fallen behind money market funds managed by JPMorgan and Fidelity, according to data from Fitch Ratings.

The Yu'E Bao fund has $157 billion in assets under management as of December 2019, compared with around $268 billion in March 2018.

Read more: Yu'E Bao's First Year of Development [INFOGRAPHIC]

Yu’E Bao users 50 year-old and above grew by 40% in Q3 2017

Alibaba recently released a report entitled “Mom and Dad’s Mobile Internet life” which shows that the national middle-aged preferred 3C and home appliances when shopping online.

Alipay’s internet fund Yu’E Bao exceeds 1 trillion yuan in Q1 2017

Yu’E Bao grows by over 40% QoQ in the first quarter of 2017 and totals 1.14 trillion yuan (US$170 bn).

Alipay to charge service fee from Oct 2016

Alipay will start to charge service fee for cash withdrawal (balance transfer from Alipay account to bank deposit accounts) from 12 October 2016 as it announced earlier today.

China Fast-Growing Internet Investment Product Insights in 2014

Nowadays, the penetration of internet investment products has exceeded 45% in china. The internet investment products, such as P2P, Yu’E Bao, WeChat Licaitong and so on, are very popular among internet users according to research of Nielsen.

Yu’E Bao Exceeded 578.9 Bln Yuan in 2014

Tian Hong Fund released the news on 5 January 2015 that as of 31 Dec 2014, Yu’E Bao’s exceeded RMB578.9 billion (US$94.09 billion), contributing over 98% of Tian Hong Fund’s total capital.

Yu’E Bao Grew to 149M Users in Q3 2014

Tianhong Fund disclosed the report of Yu’E Bao’s first three quarters’ performance in 2014 on 24 October. As of 30 September 2014, total transaction value of Yu’E Bao exceeded RMB534.9 billion ($87.46 billion) with a decrease of 6.8% quarter on quarter in Q3 2014.

Taobao & Yu’E Bao Offers Money-making “Tour Packages”

Alipay Yu’e Bao and Taobao Trip launched Lvyou Bao, or “travel treasure”, a travel product with investment benefit. How it works: Consumers pay for travel service on Taobao with Yu’e Bao after which the paid money is not in fact spent but “frozen” until consumers confirm the travel service. During the “frozen” period, consumers can […]

INFOGRAPHIC: Brief History of Alipay Yu’E Bao’s Rapid Development in China

Alipay’s Yu’E Bao, linked with monetary fund, is a value added service of Alipay serving as an alternative investment way for China internet users. It’s been launched for a little over one year; let’s take a look at its journey of rapid development.

Jack Ma Acquired Hengsheng Group With 3.3 Billion Yuan, Became The Largest Shareholder of Hundsun

Hundsun, a well known supplier of financial software and network services, announced on Weibo that Zhejiang Rongxin owned by Alibaba’s founder Jack Ma acquired Hengsheng Group with 3.299 billion yuan (USD 534.38 million) on April 3, 2014. Zhejiang Rongxin holds 20.62% of stake in Hundsun, becomes the largest shareholder.

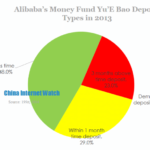

Demystify Alibaba’s Money Fund Yu’E Bao

Alibaba’s money fund Yu’E Bao belongs to Tianhong Asset Management, which was found on May 29 in 2013. How did Yu’E Bao perform in the past 2013?

Alipay Yu’E Bao Fund Reached 100 Billion Yuan

Tianhong Asset Management announced on November 14 2013 that Yu’E Bao fund users surpassed 30 million, fund size reached 100 billion yuan (USD 16.32 billion). It was the first Chinese money fund over 100 billion yuan, ranking 51 in the world.

Taobao Money Fund Sold 100 Million Yuan In 1 Minute

Double 11 was not only a shopping carnival for consumer goods, this year, Taobao began sellling money fund. Data from Taobao finance management showed that by the end of 3 pm on November 11 2013, money fund products total transaction reached 682 million yuan (USD 112 million). Guohua Life sold out 401 million yuan (USD 65.39 million) worth money […]

Baidu Finance Center Outperformed Alibaba Yu’E Bao On the First Day

Baidu launched its finance center on October 28, 2013, within 5 hours, Baidu sold out 1 billion yuan (USD 163 million) worth of money fund. Baidu aimed at offering a finance product with a 8% annual percentage yield (APY) in cooperation with China AMC (China Asset Management Co.). Over 120,000 users bought Baidu money fund, […]

Alibaba Yu’E Bao Fund Size Hit 55.6 Billion Yuan

By the end of September 2013, Yu’E Bao Tianhong Asset Management fund reached 55.6 billion yuan (USD 9.08 billion), the largest fund in China market. The total fund size of Tianhong Asset Management had increased 4 times. Yu’E Bao fund reached 4.24 billion yuan (USD 693 million) in Q2 2013, growing by 1211.33% in Q3. […]