This is part 1 of a series of posts that walk you through a variety of stats on China credit card users. Part 2, Part 3, Part 4.

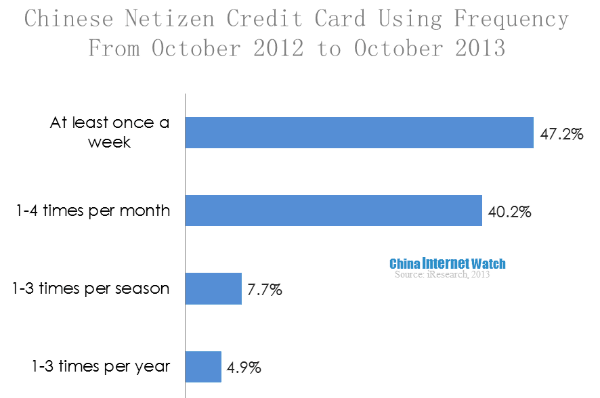

iResearch released China credit card holders behavior report from 2012 to 2013 in the recent. From October 2012 to October 2013, Chinese credit card holders showed a high frequency of credit card usage. 47.2% used credit cards at least once a week, and 40.2% said they used it averagely one to four times per month.

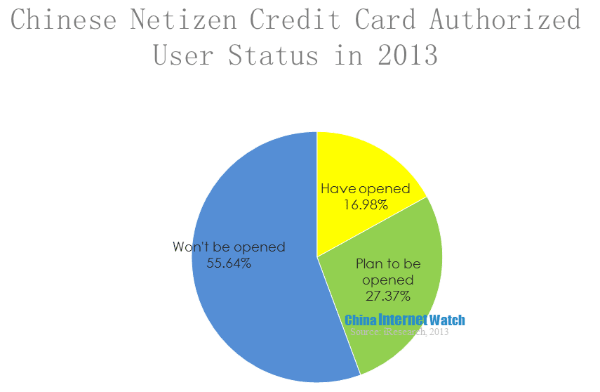

However, although Chinese credit card holders were highly active in the past year, credit card authorized users were optimistic. Only about 17% opened credit card authorized user account, while 56% said they wouldn’t open authorized user account.

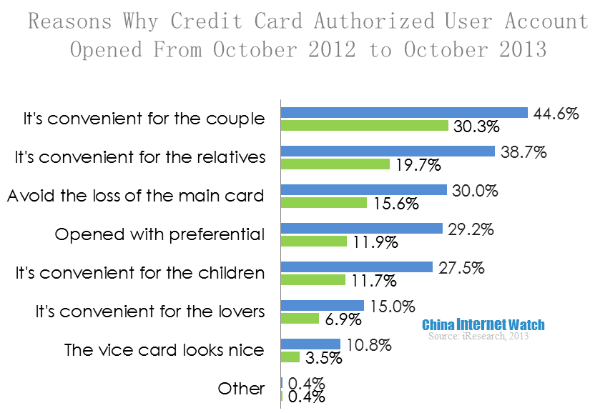

By October 2013, Chinese credit card holders who had opened credit card authorized user account and planned to open it occupied 44.4%. The most important reason for opening authorized user account was the convenience for spouse, with 30.3%. 19.7% opened it for the convenience of their relatives. 15.6% opened it to make precautions for losing primary card.

It showed that Chinese card holders were still in the early stage, focusing mostly on the basis needs of credit cards. They had pretty high credit cards using frequency, but few credit card authorized users. Most Chinese credit card holders had little knowledge of the strengths of using credit card authorized user account.

Credit card authorized user account was one of the main feature of credit card, separating it from debit card. According to iResearch survey, about 50% users opened authorized user account for the convenience of spouse and relatives. Credit card authorized user account was still very basic, with no specified features designed for authorized card holders.

In the future, Chinese banks could make innovation on family finance management credit card, this could be huge breakthrough for credit card business.