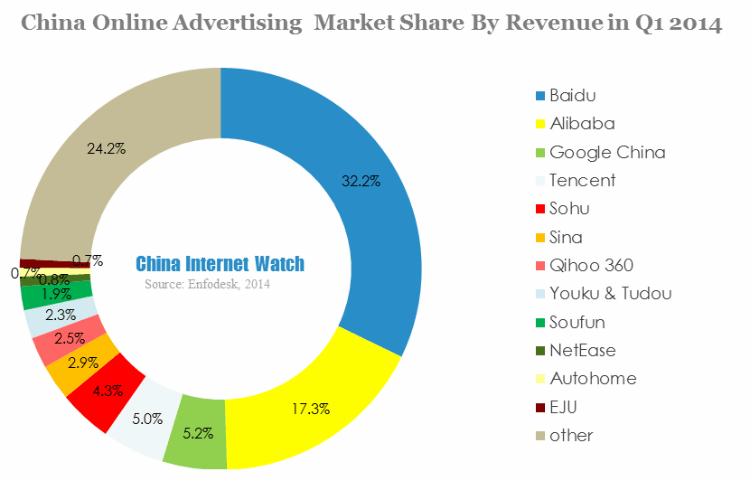

According to Enfodesk’s report, in the first quarter of 2014, Baidu accounted for 32.2% China online advertising market, followed by Alibaba with 17.3% share. Google China ranked the third with 5.2% market share.

Enfodesk regarded Baidu kept its leading place in Q1 2014, Baidu’s highly competitive because of its brand effect and technology innovation. Besides product research and development, Baidu also announced verified accounts with Consumers’ Association of China to boost the healthy development of search engine ecosystem.

Alibaba’s the second largest online advertising market player in China, Alimama and its RTB advertising system became mature. Advertisers’ recognition of Alibaba’s RTB system gradually improved, Alibaba had cutting-edge advantage in RTB system.

However, Google China’s market share kept shrinking over the years. Its Q1 market share was merely 5.2%, and the difference with Tencent’s market share was decreasing. In the near future, Tencent will replace Google China to be the third advertising platform in China. Meanwhile, Qihoo 360’s performance was excellent, surpassed Youku and Tudou and narrowed its gap with Sina.

In Q1 2014, five big portal websites which are Tencent, Sohu, Sina, NetEase and ifeng together accounted for 13.5% market share. Vertical media was growing fast, video, real estate and auto were the main stream vertical media websites. In online video market, Youku and Tudou’s market share dropped to 2.3% due to seasonal factors, and other video websites such as Sohu were strong competitors of Youku and Tudou.