Baidu recently released its Q4 financial report, which showed its thriving mobile market development. Baidu mobile search was growing steadily, it’s very unlikely that mobile search would threaten web search. Therefore, Baidu’s search concentrated business model would be sustainable. But Baidu’s solely profit pattern remained unsolved.

Baidu used to rely heavily on web search, which arouse much worries about whether Baidu could seize a large part of mobile search market share. The rising importance of mobile search was attributed to the popularity of smartphone. Baidu has made breakthroughs on several bottlenecks, which are:

- Regain Search Users on Mobile: Because of the huge difference between mobile and web entrances, Baidu’s mass web search user base was of little use to mobile search. Now Baidu has successfully regained mobile search users, search volume in mobile end accounted for 35% to 40%. It is expected to surpass web search in the second half of 2014.

- Mobile Customized Websites: We found that most of big websites have made adjustments for mobile devices, though it still cannot compare with PC , the browsing experience has been improved evidently.

- Advertisers’ Willingness on Mobile Search Ads: With an increasing number of Baidu mobile search users, it will not remain as a big problem. Mobile search CPC is much lower than web search, and this is mainly because mobile search is more about local life service and business related search is mostly done in PC end.

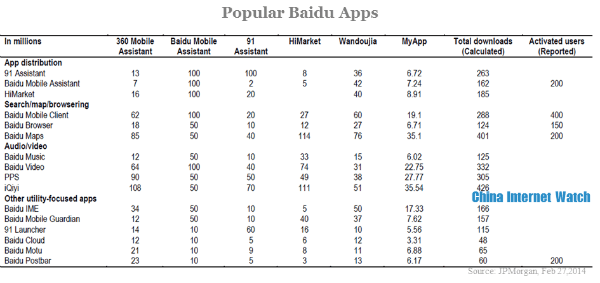

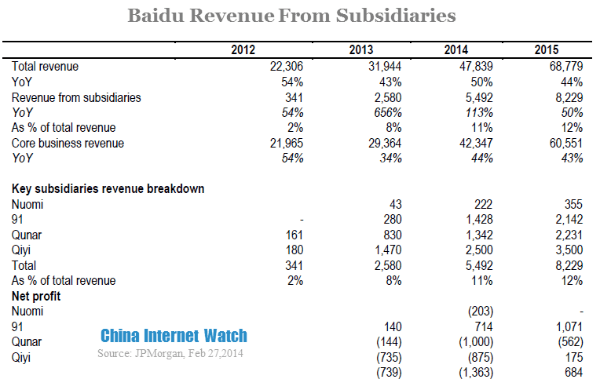

In the past 2013, Baidu purchased 91 Wireless and PPS to grow its mobile market.

Baidu’s mobile platform revitalized its mobile search. The chart below showed Baidu’s apps downloads, most of them reached 10 million times.

The cutting-edge mobile platform could bring mobile search volume, for example, Baidu Android App Store made users more likely to install its games, music, and SNS apps because of the search convenience. More importantly, mobile users formed the habit of opening baidu.com to search information.

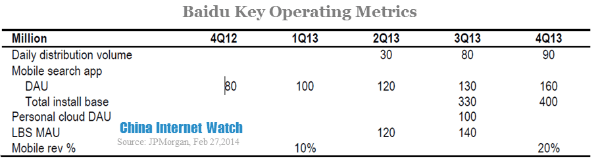

Baidu mobile assistant app had over 400 million registered users, increasing 70 million compared to Q3 2013. The estimated active users were between 150 to 160 million. Baidu revealed that it accounted for 41% of mobile android app distribution market share in Q4 2013. Unlike developed countries, iOS accounted for quite a small percentage in China.

Mobile Search

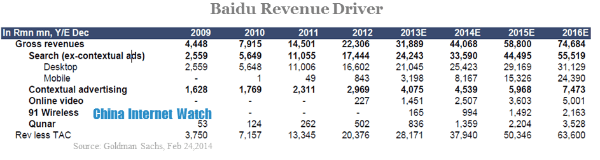

Baidu also improved its revenue structure, in Q1 2013, revenue generated from mobile search accounted for 10%. By Q4 2013, the percentage was increased to 20%. It was a big achievement for Baidu in mobile search field. When most people worried about the business prospect of mobile search in 2012, the percentage was merely 3%.

Goldman Sachs also expected mobile search remained high level growth rate while web search slowed down.

Baidu mobile search accounted for 57% share, lower than its web search market share. Still, it’s satisfying considered the complex mobile market competition.

Encroached by Qihu 360, Baidu web search market share was shrinking and yet it remained above 60%. But Qihu 360 faced great difficulty in making profit, Baidu could still benefit from the growing general search volume.

Changes in 2014

Baidu has made some changes in the attempt to gain real users: Baidu Tieba requires users to login when they browse some specific topics; and Baidu prepares to enter O2O payment part.

In 2014, Baidu will focus on four parts:

- mobile search and cloud service

- LBS service (Baidu map and groupbuy)

- Consumer service (game, music and social network)

- Probable overseas expansion

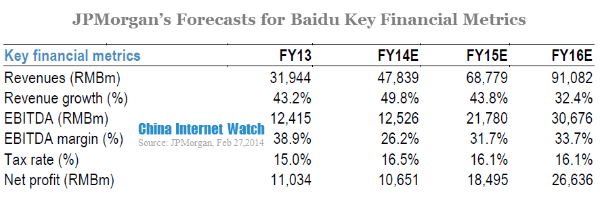

It is expected that Baidu would lay emphasis on fighting for mobile search entrance, that is, promoting its own apps. Baidu’s management revealed Baidu would spend a large quantity of money in purchasing, the expense would probably increase by USD 700 million. Because of huge investment, Baidu’s net profit will not grow in 2014 which is quite rare in IT industry.

Besides, the increasing traffic acquisition cost and copyright cost (iQiyi) would also lower its net profit. It’s estimated that Baidu’s net profit would begin growing fast next year.

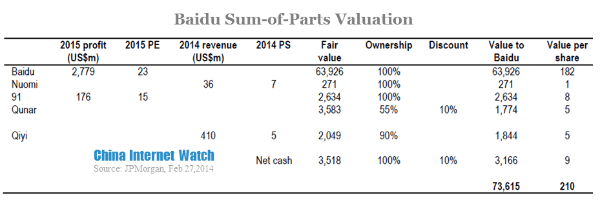

In regards of departments, search accounted for 90% of net profit. Other products, such as 91 Wireless, Nuomi and Qunar did not bring much profit and could hardly maintain balance. But they increased the use of search indirectly, therefore, they were indispensable to Baidu. Although the growth rate of subsidiaries was not slow, it’s difficult for them to make profits. As users increased, the revenue grew as well as cost.

Potentials of O2O

In short term, O2O and LBS could not realize their business value mainly because of their scales were not large enough. For each local community, online users accounted for a small percentage. The shops would not perceive O2O as a big market, as a consequence, they were not passionate about entering the market. In return, online users had trouble finding suitable shops in O2O and could barely meet their needs. To break the dead cycle, it could only begin with increasing online users. If O2O attracts more users in the next few years and improves local merchants’ enthusiasm, its operating profit rate might reach 30%.

Except for gaining revenue from shops, Baidu could also display location-based advertising to users which would bring high conversion rate. It might also take years to achieve certain effects.

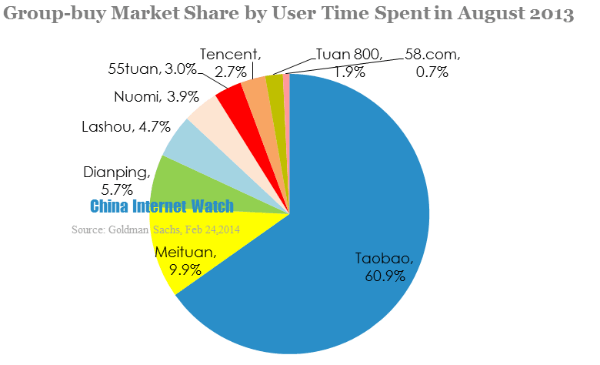

Nuomi needed to work harder to compete in groupbuy market:

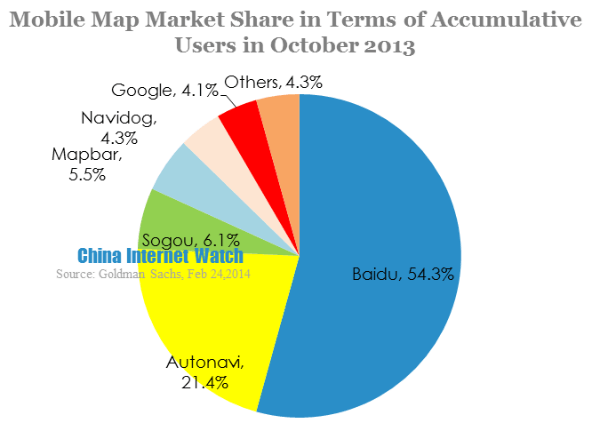

Baidu map had dominant advantage in LBS market:

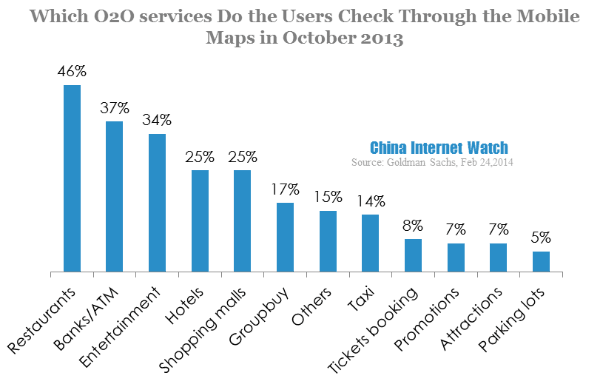

Chinese users had great search demand in restaurant, bank, entertainment and hotel, Baidu could easily cooperate with restaurants, entertainment enterprises and hotels to generate profits.

Compared With Google

Apparently, Baidu is not so innovative as Google. But Baidu has good business sense, and a growing potential market.

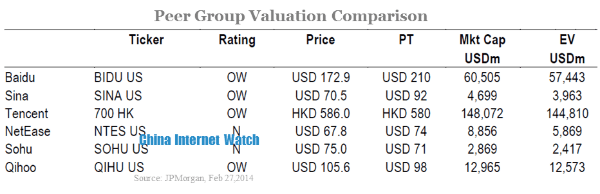

Comparison of Chinese internet enterprises valuation: