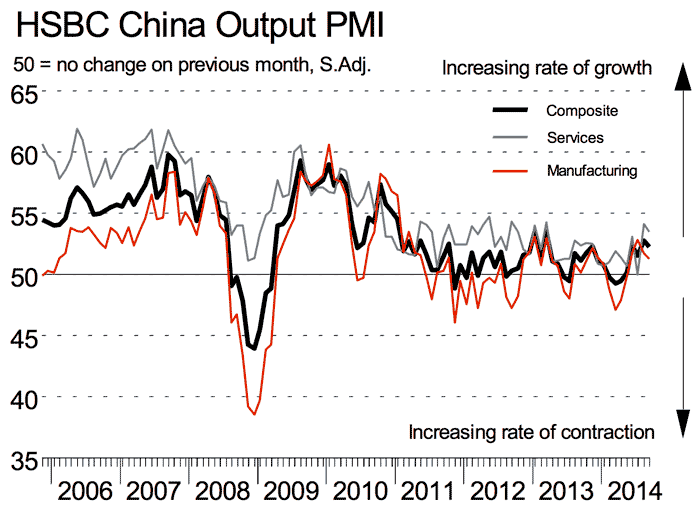

Purchasing managers index (PMI) data, released by HSBC covering both manufacturing and services, signalled a further expansion of Chinese business activity in September 2014.

HSBC’s PMI data for September signalled slightly weaker expansions of both manufacturing and services business activity. And, the latest PMI data indicated the weakest increase in manufacturing output in the current four-month sequence of expansion. Meanwhile, service sector business activity growth eased from August’s recent peak but remained solid overall. The latter was signalled by the HSBC China Services Business Activity Index posting at 53.5 in September, down from 54.1 in August.

New business intakes continued to increase across both the manufacturing and service sectors in September. However, the rate of new order growth at manufacturing firms was only moderate. Meanwhile, new order books expanded at a solid pace at service sector companies, despite the rate of increase easing since August’s 19-month high.

Staffing levels rose for the thirteenth successive month at service providers in September, while workforce numbers declined modestly at manufacturers. The rate of job creation at service sector firms was similar to that recorded in the preceding three months and moderate overall. At the composite level, employment declined for the second month in a row, albeit marginally.

Backlogs of work rose for the fourth month running at manufacturers in September. In contrast, unfinished business declined for a third consecutive month at service sector firms. That said, the rate of backlog depletion eased from August’s 21-month record and was only modest. As a result, unfinished work volumes were unchanged from August at the composite level.

Service sector firms in China saw a further rise in average input costs in September. However, the rate of inflation was moderate and the weakest since April. Meanwhile, cost burdens faced by manufacturers fell at a solid pace.

Consequently, input costs declined for the first time in five months at the composite level, though only slightly. Latest data signalled divergent output prices trends across the manufacturing and service sectors, with charges falling markedly at manufacturing firms, while service providers raised their tariffs for the second straight month. That said, the rate of inflation was similar to August and only fractional.

At the composite level, output prices fell modestly over the month. Service providers were optimistic towards the 12-month business outlook, with the degree of positive sentiment rising to a six-month high in September. Moreover, 31% of panellists forecast increased activity over the next year.