As one competitor of Shenzhou Car Rental Service who’s listed in Hong Kong Stock Exchange, eHi Car Rental Service is making struggling to catch up. However, according to its finance data, it still faces many challenges and the gap with Shenzhou Car Rental Service in total revenue is getting bigger.

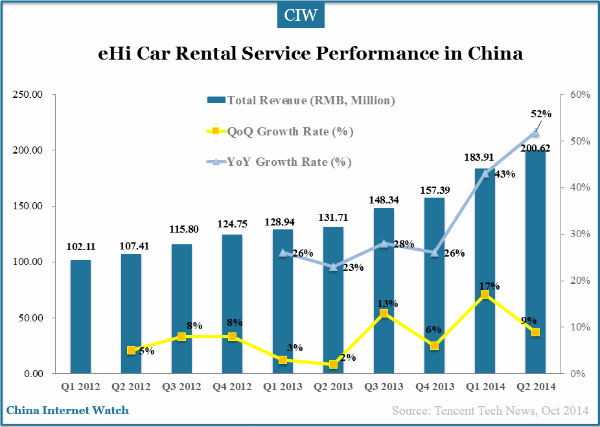

in Q2 2014, eHi Car Rental Service had RMB200.62 million ($32.72 million) total revenue with an increase of 9% (QoQ). In H1 2014, eHi’s total revenue was RMB383 million ($62.48 million) while Shenzhou’s was RMB1.862 billion ($0.3 billion) which was 5 times more than eHi.

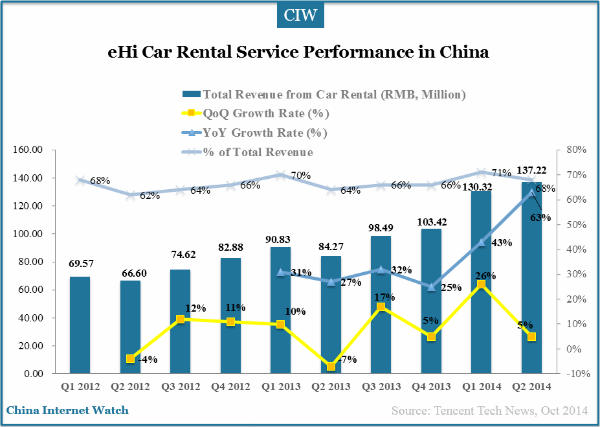

Car renting service is core business of eHi Car Rental Service. eHi’s total revenue of car renting was RMB137 million ($22.34 million) which accounted for 68% of total revenue in Q2 2014.

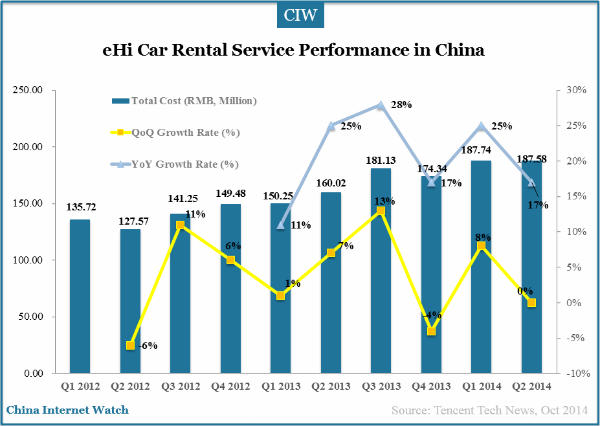

In Q2 2014, eHi’s business cost was RMB 187 million ($30.5 million) with an increase of 17% YoY.

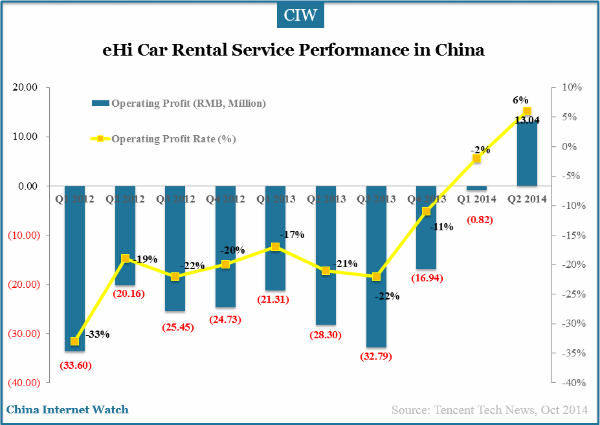

In Q2 2014, eHi’s operating profit was RMB 13.04 million ($2.12 million) with 6% operating profit rate.

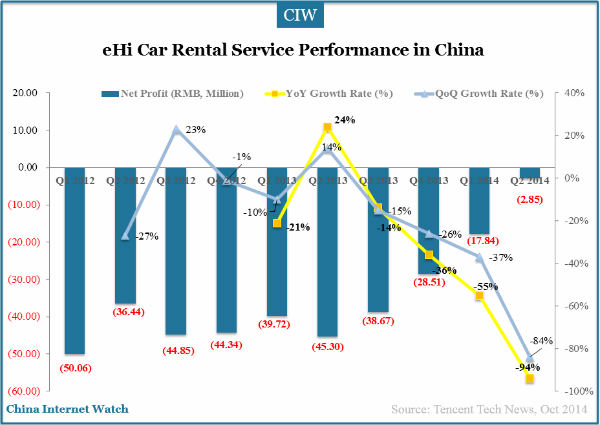

In Q2 2014, eHi’s net loss was RMB2.85 million ($0.46 million) with a decrease of 84% from prior quarter. Since 2012, eHi’s net loss has been increased to RMB348 million ($56.7 million) till Q2 2014.

In comparison with eHi, Shenzhou Car Rental Service, who received several years’ high investment, had net profit of RMB 277.2 million ($45.2 million) in Q2 2014, making a big success in China car rental service market.

Also read: Business Car Renting Services’ Potential in China