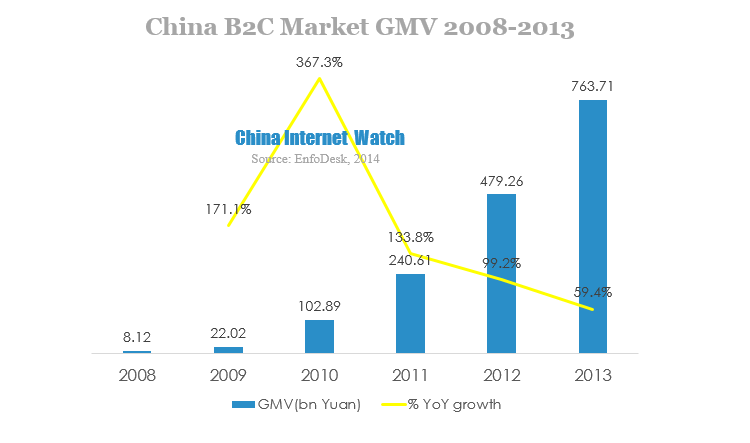

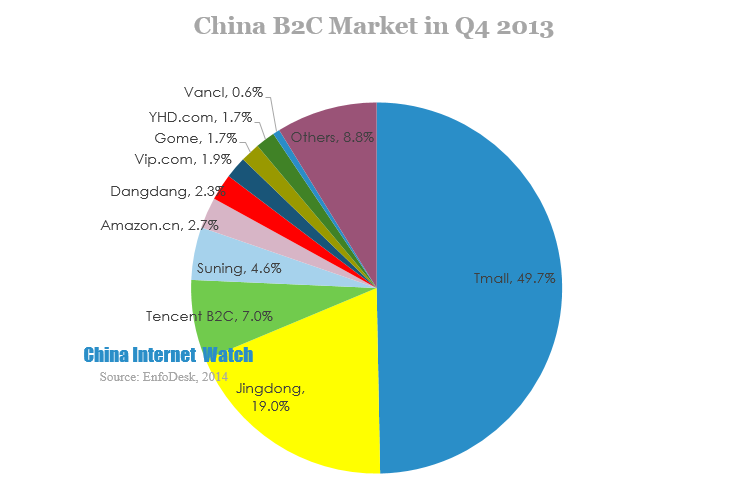

According to report released by EnfoDesk, China B2C market GMV reach 194.65 billion Yuan (USD 31.65 billion) with 20% QoQ growth in Q4 2013. Annual GMV of China B2C market hit 763.71 billion Yuan (USD 124.18 billion), and the YoY growth fell slightly to 59.4%.

According to report released by EnfoDesk, China B2C market GMV reach 194.65 billion Yuan (USD 31.65 billion) with 20% QoQ growth in Q4 2013. Annual GMV of China B2C market hit 763.71 billion Yuan (USD 124.18 billion), and the YoY growth fell slightly to 59.4%.

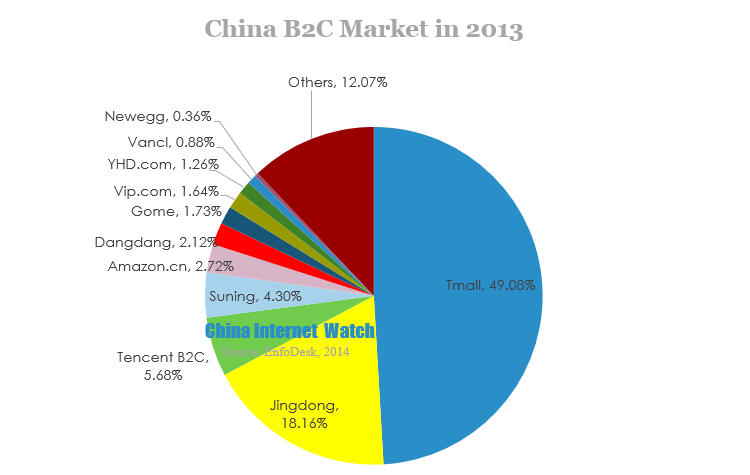

In Q4, Tmall, Jingdong and Tencent B2C remained Top 3 on the list. Matthew Effect was more obvious in the market: the market share of Tmall, Jingdong and Tencent all increased slightly to 49.7%, 19.0% and 7.0% respectively. Many e-commerce giants broke their order record on Double 11, due to the large traffic from Double 11 promotion. EnfoDesk suggested that large B2C enterprises with abundant capital had advantage in traffic acquisition and mobile entry, enlarging the gap between large and small B2C enterprises. To compete, small and medium B2C must cooperate with large B2C and improve their profession as well.

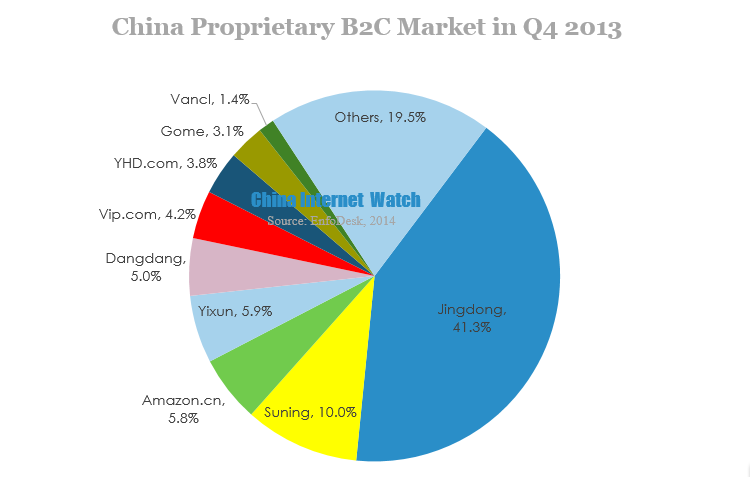

Jingdong ranked the first with market share of 41.3%, followed by Suning with 10.0% and Amazon.cn with 5.8%. In terms of enterprises performance, the “flash sale” mode of Vip.com (former Vipshop) was copied by many enterprises, such as Dangdang, Tencent B2C and Jingdong. EnfoDesk regarded “flash sale” as a possible mode for large e-commerce platform to do shoes&clothing business, and a good solve to the high inventory problem of China clothing market.This is the reason why “flash sale” mode was widely copied. The core of this mode was to get authorization from brand suppliers, rather than technique. In the short run, large B2C managed to copy the “form” of “flash sale”, but it is hard to success without brand authorization and superior suppliers.

EnfoDesk found the driving force of online retail GMV was mostly the sale promotion. Especially since large promotions launched, such as Tmall Double 11 in 2011 and “price war between online retailers” in 2012, China online retail market experienced a new stage of rapid development. Furthermore, traditional industry began trying e-commerce; online retailing and trading were gradually accepted, boosting the development of online retailer market.

In 2013, Tmall remained on the top with 49.08% market share. It benefited largely from the consumer and commerce resources that Alibaba accumulated over years, giving Tmall an advantage of goods richness and brand strength. Also, Double 11 quickly enlarged the market and enhanced the influence of Tmall.

Jingdong followed Tmall with 18.16% in 2013. With perfect service and rapid delivery, Jingdong won many customers. In 2013, Jingdong expanded its business and enriched its goods variety, to seize a large market share.

Tencent B2C (including QQ wanggou and Yixun) accounted for 5.68% of the market. Although Tencent had huge traffic resource, its conversion rate was quite low. In 2013 Tencent integrated its B2C business, optimized merchant resource and eliminated overlapping business to achieve a higher resource utilization.

In 2013, Suning took 4.30% of the market with its brand awareness, offline supply chain and price advantage. Moreover, the acquisition of PPTV expanded its traffic source, providing a foundation to secure the market share and customers.

Amazon performed well in global market except in China. Amazon.cn only had 2.72% of market in 2013, as a consequence of poor localization capability. However, there were still many loyal customers appreciating its price, richness, technology and delivery advantages.

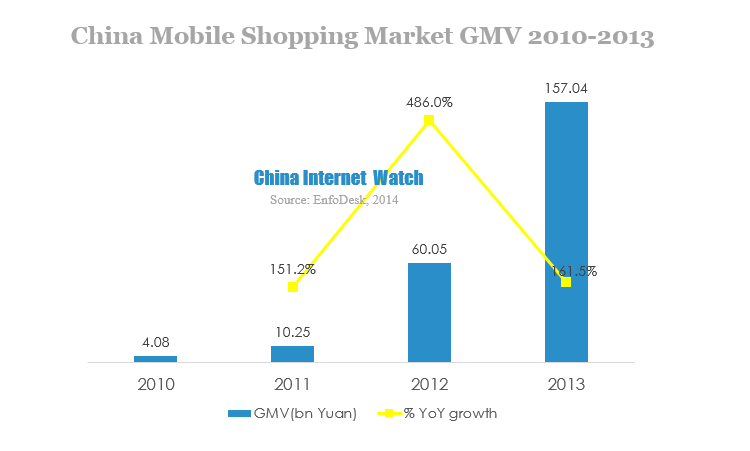

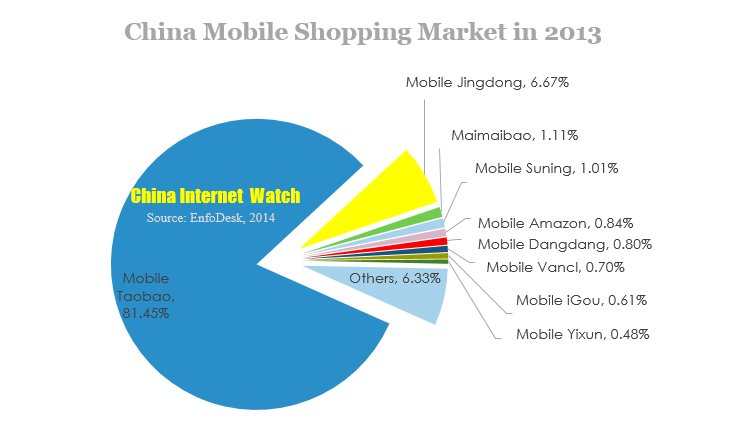

EnfoDesk statistic showed China mobile shopping market hit 157.04 billion Yuan (USD 25.54 billion) in 2013, up 161.5% YoY. The whole market was in a rapid developing period.

There were three major driving forces of mobile shopping market. Firstly, as online retailing acceptance was gradually increasing, it was easy for online retail to shift to mobile terminal. Secondly, many e-commerce giants focused on mobile shopping last year, their promotion activity boosted the development of mobile shopping. Thirdly, the mature of other mobile application such as mobile game also helped developing mobile payment habit, thus mobile shopping became popular.

The competition of mobile shopping market was basically the same as web shopping. EnfoDesk suggested that in the field of shopping, there were back-end supply chain competition besides front-end product competition. Although the mobile-only enterprises could firstly enter the unnoticed market in 3rd or 4th tier cities, they faced high cost structure due to the absence of supply chain and brand strength. In 2013, mobile-only e-commerce excluding MMB (maimaibao) all lost competitiveness. In terms of market share, Taobao Mobile accounted for 81.45% of market by taking advantage of Alipay, followed by Jingdong Mobile, MMB, Suning Mobile and Amazon Mobile.