Alibaba-backed Ant Group going duo-IPOs in Hong Kong and Shanghai

Ant Group, renamed from Ant Financial and the parent company of China’s largest payments platform Alipay and leading provider of financial services technology, announced its

China Internet Stats, Trends, Insights

Ant Group, renamed from Ant Financial and the parent company of China’s largest payments platform Alipay and leading provider of financial services technology, announced its

By March 2020, the number of online payment users in China has reached 768 million, an increase of 168 million over the end of 2018,

MYbank, a digital bank under Ant Financial Services Group, served 20.87 million small and micro businesses (SME) in China as of the end of 2019,

In the fourth quarter of 2019, China’s third-party mobile payment transactions reached 59.8 trillion yuan (US$8.56 trillion), with a year-on-year growth rate of 13.4%. The

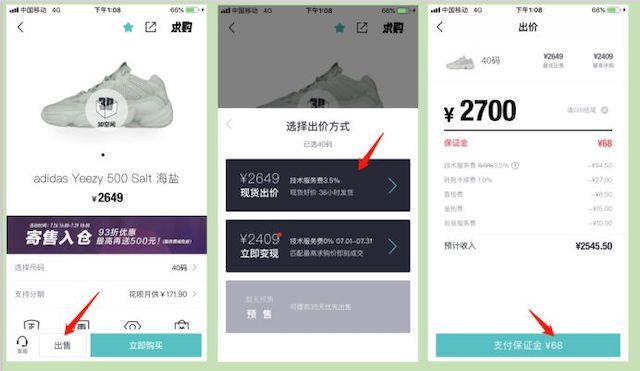

Recently, “Investing in sneakers” has become a trend, it is said that selling sneakers can bring money more easily and quickly than selling houses. And,

35.7% of China internet users purchased insurance and 33.7% don’t have any insurance policies according to a Tencent survey. China internet users buying insurance for

The number of mobile payment users has reached a saturation point, and the growth is drawing to a close. According to an Ipsos survey, the

The competition pattern of “duopoly” is still solid, while the competitiveness of UnionPay, a state-owned player, is improving. The penetration rates of Tenpay, inclusive of

Monthly unique devices of mobile banking reached 326 million units in China, an increase of 10.9% year-on-year. China Construction Bank led this market with 74

Market penetration of payment and settlement applications in China reached the highest point in December 2018 with an average DAUs of 157.9 million. Alipay is

In Q4 2018, China’s third-party mobile payment grew by 7.78% to US$7 trillion in Q4 2018. Alipay (53.78%) and Tencent Finance (38.87%) combined had a

The increase in Tencent’s revenues in Fintech in 2018 was driven by its take-rate on commercial transactions collected from merchants, cash withdrawal fees and credit

China’s top 3 online banking players accounted for 36.7% of the total monthly active users of the online banking industry in December 2018. UnionPay QuickPass

Alipay announced yesterday it will start charging for its service of credit card repayment from 26 March. Alipay users can still enjoy the service for

Financial transactions via mobile devices in China is projected to be hit US$497.52 billion by 2019. Ads concerning debit and credit products took the largest share of

[tabby title=”Overview”] This eBook shares three trends of digital content consumption in China, China’s digital content ecosystem, and how content help businesses in branding and

[tabby title=”Overview”] The average monthly disposable income of new small-town youths from China’s lower-tier cities is 3,730 yuan, compared with 5,401 yuan of young people

[tabby title=”Overview”] E-commerce factory is the collaboration of the manufacturing industry and the internet. Under the circumstances of retail sector being depressed while the traffic