This is part 3 of a series of posts that walk you through a variety of stats on China credit card users. Part 1, Part 2, Part 4.

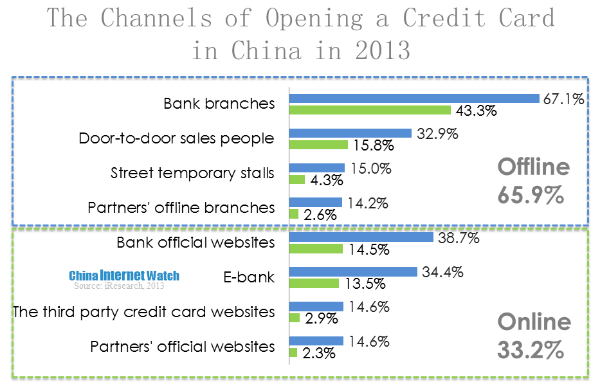

In the past year, Chinese consumers preferred to open a credit card offline, and 43.3% users went to bank branches according to iResearch. Another popular method was door-to-door sales, which accounted for 15.8%.

Bank official websites was the most often used channel to open a credit card online, with 14.5% of total users. Followed by e-bank with 13.5%. The other channels each accounted for less than 5%.

One reason was that Chinese consumers hadn’t get used to online services, what’s more, they had more face-to-face communications with salesperson and gained customized services. Another major reason was few banks offering online credit card applying channels. However, as the rise of e-banks, there would be more people choose e-bank services.

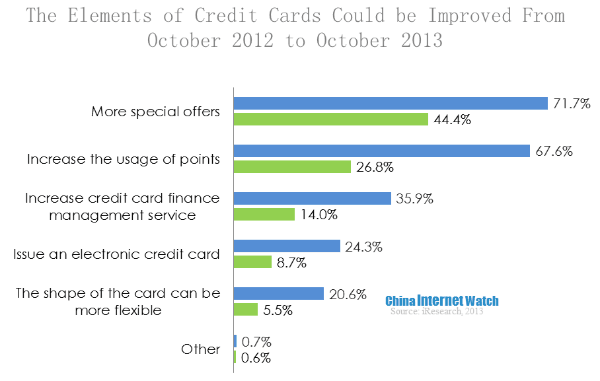

From October 2012 to October 2013, 44.4% Chinese consumers thought credit card should offer more special offers. And 26.8% users would like the banks to increase the usage of credit card points. 14% wanted to increase credit card finance management service, while less than 9% users preferred to issue an electronic credit card or to change the shape of cards.

Due to the fact that Chinese credit card market was still in the early stage, consumers’ needs for improving credit cards remained very basic. The majority of credit card holders wanted to enrich existent services and improve finance management.