On April 1 2014, Sina Weibo renewed its prospectus and announced that Weibo will be listed on Nasdaq as “WB”.

On March 15 in 2014, Sina Weibo submitted Form-1 to Securities and Exchange Commission for financing USD 500 million, half of which will be used to pay off debt and the other half will invest in technology and product development. In the updated prospectus, it is certain that Weibo will be listed on Nasdaq as “WB”, Goldman Sachs Group and Credit Suisse will be lead underwriters, as well as Morgan Stanley, Piper Jaffray and China Renaissance. But the IPO time and pricing range remain uncertain.

The name of the listed company will be “Weibo Corporation”, on March 27, Sina Weibo changed its logo to “Weibo”, removed “Sina” completely.

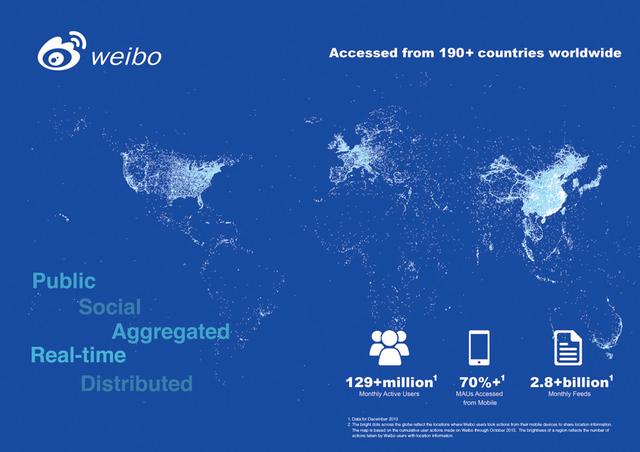

According to the prospectus, by December 2013, Sina Weibo’s monthly active accounts reached 129 million, with a 33.5% YoY growth. Daily active accounts reached 61.4 million, with a 36.1% YoY growth. Monthly average posts hit 2.8 billion, among which 2.2 billion included a picture and 81.7 million contained a short video and another 21.5 million shared music.

Sina Weibo has lost its best chances filing for IPO in 2011 and 2012 with highest valuation, but now is a pretty good opportunity, for it started to make profit for the first time. According to Sina’s latest financial report, Sina Weibo’s revenue reached USD 71.4 million in Q4 2013, with 151% YoY increase and 33.7% QoQ increase. In Q3 2013, Sina Weibo nearly broke even.

Sina Weibo’s total revenue in 2013 was USD 188.3 million with 186% YoY increase, net loss was USD 38.1 million decreasing by 63% compared to 2012. In 2012, Sina Weibo’s total revenue was USD 65.9 million, net loss was USD 102.5 million. By advertising, games and other channels, Weibo began to make profits for Sina. The main revenue of Weibo came from advertising and marketing campaigns on the platform.

According to Weibo’s prospectus, in 2013, revenue from advertising and marketing reached USD 148.426 million, threefold of that in 2012. The cooperation with Alibaba contributed USD 49.135 million, and third-party advertisers contributed USD 99.291 million. Alibaba’s Taobao and Tmall platforms had growing influence on Sina Weibo’s revenue.

Notably, Alibaba purchased 18% stake in Sina Weibo with USD 586 million in April 2013. The deal allowed Alibaba to hold up to 30%. The prospectus shows that Sina and Alibaba hold approximately 97% of Weibo’s stake, and Sina Weibo’s executive team holds the rest. Sina Corporation holds 140 million shares, which accounted for 77.6%. Alibaba Group holds 34.89 million shares and took up 19.3%. Sina Weibo’s executive team holds 5.42 million shares, accounted for 3%.

Since several sensational news in March 2014 (Kunming train station attack on March 1 and the missing airline MH370 on March 8), Sina Weibo has gained wide-spread recognition as an important media for information release. Because of a large number of professionals using Weibo, though the information sources may be various, Weibo’s self-correction and rumor identifying abilities are more powerful than private social networking apps’.

These public events rediscovered the positioning and value of Sina Weibo, offered perfect opportunity for IPO. Sina stressed that Weibo as a social media, rather than WeChat and QQ alike instant messaging apps. (Click here to check out event marketing on Weibo: How Brands Utilized Chinese Spring Festival Gala on Sina Weibo.)

Actually, Sina Weibo began its commercialization in 2012. With banner ads, promoted Weibo post, Weibo and Taobao account bundling and Weibo Wallet, Sina Weibo has built a complete advertising system targeting brands, SME and Taobao store owners. Insiders revealed that the major clients of Sina Weibo are SME, in the future, it will attract more brands to market on the platform.