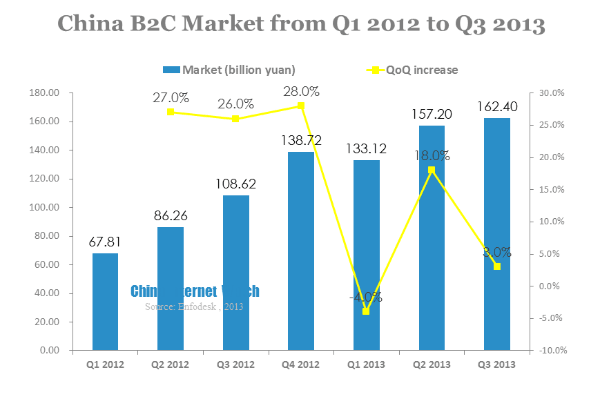

Enfodesk published its 2013 Q3 China B2C Market Report recently, China B2C market reached 162.4 billion yuan (USD 26.52 billion) with 50% YoY increase.

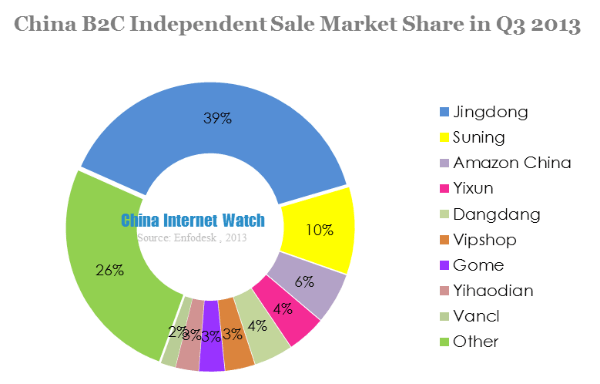

According to China B2C independent sale market performance, top 3 enterprises market share added up to 54.4%, 2% higher than Q2 2013. It was mainly because big B2C enterprises encroached small B2C enterprises’ market shares, Jingdong led B2C independent market with 38.8% share. Suning ranked the second with 9.9%, followed by Amazon China with 5.8%.

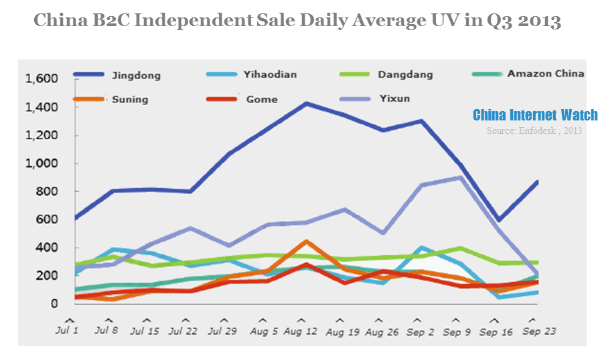

Because of market promotion, Jingdong website’s traffic hit apex in the middle of August 2013, and it hit another apex in the beginning of September but it soon went down by the end of September. Yixun (51buy) traffic went up in Q3 2013 with a large part of traffic guided from Tencent. Dangdang’s traffic went up in July and September for its two promotion campaigns. Suning’s traffic went up in August because of its anniversary celebration.

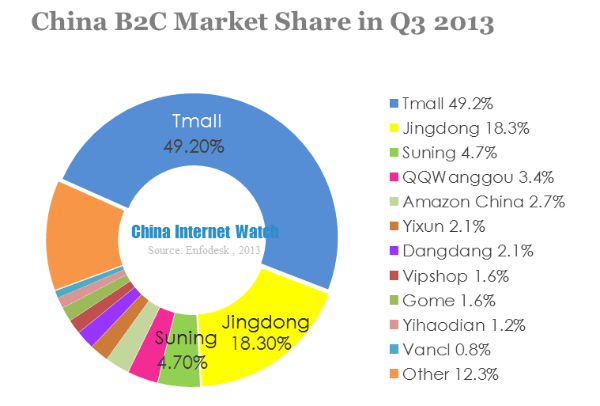

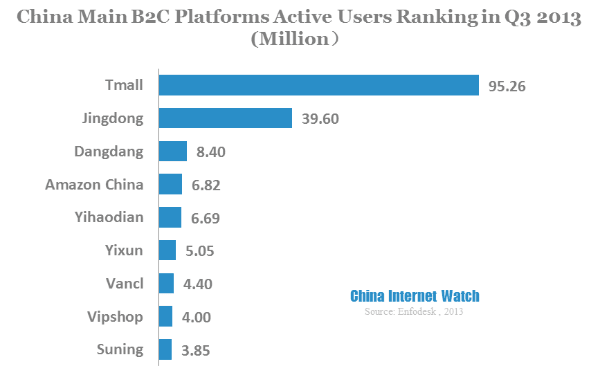

Tmall, Jingdong and Dangdang ranked the top 3 B2C platforms active users. Tmall active users growth slowed down, while Jingdong and Dangdang’s active users kept growing steadily.

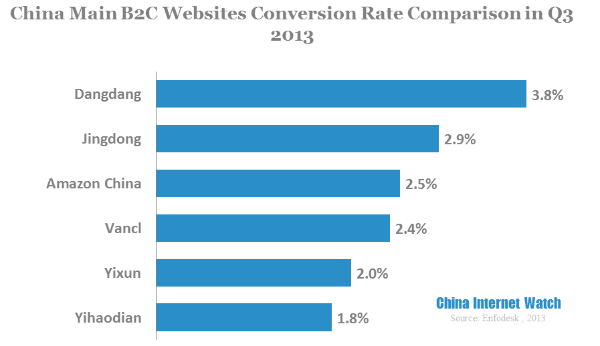

Dangdang remained leader in conversion rate, and its Q3 conversion rate grew a little bit. Amazon China’s conversion rate increased a little by optimizing pages. Yihaodian launched market promotion in July and drove a lot of traffic, but its conversion rate dropped.

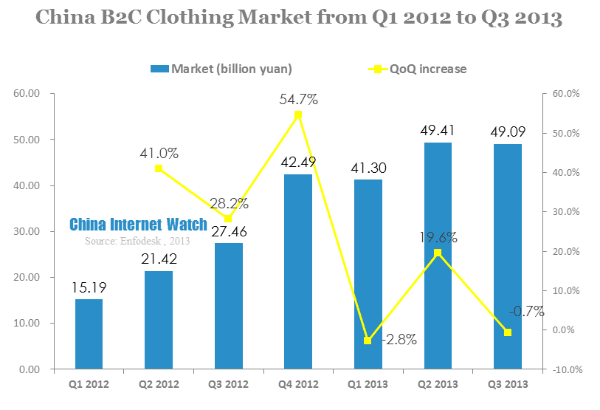

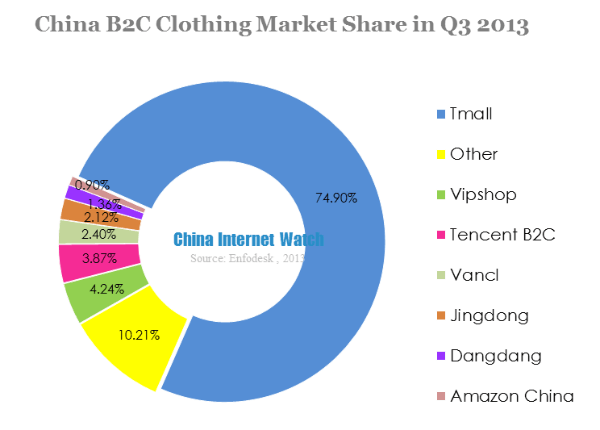

In Q3 2013, B2C clothing market reached 49.09 billion yuan (USD 8.03 billion), with 78.7% YoY increase. Vipshop had a good market performance in Q3.

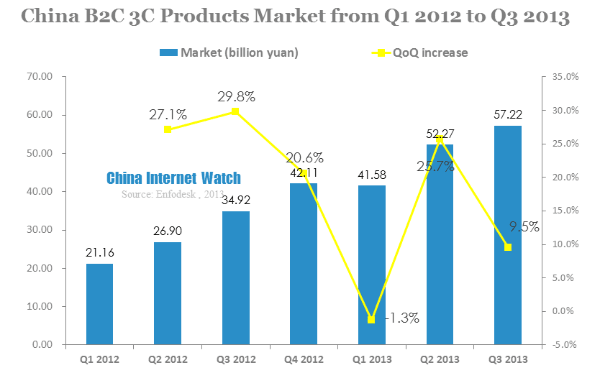

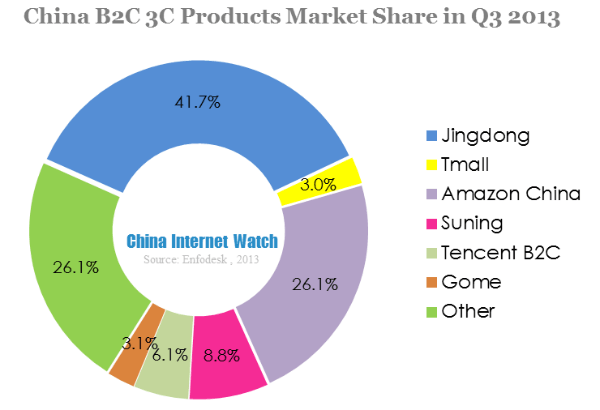

In Q3 2013, B2C 3C products market reached 57.22 billion yuan (USD 9.36 billion), 35.2% of total B2C market. It increased 63.9% compared to Q3 2012. The difference between Suning and Jingdong enlarged by 2%.

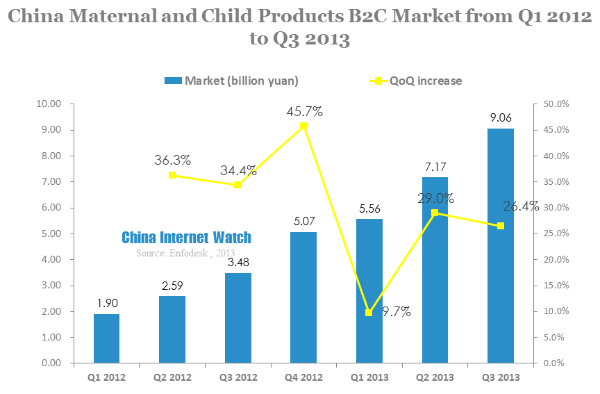

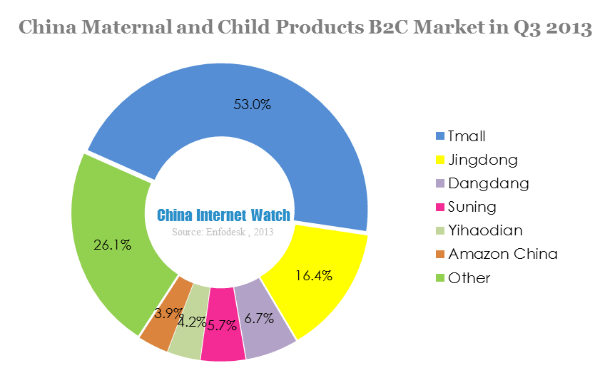

In Q3 2013, Maternal and Child products B2C market reached 9.06 billion yuan (USD 1.48 billion), with 160.3% YoY increase and 26.4% QoQ increase. Maternal and Child products B2C market was growing quickly and became the new key market to fight over.

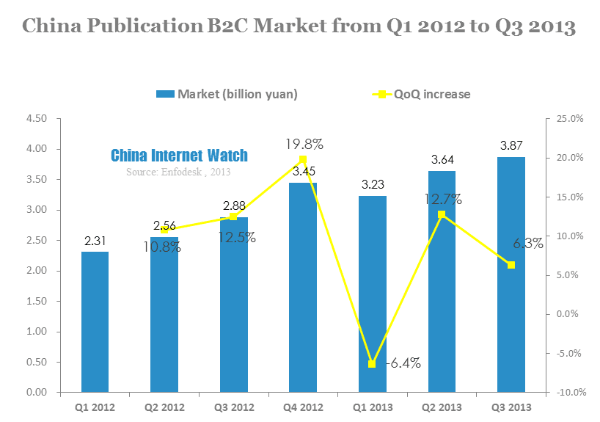

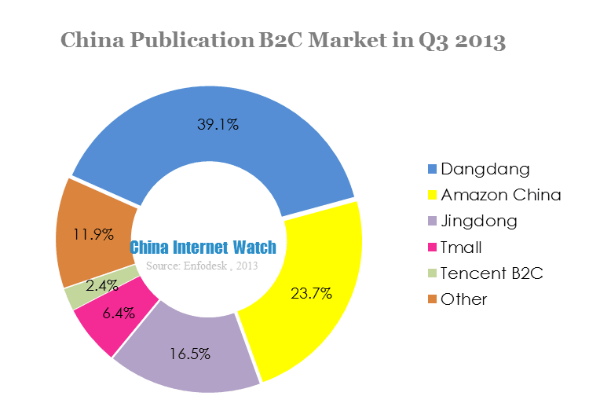

In Q3 2013, B2C publication market reached 3.87 billion yuan (USD 633 million), with 34.4% YoY increase and 6.3% QoQ increase. Dangdang remained the leader in publication market with 39.1% market share, 2% higher than Q2 2013. Amazon China ranked the second with 23.7%, Jingdong ranked the third with 16.5%.

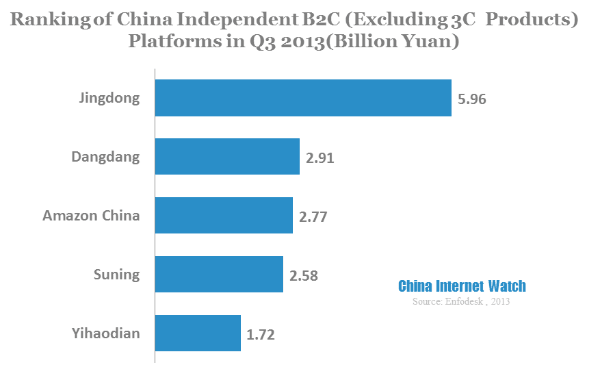

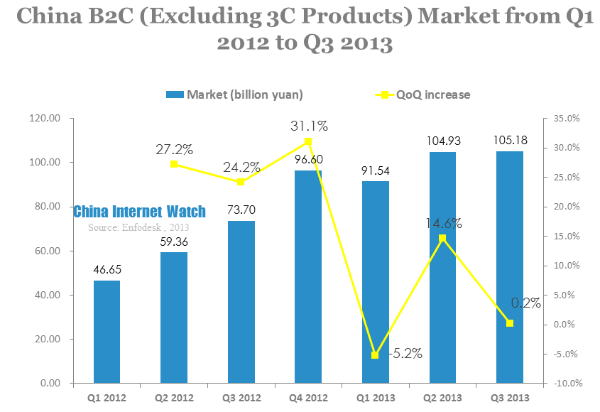

Because 3C products had relatively high unit price, so 3C products market had a high percentage on the whole. But 3C products profit was low. Therefore, by examining B2C platforms excluding 3C products could give us a more objective assessment of B2C platforms. Non-3C products included clothing, publication, cosmetics and skincare products, maternal and child products, during which clothing had a big market share.