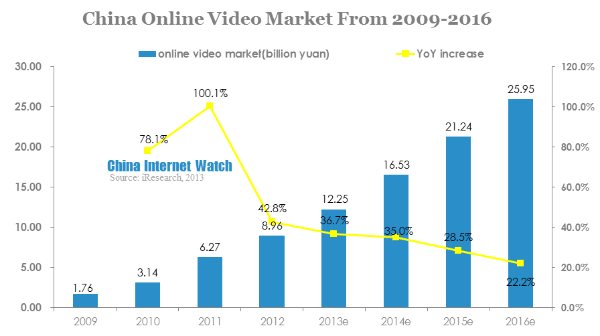

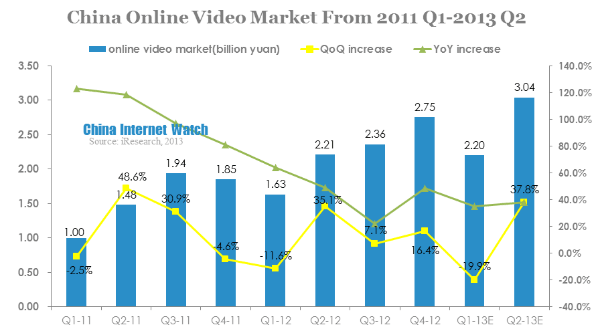

iResearch recently published China online video industry report from 2012-2013, China online video market kept growing fast. In 2012, China online video market reached 8.96 billion yuan (USD 1.47 billion), with 42.8% YoY increase. In Q2 2013, China online video market reached 3.04 billion yuan (USD 497.26 million), with 37.8% YoY increase and 38.1% QoQ increase. The growing in Q2 2013 was mainly driven by advertising revenue due to advertisers increase.

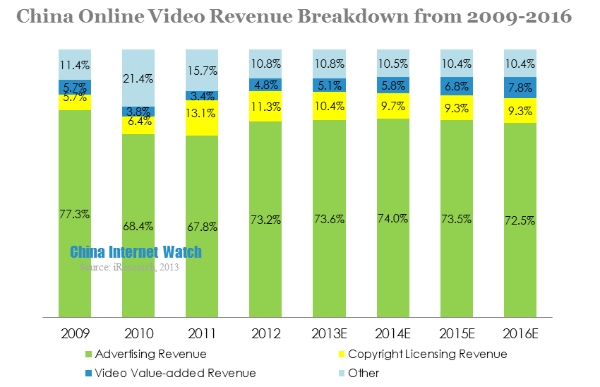

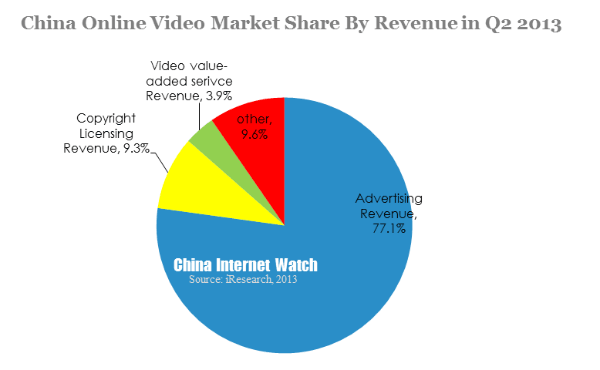

In 2012, a large part of China online video revenue was from advertising, accounted for 73.2%. In Q2 2013, advertising revenue accounted for 77.7% of online video industry, with 4.1% QoQ increase.

In 2012, copyright licensing revenue accounted for 11.3%, dropped 1.8% compared to 2011. In Q2 2013, copyright licensing revenue accounted for 9.3%, dropped 6.7% compared to that of 2012.

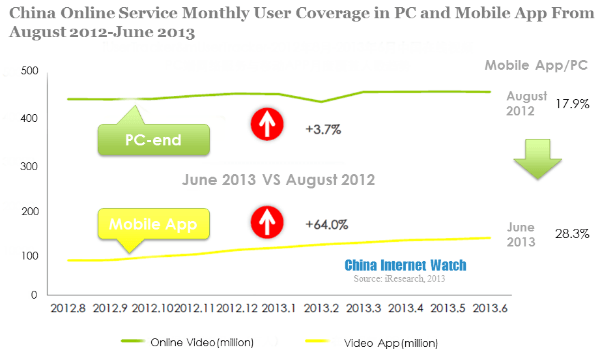

In June 2013, online video app monthly user coverage reached 130 million, increasing 64% compared to August 2012. PC-end monthly user coverage in June 2013 was 460 million, merely growing 3.7% compared to August 2012.

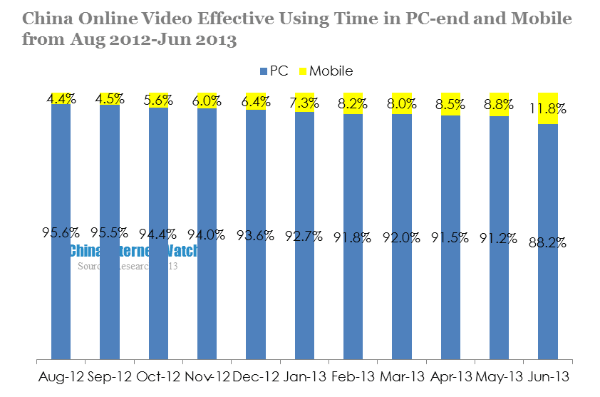

In June 2013, online video effective using time in mobile end accounted for 11.8%, 7.4% higher than that of August 2012.

In Q2 2013, China online video market reached 3.04 billion yuan (USD 497.26 million), with 37.8% YoY increase and 38.1% QoQ increase. The growing in Q2 2013 was mainly driven by advertising revenue due to advertisers increase. With the popularity of smartphone, netizens gradually transferred from PC-end to mobile end and mobile video became the focus strategy of many video enterprises.

In 2012, a large part of China online video revenue was from advertising, accounted for 73.2%. In 2012, copyright licensing revenue accounted for 11.3%. In the future, the market share of online video revenue would remain stable.

In Q2 2013, advertising revenue accounted for 77.7% of online video industry, with 4.1% QoQ increase. Copyright licensing revenue accounted for 9.3% in Q2 2013, with 6.7% YoY drop. The reasons for the dropping of copyright licensing were: first, online video industry experienced integration, and video enterprises bargaining power in copyright licensing increased; second, main video enterprises increased input in user generated content which in return slowed the growth of copyright licensing revenue.

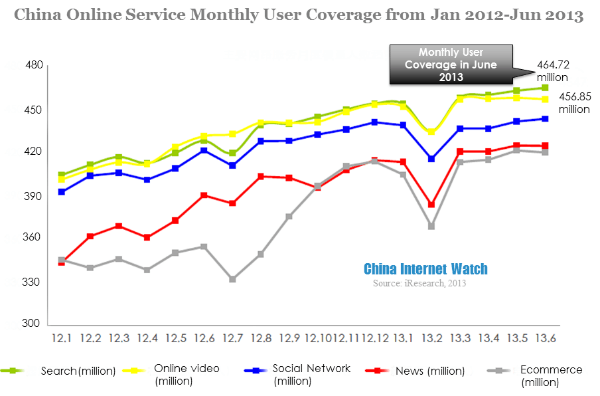

Since January 2012, online video and search in PC-end monthly user coverage took turns to lead, and they were two biggest online services. In June 2013, online video monthly user coverage reached 464.72 million and search monthly user coverage reached 456.85 million.

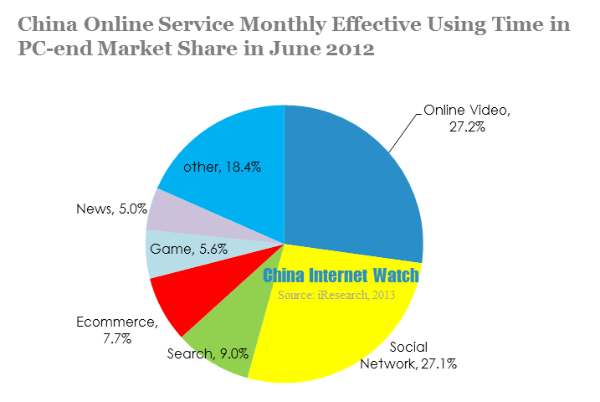

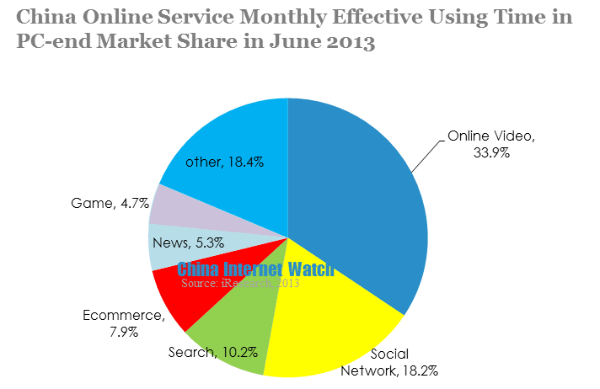

In June 2013, online video monthly effective using time accounted for 33.9%, 6.7% higher than that of June 2012. While social network market share dropped from 27.1% in June 2012 to 18.2% in June 2013.

In June 2013, online video app monthly user coverage reached 130 million, increasing 64% compared to August 2012. PC-end monthly user coverage in June 2013 was 460 million, merely growing 3.7% compared to August 2012.

Online video Mobile app/PC rate went up from 17.9% in August 2012 to 28.3% in June 2013. The growing in mobile end were due to three reasons. First, the popularity of mobile devices (smartphone, tablet) kept growing. Second, major online video enterprises had improved mobile end watching experience. Third, mobile end video catered to the needs of making use of fragmented time.

In June 2013, online video effective using time in mobile end accounted for 11.8%, 7.4% higher than that of August 2012.