Business travel in Asia Pacific, led by a dominant China, outpaces the rest of the world, according to a newly released travel forecast by the GBTA Foundation.

Driven by infrastructure investments, exports and service development, business travel spending in China has grown from US$32 billion in 2000 to US$225 billion in 2013, an average of 16.2% each year. By comparison, growth in business travel spending from the US has grown at an annual rate of just 1.1% since 2000.

The report, which details travel spending in 75 countries, along with the top industries, economic factors and characteristics that influence business travel, finds that record high business travel spending is driven by a few dominant markets – namely the US, China and Western Europe.

Currently Asia Pacific owns the largest share of the business travel spend market with 38% followed by North America (21%) and Western Europe (24%). GBTA expects that by 2018, Asia Pacific will have gained another 5% in market share, while the US and Western Europe will lose three% and two%, respectively.

This report underscores that China, along with the other BRIC countries of Brazil, Russia and India are leveraging their business travel expenditures into more economic opportunities,

said GBTA Executive Director and COO Michael W. McCormick.

We expect to see this shift in business travel spending to continue.

The report’s other key findings include:

- 89% of total business spending around the world – totaling US$984 billion – originated from traffic in Asia Pacific, Western Europe or North America.

- Even accounting for concerns over an economic slowdown in the country, GBTA expects China to surpass the US in business travel spending by 2016.

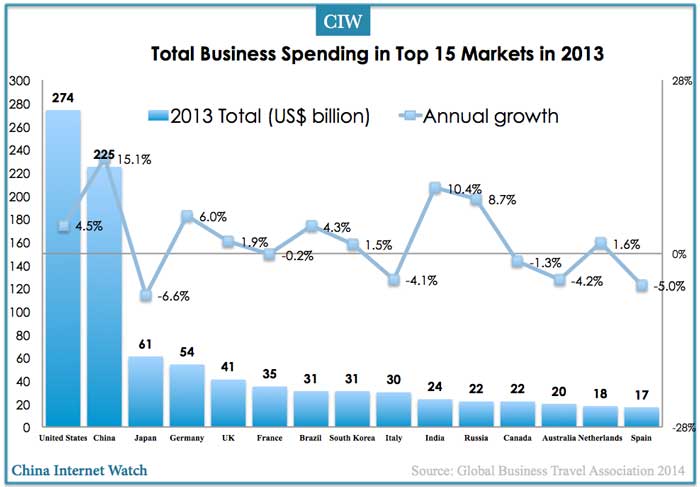

- Italy and Spain continue to slip in GBTA’s annual rankings of the top 15 countries by travel spend. In contrast, BRIC countries – Brazil, Russia, India and China – continue to rise in the growth ranking, representing four of the top six countries in terms of business travel spending growth. A chart detailing the top 15 countries can be found below.

- Regionally, Asia Pacific is already the largest business travel region in the world, comprising 38% of global business travel. Business travel spending in Asia Pacific totaled $392 billion in 2013 – more than doubling in size since 2000 with a growth rate of 7.5% annually. GBTA expects business travel spending to continue growing at a 10.2% annual pace over the next five years.

This year’s global BTI™ predicts single-digit expansion of global spending on business travel and the emersion of the Asia Pacific region as the world’s largest travel market, comprising 38% of global business travel with two-thirds of that activity coming from China and Japan,

said Tad Fordyce, head of Global Commercial Solutions at Visa, Inc.

As global business travel is expected to continue growing in the coming years, China is projected to surpass the U.S. as the top business travel market in the world by 2016.

The Annual Global Report & Forecast identified other key trends that could impact business travel over the next year, including political activity in Emerging Europe and the cost of oil.

TOP 15 BUSINESS TRAVEL MARKETS

The GBTA report identified the top 15 business travel markets, ranked by spending in 2013. The largest growth was seen in three of the BRIC countries – China (15.1%), India (10.4%) and Russia (8.7%).