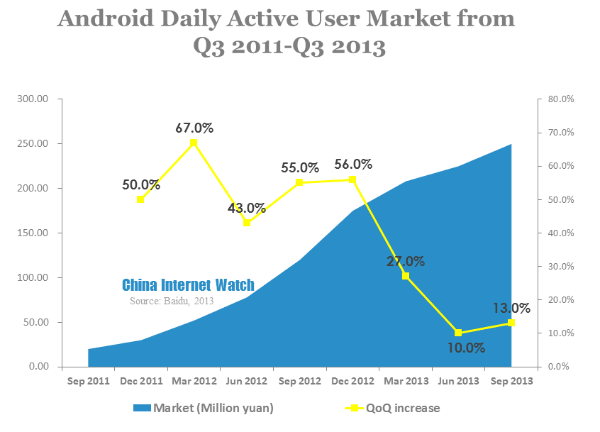

Baidu published its third quarter mobile internet development report recently, according to the report, Android daily active users reached 270 million. Growth rate in 2013 slowed down, due to seasonal factors, Q3 quarterly growth rate climbed back to 13%.

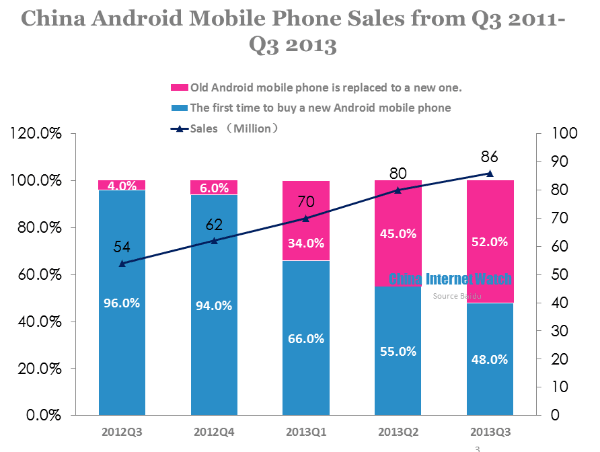

Though android mobile phone sales kept growing, about half of its growth was from android users replacing their old devices.

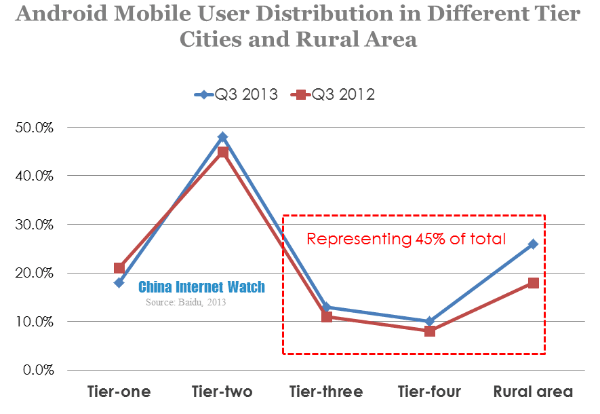

By Q3 2013, android users from tier three and four cities and rural area accounted for 45% together, 10% higher than that of 2012. It means most of new users this year were from these area.

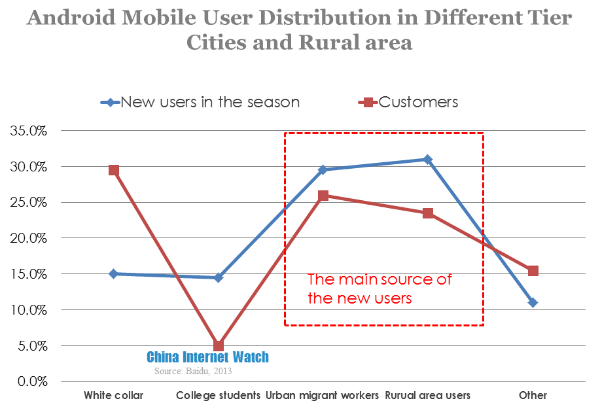

30% of the new daily active users in Q3 2013 were from rural area users and migrant workers, becoming a new driving force. College students android devices purchasing increased largely in Q3 because of a large number of freshmen, this trend would not continue in the last quarter.

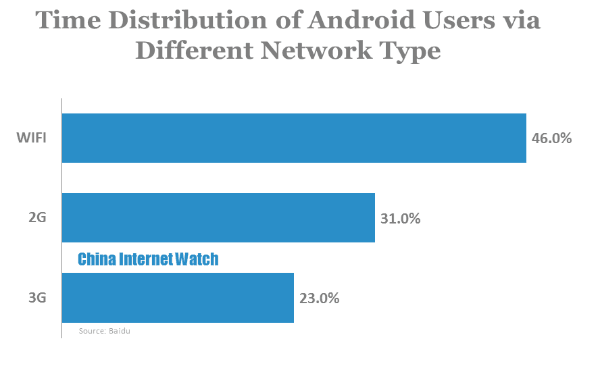

Android users spent 46% of time connecting internet via Wi-Fi, 31% via 2G and 23% via 3G.

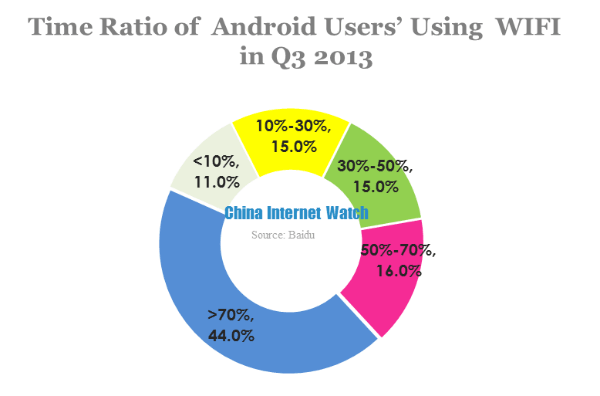

44% users spent more than 70% of their time using Wi-Fi.

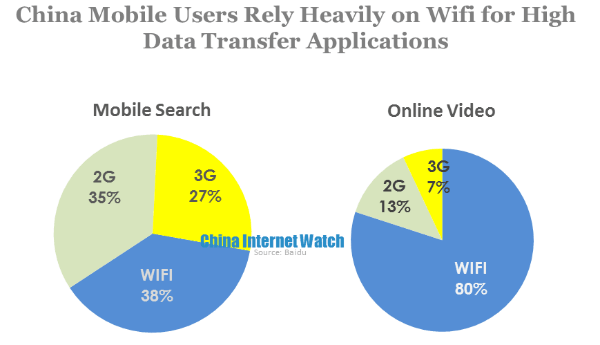

In mobile search market, most of traffic were from 2G and 3G, Wi-Fi accounted for a small percentage of 38%. However, in online video market, Wi-Fi accounted for 80% of traffic.

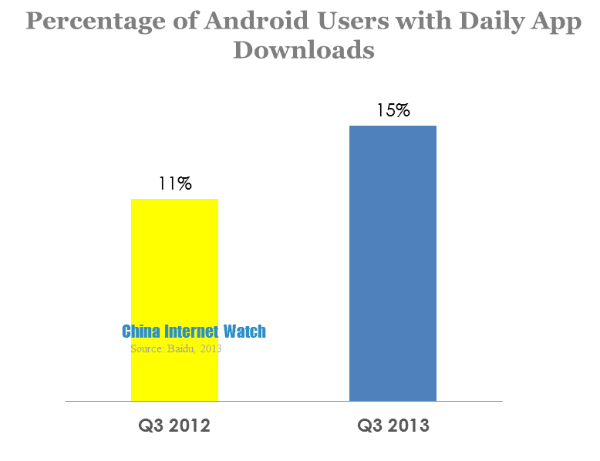

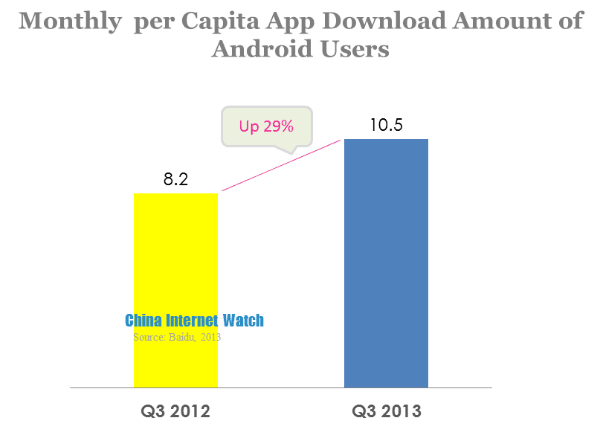

In Q3 2012, 11% of users downloaded at least one app per day. And in Q3 2013, it grew to 15%.

Android users downloaded averagely 8.2 new apps monthly in Q3 2013, and the number increased to 10.2 in Q3 2013.

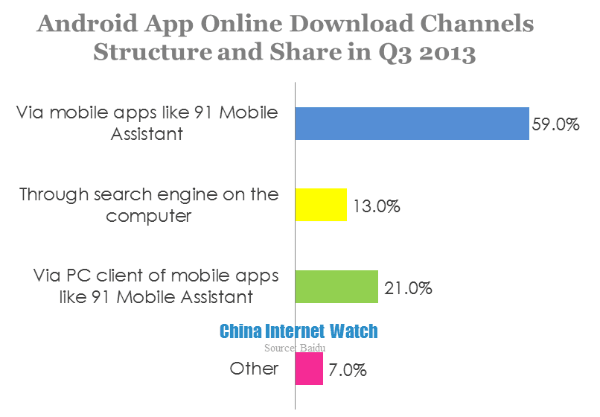

About 60% of users downloaded apps through mobile assistant app like 91, which was the main channel for getting apps online.

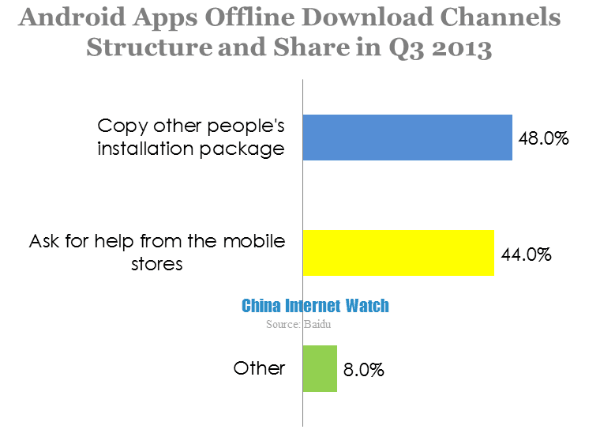

For offline app channels, 48% would copy other people’s installation apk and 44% would ask for help from mobile stores.

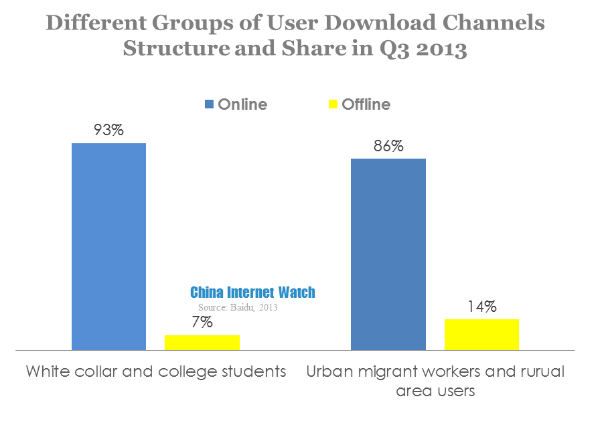

Only 7% of white collar and college students would get app offline, while the percentage in urban migrant workers and rural area users was 14% in Q3 2013.

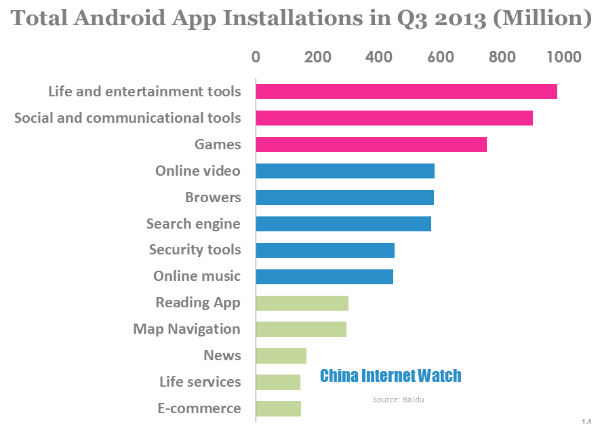

The top 5 categories of mobile app installations is shown above, which were life and entertainment tools, social and communication, game and online video.

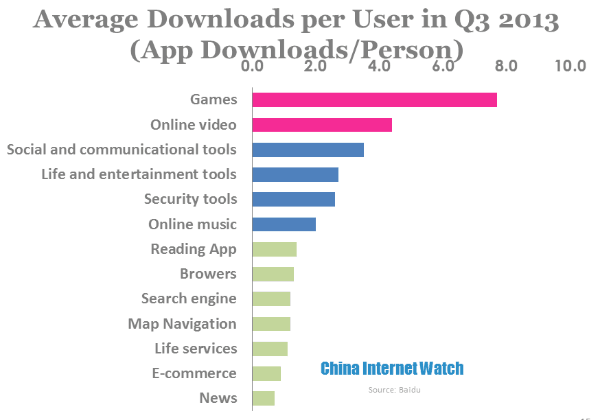

Affected by summer vacation, app downloads in Q3 was a little different. Game ranked top with 7.7 apps per user, followed by online video with 4.4.

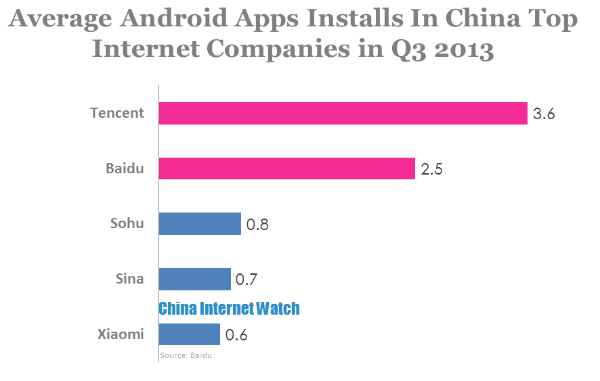

The top 5 internet companies in regards of average app installations per user were Tencent, Baidu, Sohu, Sina and Xiaomi. Android users each averagely installed 3.6 Tencent apps.

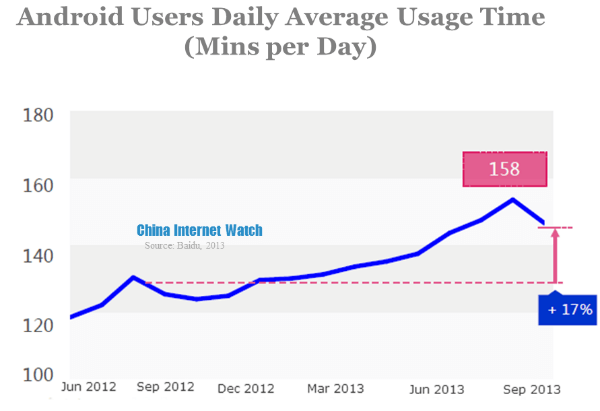

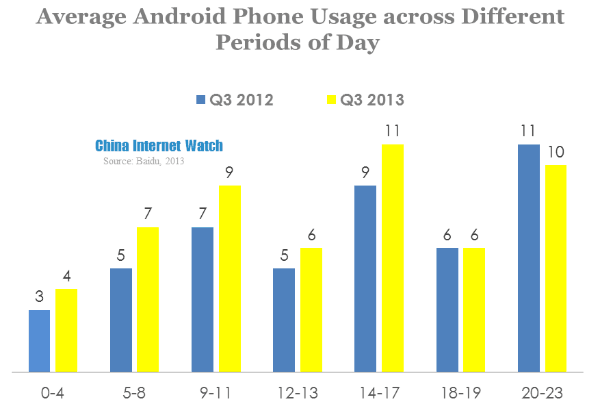

Also affected by high student activity in summer vacation, android users daily average usage time reached 160 mins/day peak in August, it dropped a little in September 2013. It increased 17% compared to Q3 2012.

Android users averagely checked their mobile 53 times per day, the frequency was extremely high in the afternoon. For example, between 2pm to 5pm, users checked about 11 times in Q3 2013.

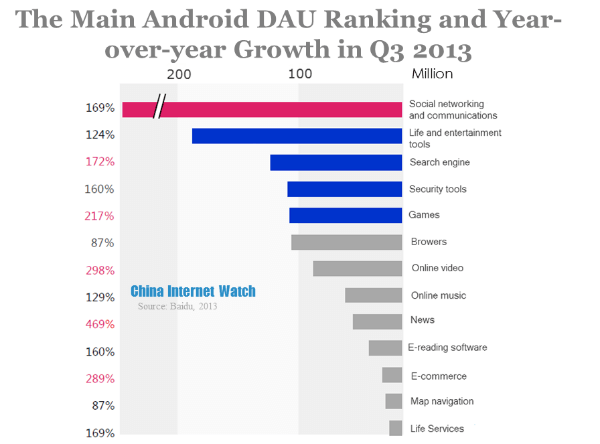

Social and communication apps had high using frequency and user accounts, relatively, it had high Daily Active User (DAU). Life and entertainment apps ranked the second. Thought it neither had high using frequency nor user accounts, it had a large number of apps in this category. Search engine and game had high growth rate in the categories with over 100 million DAU.

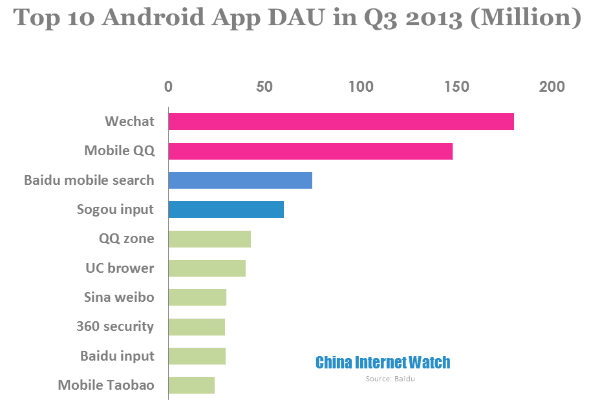

By Q3 2013, two android apps surpassed 100 million DAU and four surpassed 50 million DAU. Top 10 apps were mainly social and communication apps, input and mobile entrance apps like search engine and browser.

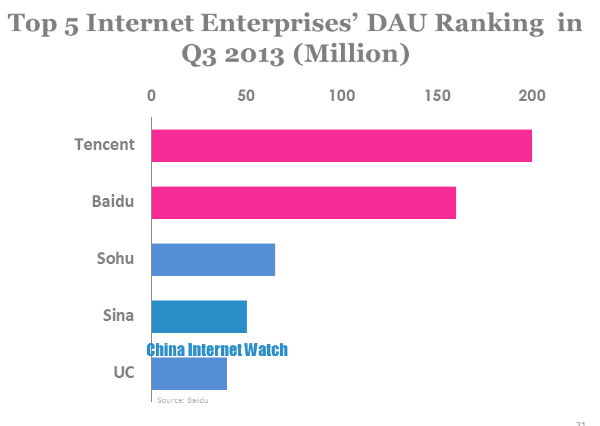

Deducted overlapping users, Tencent and Baidu both surpassed 150 million DAU in Q3 2013. For example, if one uses Baidu input and Baidu video in the same day, it will only be counted once.

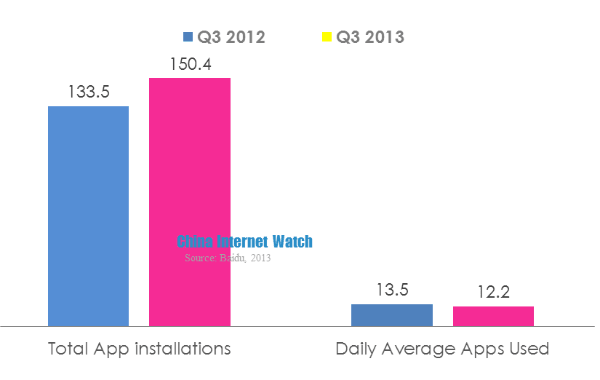

Compared to Q3 2012, the total apps installed increased 17 in 2013, however, the apps used daily decreased by 1.3 in Q3 2013. This indicated that the competition in mobile app market would be even more intense.

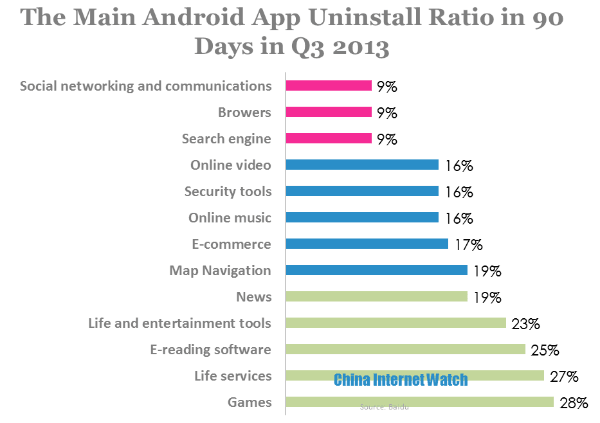

Games ranked the top in uninstall rate with 28%, because of its short product life circle and many competitors. Life and entertainment tools were low frequency apps, most users uninstalled them after using only once. These kinds of apps were more suitable as light apps, with low uninstall rate of browsers and search engines.

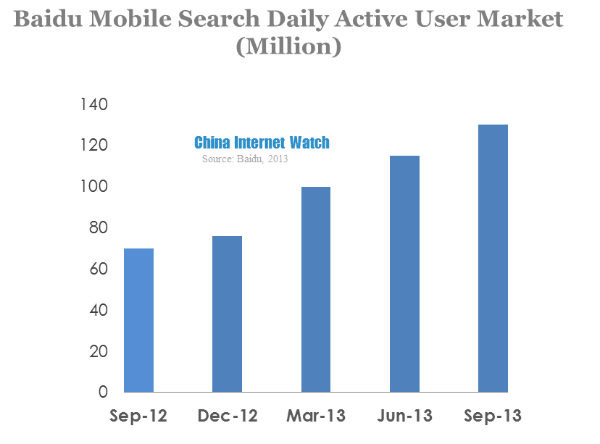

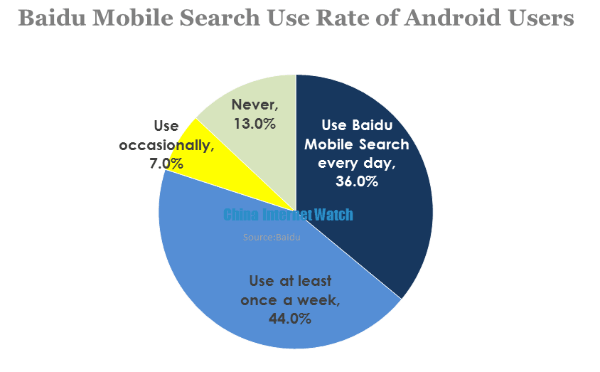

In Q3 2013, Baidu mobile search DAU reached 130 million, 36% used every day.

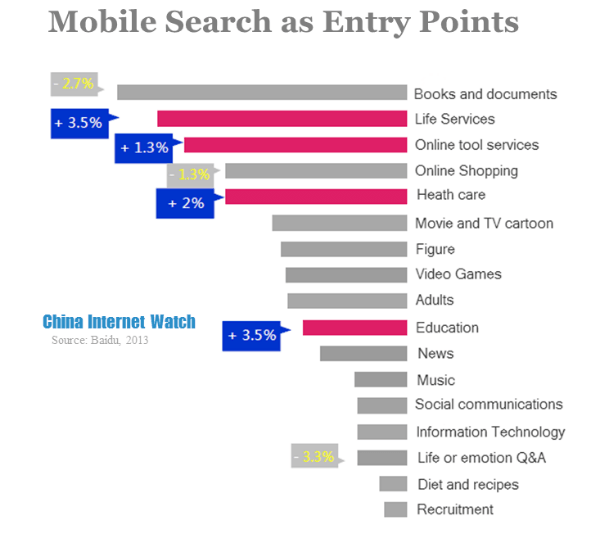

In Q3 2013, search queries for life services and education both increased by 3.5% compared to 2012, while search queries for book and documents decreased by 2.7%.

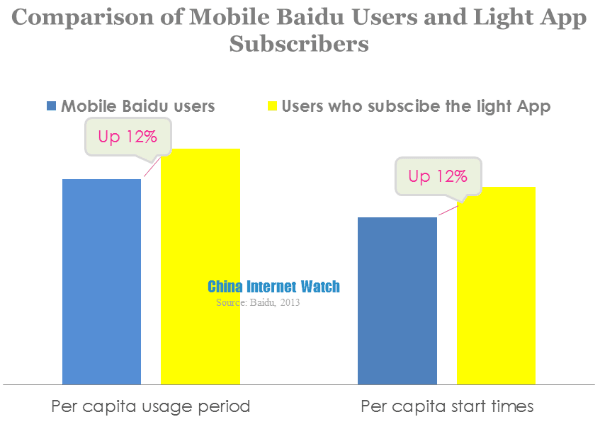

Compared to normal mobile Baidu users, those who subscribed to light apps showed high using time and frequency. It proved that light apps could bring better user experience and satisfy consumers needs for instant search.