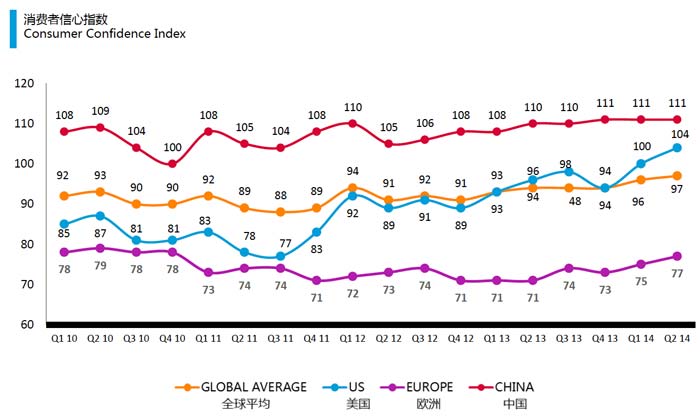

Chinese consumer confidence remained at an historic high in the second quarter this year according to Nielsen’s latest China Consumer Confidence Survey report. And, both male and younger consumers (less than 30 years old) are more confident the same as in global scale. Chinese consumers’ willingness to spend also rose in Q2 2014.

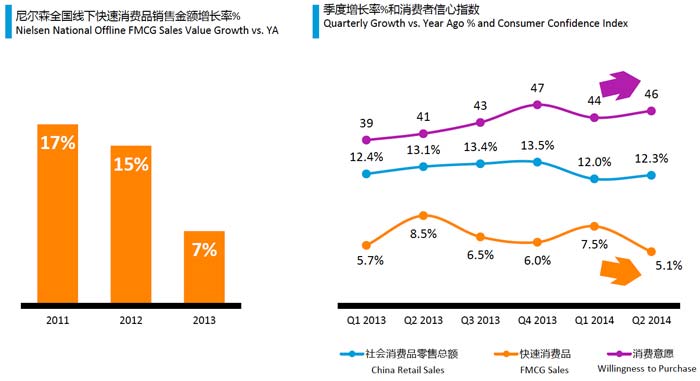

Offline FMCG retail sales growth slowed down in q2, despite rising willingness to spend:

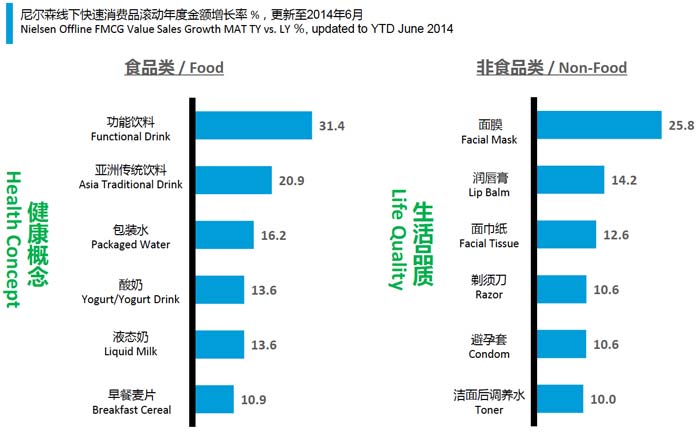

Income and health have consistently ranked as the biggest concerns for Chinese consumers since 2010. Some categories related to health and life quality saw double-digit growth in offline sales:

Nielsen found that market dynamics are becoming increasing challenging due to diverse consumers, numerous new products, huge advertising investment and evolving retail landscape, but 217 winning brands achieved four times of market growth among 3,995 brands analyzed due to four key drivers:

- Unlock target consumer demand

- Innovation for business expansion

- Investment in effective communication

- Superior retail execution in expansion

Chinese young consumers, who are less than 30 y-o, are more confident; and, the brands they prefer have a story and can echo their personality. Post-90s are the main target group.

Find out more on about Chinese post-90s.