The pattern of brand awareness of China smartphone market changed a lot in January 2014. Judging by competition situation, smartphone market was gradually entering an era of red ocean; however, as for development prospect, the need of smartphone users was far from being satisfied. Domestic and foreign smartphone vendors were all devoted to meeting users’ different demands of experience. Differentiation became the top priority of mobile manufacturers.

Brand Awareness

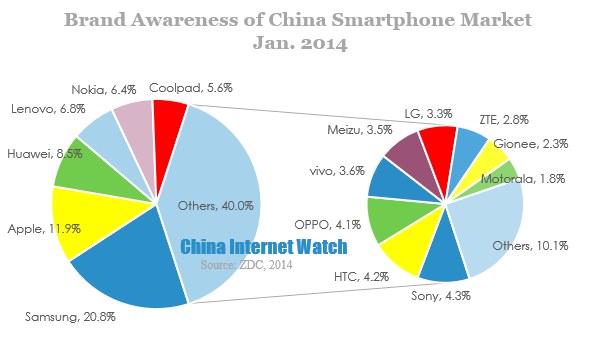

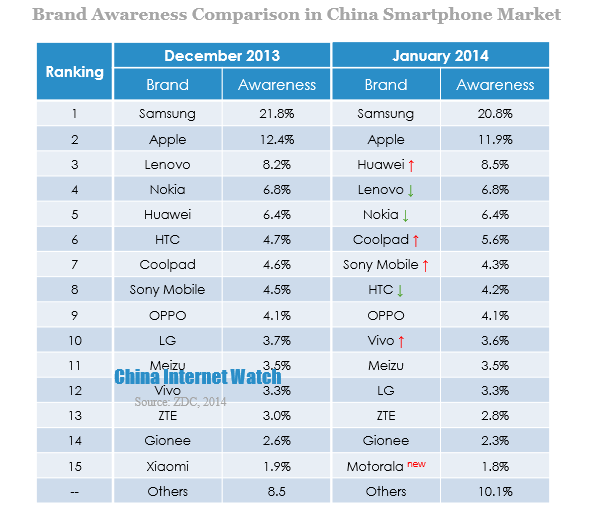

On the whole, the competition of brand awareness in China smartphone market was getting more intensely. The accumulative awareness of top 15 brand fell down, representing the lower concentration. Specifically, Samsung topped the ranking with a 20.8% awareness, followed by Apple and Huawei. Awareness of Lenovo was close to Nokia’s, merely 0.4% higher. Coolpad got the sixth place with a 5.6% awareness. The awareness of other brands on the ranking list were all below 5%.

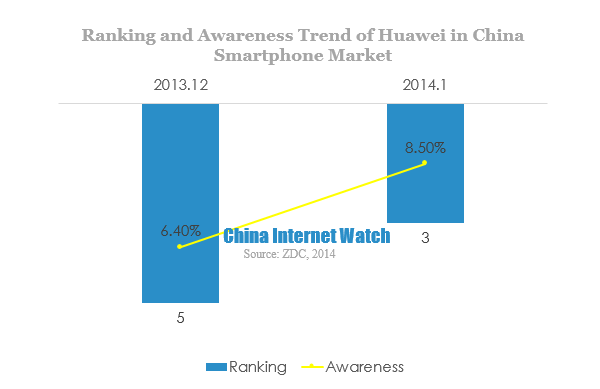

Compared to December 2013, great changes had taken place in just one month. For top 3, Huawei’s awareness rose 2.1 percentage point to the No.3, boosted by new products Honor 3C, 3X and A199. Coolpad also rose 1% with the help of new awesome product, up one rank to seven.

Product Awareness

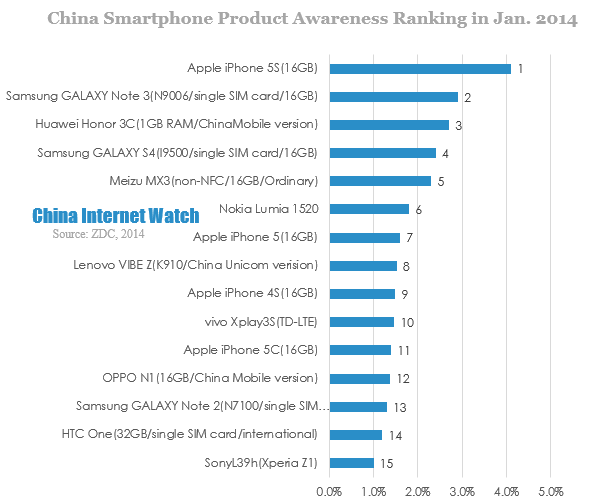

Apple iPhone 5S (16GB) was still far ahead of other product with a 4.0% awareness. Meanwhile, Apple iPhone 5, iPhone 4S and iPhone 5C were also on the list, making Apple the listed brand with most products.

The second was Samsung with three products on the list in January. Samsung GALAXY Note 3 (N9006/single SIM card/16GB) ranked the second with 3.0%. GALAXY S4 and GALAXY Note 2 ranked No.4 and No.13 respectively.

It is noteworthy that the newly marketed Huawei Honor 3C (1 GB RAM/China Mobile version) made the top 3 place with a 2.7% awareness, the highest awareness among domestic smartphones. And Meizu MX3 (non-NFC/16GB/Ordinary) ranked No.5.

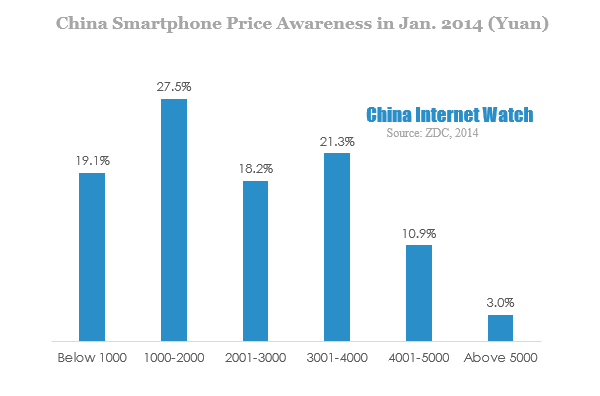

In terms of price, mid-end phones bwteen 1,000-2,000 Yuan (USD 163 to 326) were still the focus, with awareness of 27.5%. Followed by products of 3,001-4,000 Yuan (USD 490 to 653), its awareness was above 20% too. The awareness of products below 1,000 Yuan (USD 163) and 2,001-3,000 Yuan (USD 326 to 490) were both close to 20%. High-end smartphones over 4,000 Yuan (USD 653) reached 13.9% brand awareness.

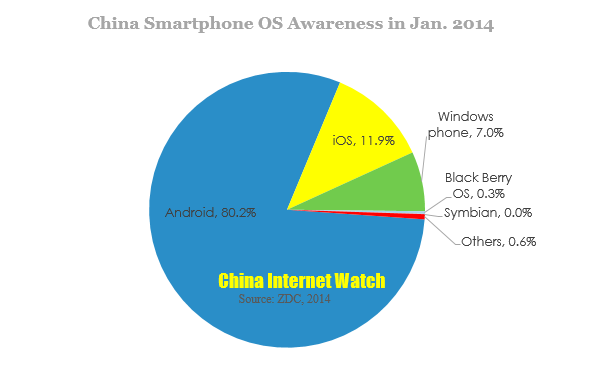

For operating system, Android was in the unshakable mainstream position as before, with a awareness of 80.2%. The awareness of Apple iOS was 11.9%, followed by slow growing Windows phone of 7.0%. Other OS shrunk in this month.

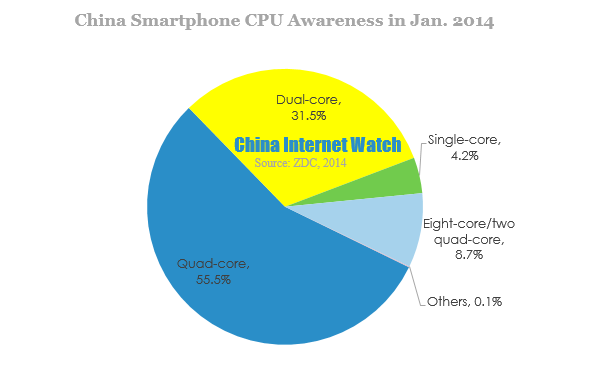

For numbers of CPU cores, the position of quad-core phones was more stable. In January quad-core smartphone won 55.5% awareness, followed by dual-core with over 30%. Eight-core/two quad-core phones had low awareness so far. ZDC predicted that awareness of eight-core phones wouldn’t increase rapidly in short term, as a consequence of high price and low experience improvement.

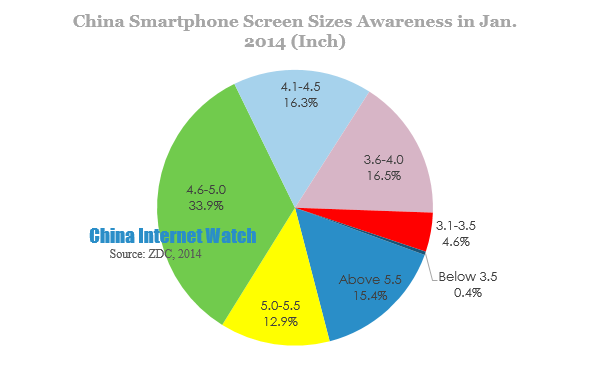

According to ZDC, smartphones with 4.6-5.0 inch screen were the most popular device, getting a 33.9% awareness. The awareness of 4.1-4.5 inch and 3.6-4.0 inch were very close: 16.3% and 16.5%. Note that smartphones with screen bigger than 5.5 inch had awareness of 15.4% this month.

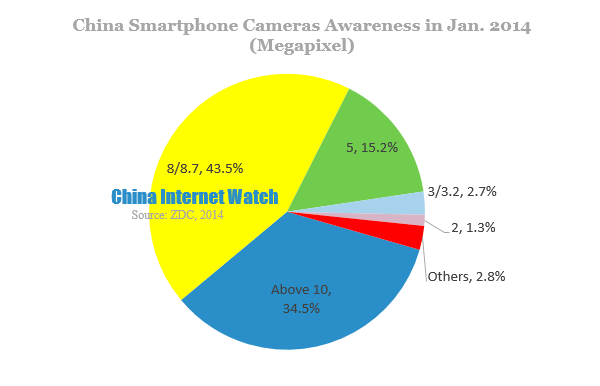

Among more than 1,000 smartphones on the market, two cameras became the standard. For main camera – the rear camera, phones with 8-8.7 megapixel camera were the mainstream, with a 43.5% awareness. It’s remarkable that awareness of smartphones with over 10 megapixel camera grew fast, reaching 34.5% in January.

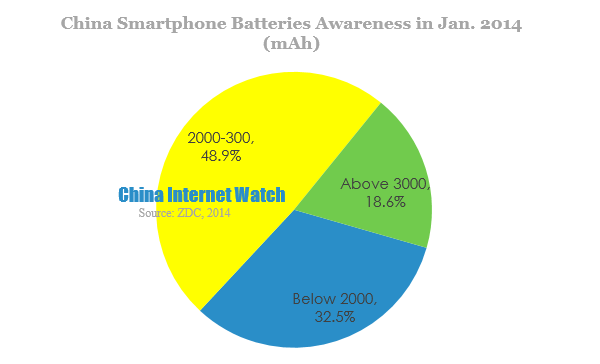

In terms of battery capacity, smartphone with 2,000-3,000 mAh battery was favored with a 48.9% awareness, almost the half. The second was below 2,000 mAh battery, with awareness of 32.5%. Affected by high price, smartphones with over 3,000 mAh battery was unpopular so far.

Case Study: Huawei

As ZDC data showed, the awareness of Huawei rocketed to 8.5% in a month, 2.1 points higher compared to December 2013. Huawei beat Nokia and Lenovo to become top 3 in January 2014. ZDC attributed this amazing performance to the increasing awareness of 3C, 3X and A199.

Huawei had 56 products on the market at present, mostly equipped with 4.5 inch or 5.0 inch screen. Each size accounted for over 20%. Huawei’s product with 5.0 inch screen was the most popular, with a 52.4% awareness. The awareness of products with 4.5 inch or 4.7 inch screen were both below 20%.

Conclusion

In January 2014, the strength of domestic brands in smartphone market was enhanced. At the same time, competition between domestic phone manufacturers was heating up. Under the market environment of homogenization, the more creative you are, the longer you will stand.