This is part 4 of a series of posts that walk you through a variety of stats on China credit card users. Part 1, Part 2, Part 3

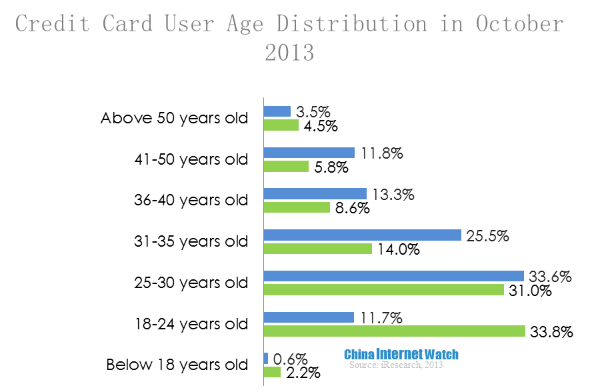

iResearch report of Chinese credit card user behavior gave us an insight on the demographic features of Chinese credit card holders. By of October 2013, most Chinese credit card holders were between the age of 25 to 30, accounted for 33.6% of total users. 25.5% users were between 31 to 35 years old, and 13.3% of users were between 36 to 40 years old. Generally, credit card users had an average higher age than non-credit card users.

Senior consumers had more stable jobs and strong purchasing power and repayment ability than young people, thus they were the main credit card target users.

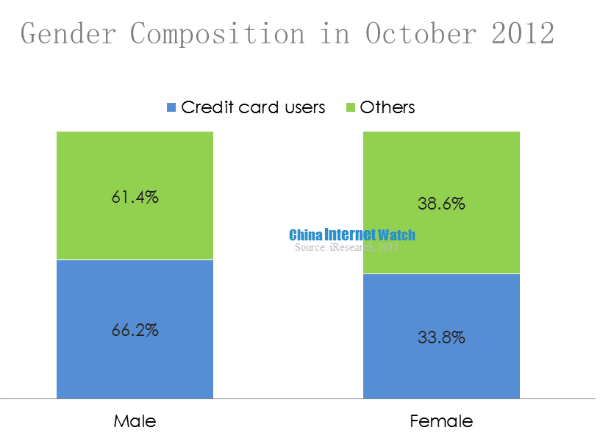

By October 2013, male credit card holders accounted for 66.2%, 4.8% higher than non-credit card male users. And female credit card users accounted for 33.8%.

Male users had been the main consumers in finance industry, it didn’t change in credit card market. Male users generally had a deeper understanding of finance products and more interest in it, besides, male users tended to have better control over impulse purchasing than female, which made higher male credit card holders.