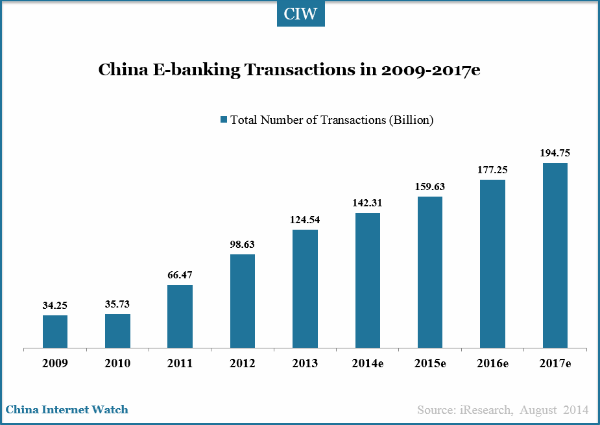

China total number of e-banking transactions of commercial banks exceeded 125.54 billion in 2013 according to iResearch data.

Nearly half e-Banking users use mobile banking service in China now. It is estimated that with the rapid development of the mobile Internet, the future commercial banks are going to form a system which is based on e-currency payment, assisted by mobile payment, phone payment, self-service terminals, Wechat payment and other electronic channels.

Related: Alipay and Huawei Launched Finger Payment Standard in China

iResearch believes there are several reason for the booming of e-banking service in China:

- E-banking can meet the needs of users to deal with banking business. Development of Internet directly leads to rapid growth of e-banking.

- Major commercial banks have high e-banking replacement rate with stable increase

- Commercial banks are more reliable on e-banking service and e-banking can inspire the potential of different banking business

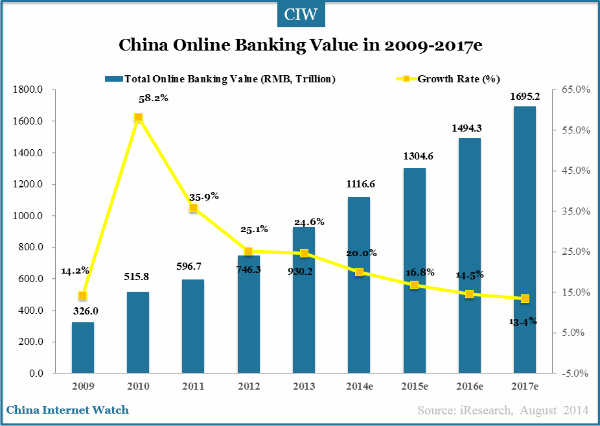

In 2013, total online banking value of commercial banks reached RMB930.2 trillion ($151.4 trillion) with growth rate of 24.6% according to data of iResearch. It is estimated that online banking will maintain stable growth and its growth will slow down.

Also read: China’s Third-party Internet Payment Exceeded $302B in Q1 2014