The total number of mainland Chinese cross border online shoppers reached 18 million 78% of which are mobile shoppers; and, China has become the second cross border online shopping destinations in the United States, according to a Nielsen survey, commissioned by PayPal.

Related: Chinese cross-border online shopping insights 2016

Cross-border Online Shopping Trend

The research from Nielsen shows that over 90 million cross-border shoppers across six key markets – the United States, the United Kingdom, Germany, Australia, mainland China and Brazil – will be spending over USD100 billion on overseas websites this year alone.

One interesting finding from the research: shoppers in of China (and Brazil) proved particularly keen to be protected should something go wrong with a purchase, showing that a perceived lack of security can be a far bigger barrier to a purchase than any country border.

It also revealed the top online shopping destinations in the world:

- USA (45%)

- UK (37%)

- mainland China (26%)

- Hong Kong (25%)

- Canada (18%)

- Australia (16%)

- Germany (14%). But despite the global

Characteristics of China Cross-border Online Shoppers

- There are 18 million online cross-border shoppers in China, 78% are cross-border mobile shoppers

- Chinese cross-border shoppers spent RMB216 billion in 2013 – with up to 35.9 million online cross-border shoppers expected to spend up to RMB1.0 trillion a year by 2018; Chinese mobile shoppers spent $16.7 billion in 2013

- Health and beauty products are a popular purchase for shoppers in China; top five cross-border purchase categories in China over the past 12 months are:

- clothes, shoes and accessories (RMB22.0 billion)

- health and beauty products (RMB17.6 billion)

- computer hardware (RMB13.5 billion)

- jewellery, gems and watches (RMB13.1 billion)

- personal electronics (RMB12.9 billion).

- Cross-border online shoppers’ top shopping destinations: US (84%), Hong Kong (58%), Japan (52%), UK (43%), Australia (39%).

- Geographic proximity plays a part in purchasing decisions; and, mainland Chinese shoppers buy from Hong Kong and Japan

- The average age of cross-border shopper in China are younger among all countries surveyed (25-44 y-o)

- Shoppers in China and Brazil value protection more than their counterparts in the West

- China is the second cross-border online shopping destination (39%) in the USA after the UK (49%); the second (48%) in Brazil after US (79%); the second (23%) in UK after US (70%); the fourth (17%) in Germany; the third in Australia

Cross-border shopping is expected to grow by 200% in the next five years, with the greatest growth coming from China?

In 2013, the combined cross-border mobile shopping markets of the USA, the UK, Germany, Australia, China and Brazil are already worth $36.4 billion – accounting for more than a third of all cross-border online shopping in these markets.

Where China Cross-border Shoppers Shop

With the launch of Free Trade Zone in Shanghai, a cross-border B2C platform kuajingtong.com was launched at the end of 2013; and, Amazon is also going to build logistics and warehousing centers in the free trade zone.

Kuajingtong is the first cross-border e-commerce platform granted by Chinese government as they supports cross-border shopping. It is supported by Shanghai Customs, Shanghai Entry-Exit Inspection and Quarantine Bureau and State Administration of Foreign Exchange, has the advantage in product authentic guarantee, competitive pricing, transparent taxes, convenient logistics and customer service.

Amazon China will also take advantage of Shanghai’s FTZ to help Chinese shoppers buy in the global market and global shoppers buy from China.

China Cross-Border Payment Status

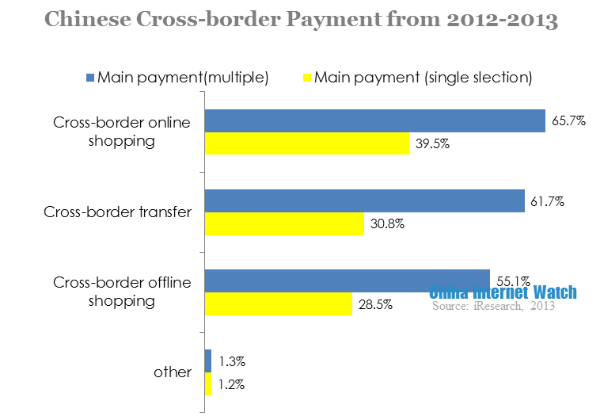

Current Chinese consumers’ cross-border payment included cross-border online shopping payment, cross-border fund transfer and cross-border offline shopping according to iResearch. Most consumers used cross-border online shopping, with 65.7%.

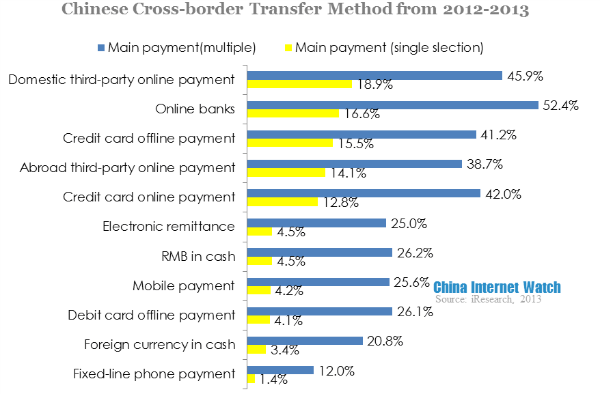

Data showed that third-party platforms were the most popular method for cross-border money transfer. 50.9% consumers chose third-party platforms to transfer money, while 39.8% chose commercial banks. Only 9.2% would use remittance companies.

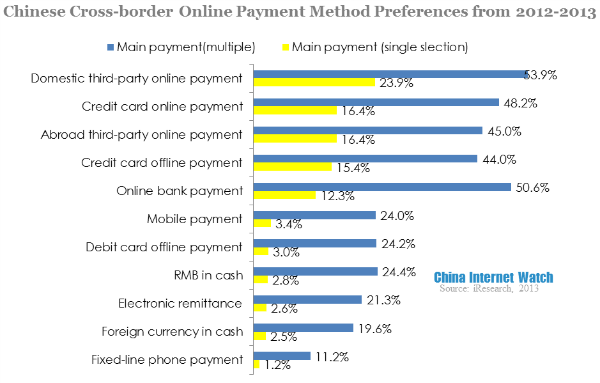

18.9% Chinese consumers preferred domestic third-party online payment; 16.6% favored online banks; and 15.5% would choose credit card offline payment.

More than 80% Chinese consumers preferred online payment in cross-border payment.