This is part 2 of a series of posts that walk you through a variety of stats on China credit card users. Part 1, Part 3, Part 4.

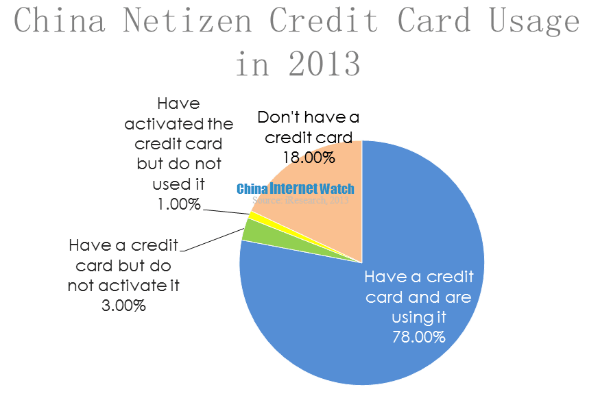

Chinese credit cards market is prosperous, the number of credit card holders increased greatly from 2012 to 2013. According to iResearch, Chinese netizens credit card penetration reached 82% in October 2013. 82% Chinese netizens held at least one credit card, 77.7% netizens were using credit cards currently.

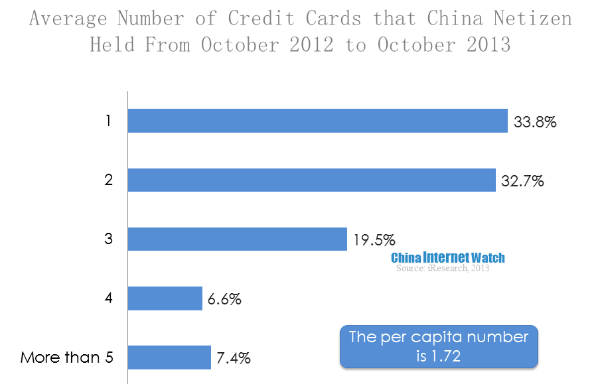

Of all credit cards holders, most people used only one credit card, with 33.8%. 32.7% netizens held two cards. The prosperous of Chinese credit card market was attributed to three major reasons. First, Chinese banks laid big emphasis on credit card business. Second, Chinese consumers gradually accepted the credit card consumption concept, their needs for credit cards grew bigger accordingly. Third, market environment for credit card consumption was mature over years.

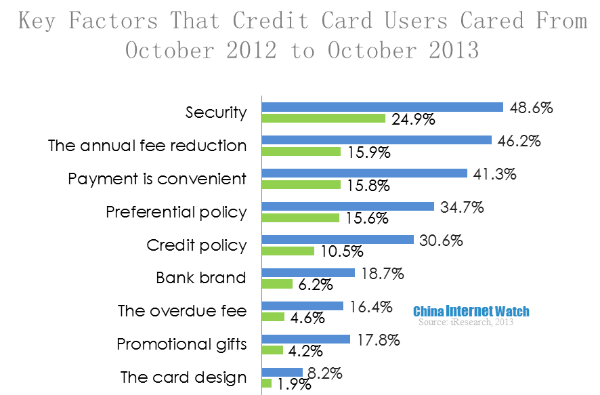

By October 2013, 24.9% Chinese credit card holders expressed their concern about credit card security, and 15.9% paid attention to annual fee reduction policies. 15.8% cared about the convenience of credit card repayment.

It showed that Chinese card holders were still in the early stage, focusing mostly on the basis needs of credit cards. Top three factors which brought most attention of Chinese consumers were security, annual fee reduction and repayment convenience. It’s both opportunity and challenge for Chinese banks, for those banks which offered customized and value-added service to credit card holders will expand their market share quickly.