China MIIT (Ministry of Industry and Information Technology) published its C-BPI report on March 30, 2014. The C-BPI report covered 178 industries and 8,500 mainstream brands.

2014 C-BPI report interviewed 13,500 consumers in 30 cities from August 2013 to January 2014, which fully uncovered 14 industries including FMCG, durable consumer goods, wholesale and retail, finance and internet services, etc. C-BPI is a brand power index to measure influence on Chinese consumers’ purchasing behaviors.

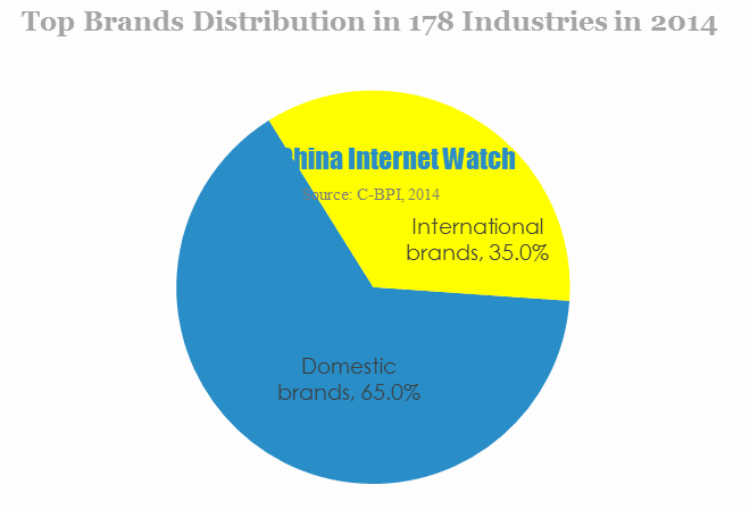

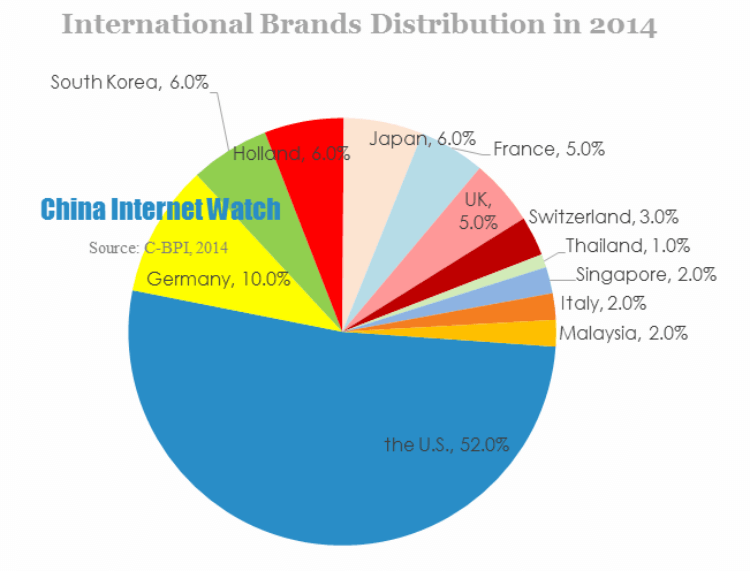

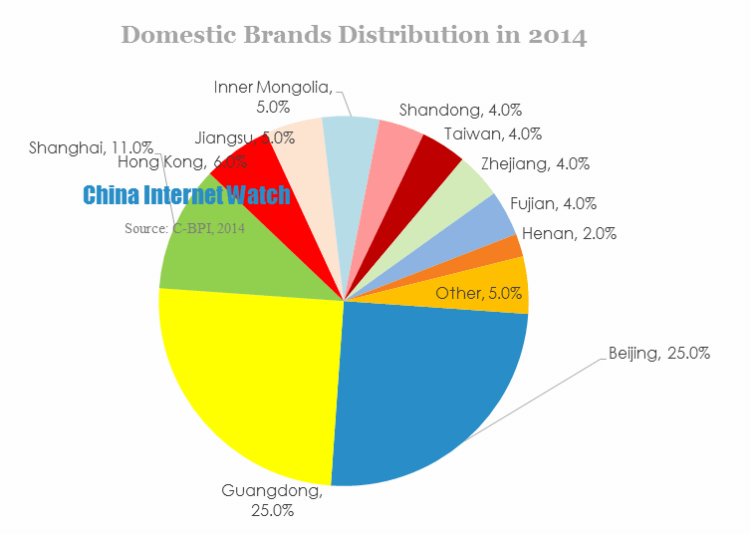

This year’s C-BPI found out that 65% of 178 industries’ top brands were domestic brands (Hong Kong, Macao and Taiwan included), dropping 1 percentage point compared to last year. The rest 35% were owned by international brands. Among the top 115 domestic brands, Beijing and Guangdong tied for the top one with most brands, each accounted for 25%; followed by Shanghai with 11%. Among the top 63 international brands, American brands accounted for 52%, followed by Germany with 10%, South Korea, Japan and Holland tied for the third place and each accounted for 6%.

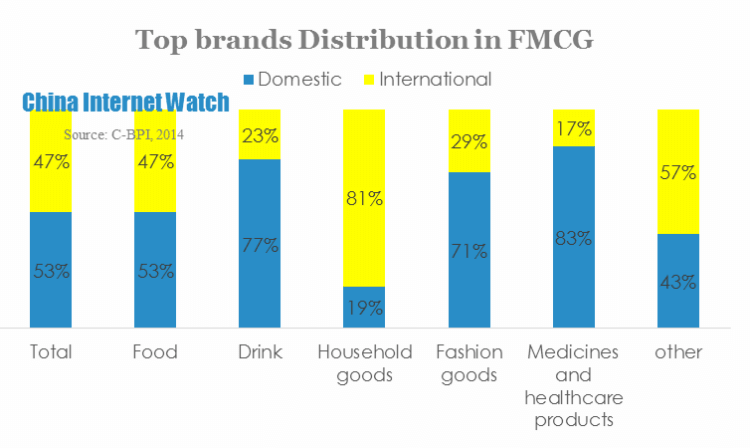

In FMCG industry, domestic brands and international brands accounted for 53% and 47%, and domestic brands’ percentage increased by 1%.

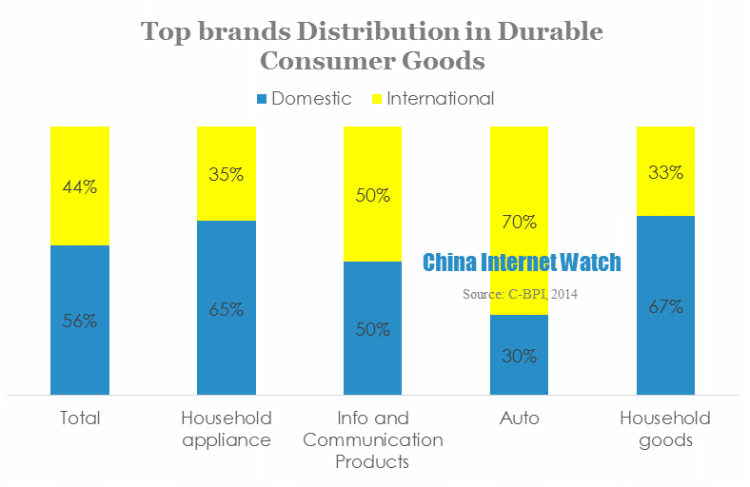

In durable consumer goods industry, domestic brands accounted for 56%, decreasing by 3%.

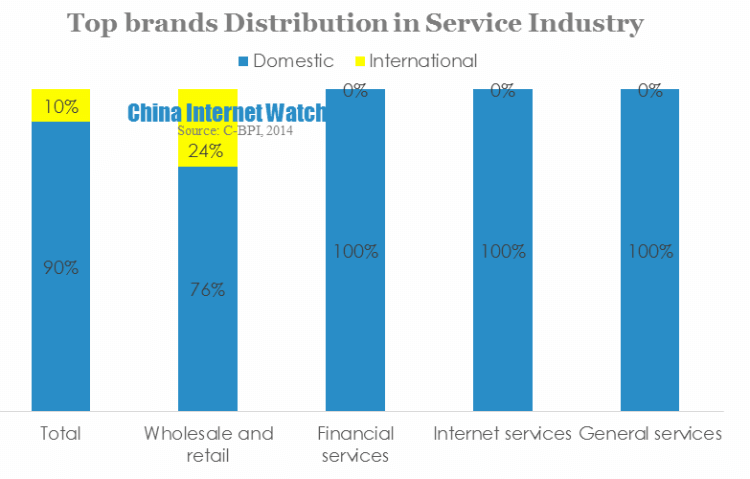

In service industry, domestic brands accounted for 90%. Although dropped by 4%, domestic brands still had dominant advantages.

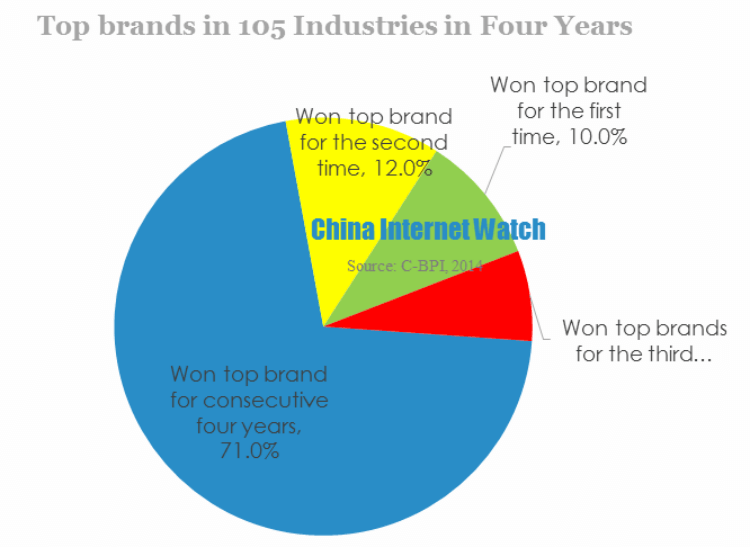

In 105 industries investigated by C-BPI for consecutive four years, there were 75 brands in total (71%) won top brand for consecutive four years. FMCG had 43 brands, durable consumer goods had 16 brands and service industry had 16 brands.

The advantages of the leading brand in industry reflected the competition intensity. If the gap between the first and second brands is greater than 100 points, it indicates dominant advantages of the leading brand. If the gap is lower than 50 points, it indicates weak advantages of the leading brand. If the gap is between 50 to 100 points, it means the general advantages of the leading brand.

Among 170 brands investigated both in 2013 and 2014, there were 56% top brands had dominant advantages in 2013. While the percentage dropped to 48% in 2014. Top brands which had weak dominant advantages increased from 21% in 2013 to 22% in 2014. It means the competition intensified in 2014.

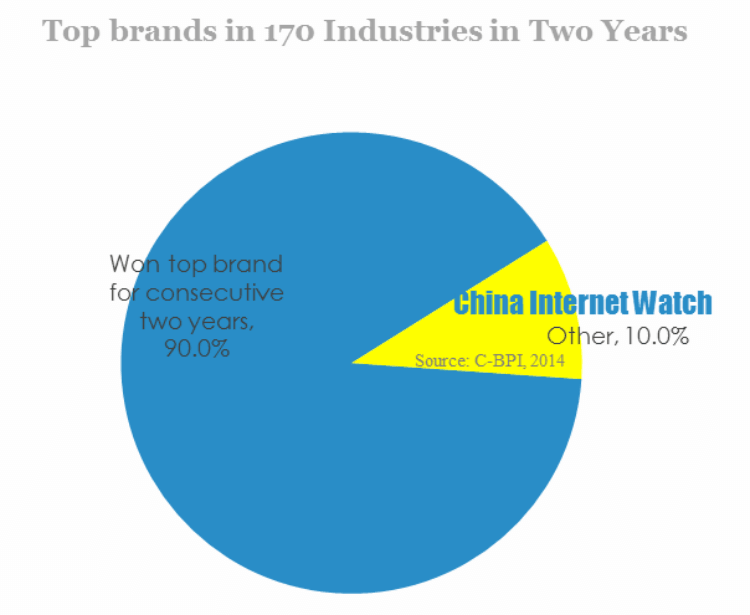

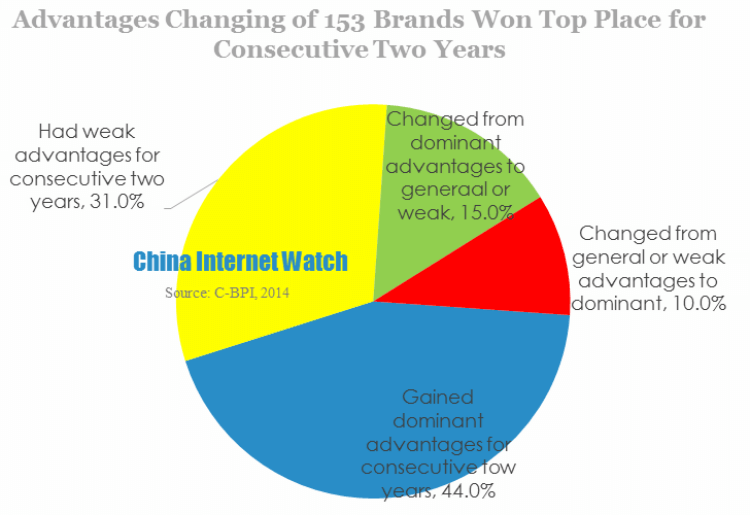

In the 170 brands, there were 153 brands (90%) championed for consecutive two years of which 67 brands remained dominant advantages.

In the past year, 15 brands changed from general or weak advantages to dominant advantages, including Sina Weibo and Ctrip. It’s also notable that 48 brands remained weak advantages for consecutive two years, which means their leading status was not stable and they should focus on brand strategy. Besides, 23 dominant brands changed from dominant advantages to general or weak advantages, these brands need to adopt aggressive strategies to compete with their competitors.

In 2014, most of brands championed for consecutive two years, however, 17 brands (10%) did not. The percentage from 2011 to 2012 was 17%, and from 2012 to 2013 was 15%, which indicated the percentage of brands which did not champion for consecutive two years was dropping in the past three years. Top brands cared more about brand maintenance.