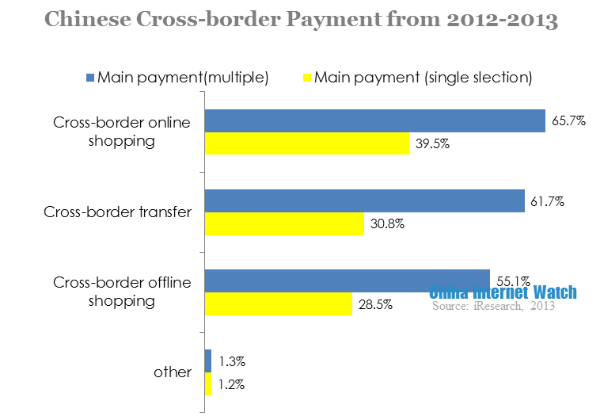

iResearch’s report showed that current Chinese consumers’ cross-border payment included cross-border online shopping, cross-border transfer and cross-border offline shopping. Most consumers used cross-border online shopping, with 65.7%. And 39.5% consumers regarded it as the most frequently used payment.

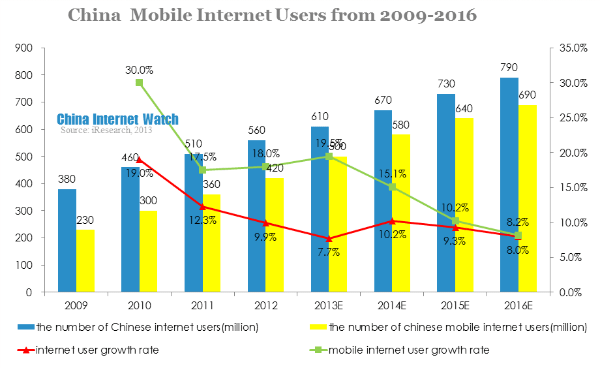

In 2012, Chinese netizen reached 560 million, and mobile internet users reached 460 million. The growth rates slowed down, which means that Chinese internet industry became mature. Affected by global internet development and finance crisis, the demand for cross-border shopping went up accordingly.

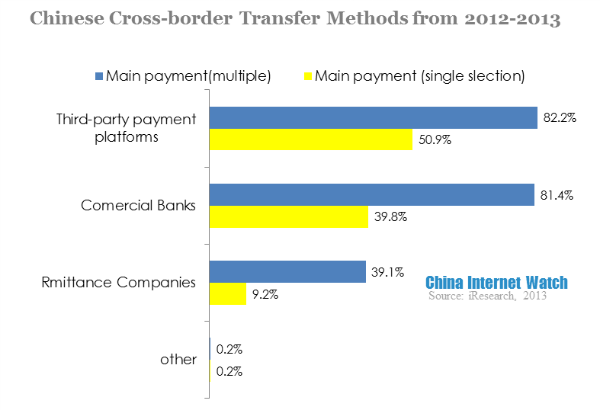

Data showed that third-party platforms were the most popular method for cross-border money transfer. 50.9% consumers chose third-party platforms to transfer money, while 39.8% chose commercial banks. Only 9.2% would use remittance companies.

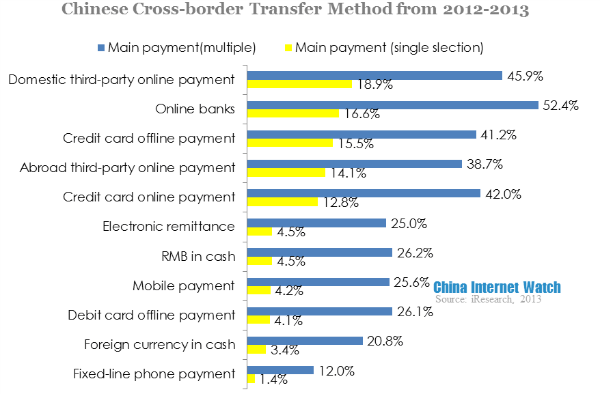

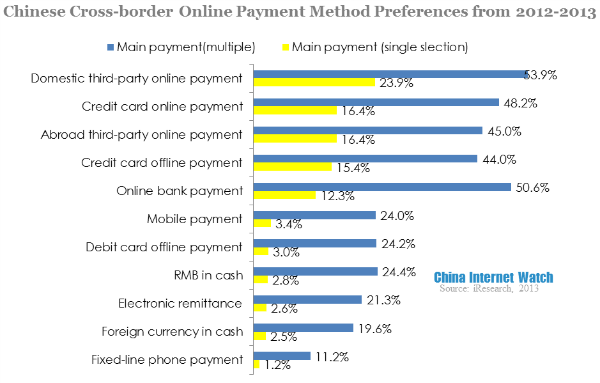

18.9% Chinese consumers preferred domestic third-party online payment, and 16.6% favored online banks and 15.5% would chose credit card offline payment.

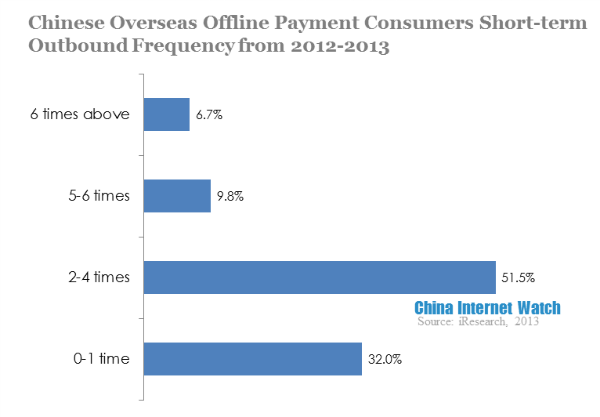

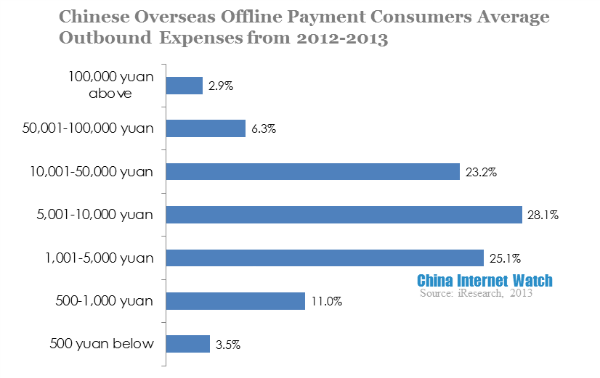

As for overseas offline payment, Chinese consumers showed a pattern of low frequency outbound and high consumption amount. 83.5% consumers’ average outbound frequency was below four times a year. And the single outbound consumption amount over 5,000 yuan (USD 815) users occupied 60%, and about one thirds of consumers spent more than 10,000 yuan (USD 1630).

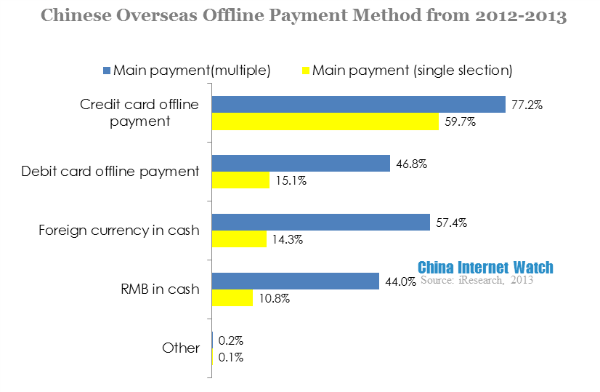

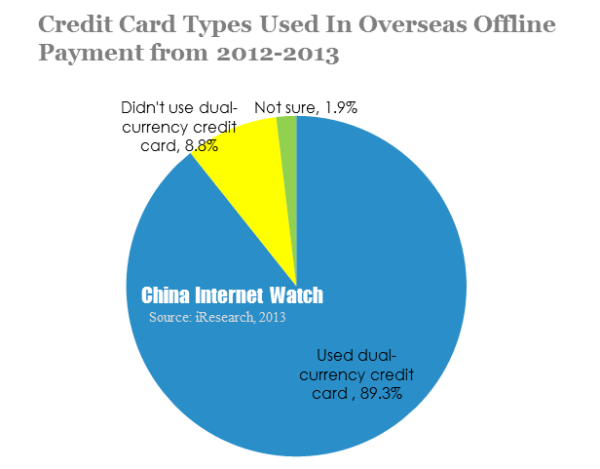

Payment by card became the main overseas offline payment methods, 59.7% paid by credit card and 15.1% paid by debit card. And 90% consumers used dual-currency credit card.

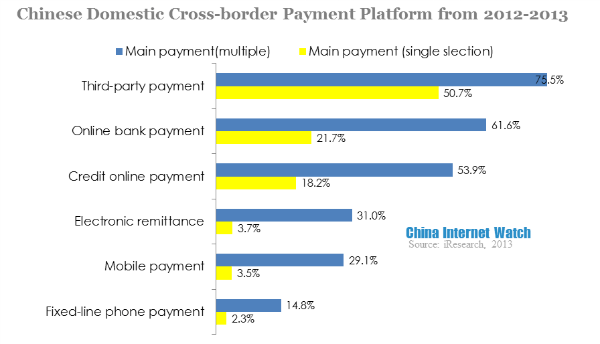

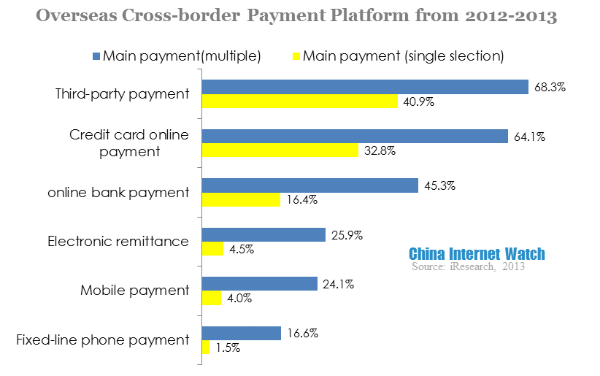

The payment methods of domestic cross-border payment platforms and overseas cross-border payment platforms were slightly different. For domestic cross-border payment platforms, 50.7% consumers chose third-party payment, and 18.2% chose credit card online payment; as for overseas cross-border payment platforms, 40.9% used third-party payment and 32.8% used credit card online payment. Because overseas credit card market is more mature than Chinese market, it has higher popularity.

More than 80% Chinese consumers preferred online payment in cross-border payment.

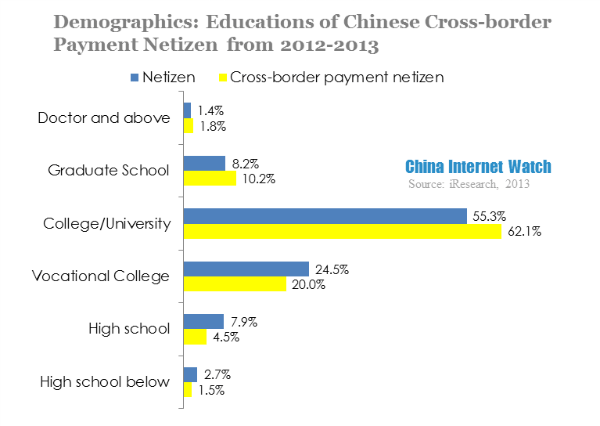

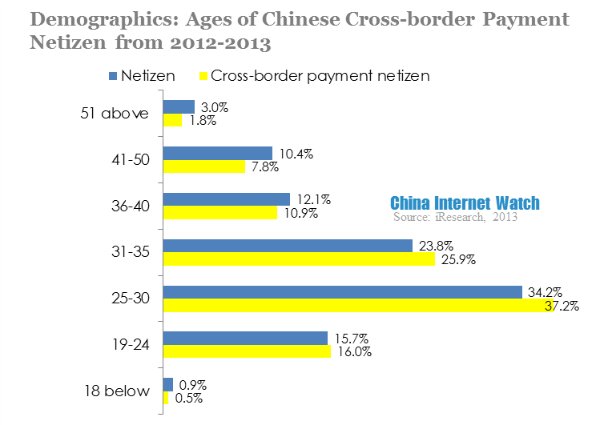

Over 60% cross-border payment users were between 25-35, and those between 25-30 had the highest cross-border payment consumers. And 74% cross-border users had college and above educations, higher than average netizen with 64.9%.