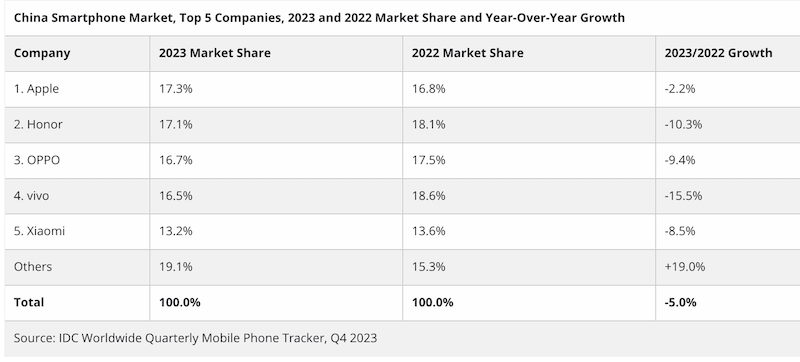

In 2023, China’s smartphone market underwent significant changes, with Apple capturing a leading 17.3% market share despite a 5.0% dip in overall shipments to 271.3 million units, the lowest in a decade, as per IDC. This contraction mirrors cautious consumer spending amidst a slow economic recovery.

However, the last quarter saw a 1.2% year-over-year increase in shipments, thanks to strong demand for premium smartphones, particularly in major cities. Apple’s strategic price cuts through third-party channels played a pivotal role in this growth, as did Honor’s reinforced channel partnerships and diversified product offerings, securing their respective top spots in the market.

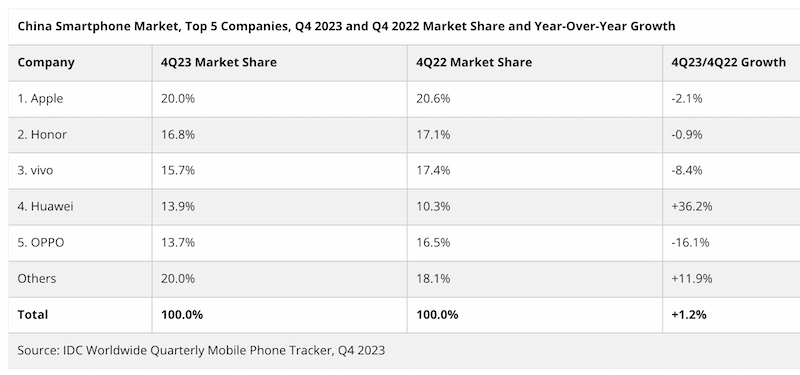

A remarkable turnaround was Huawei’s re-entry into the top five, after more than two years, suggesting a revitalized competitive landscape. Despite these shifts, the final quarter of 2023 revealed nuanced dynamics: Apple and Honor slightly decreased their market shares, while Huawei saw a significant 36.2% increase, and the ‘Others’ category grew by 11.9%, indicating a diversifying market.

In contrast, Q4 2023 observed a 1.2% year-over-year uplift in shipments to 73.6 million units, halting a streak of declines over ten quarters. This rebound was spearheaded by robust demand for premium smartphones in major cities, while the market for lower-end phones lagged, despite their majority share in China’s market.

Arthur Guo, a senior research analyst at IDC China, highlighted Apple’s ascent to prominence amidst stiffened competition and subdued spending. Apple’s strategic price cuts through third-party channels spurred demand, securing its dominance.

Concurrently, Honor solidified its second position through enhanced channel partnerships and a diversified product suite, appealing to both high-end and mid-range segments.

A notable event in 4Q23 was Huawei’s resurgence in the top five after a hiatus exceeding two years, notes Will Wong, IDC Asia/Pacific’s senior research manager. This comeback intensifies competition in the world’s most significant smartphone arena.

The data reveals a mixed picture:

- Apple’s market share declined slightly from 20.6% in Q4 2022 to 20.0% in Q4 2023, indicating a -2.1% change.

- Honor also saw a slight dip from 17.1% to 16.8%, a -0.9% change.

- Vivo’s market presence shrank by -8.4%, dropping to 15.7% from 17.4%.

- Huawei defied the trend, soaring by +36.2% to reach a 13.9% market share, up from 10.3%.

- OPPO’s share fell by -16.1% to 13.7%, down from 16.5%.

- The ‘Others’ category grew by +11.9%, accumulating a 20.0% share, a significant collective rise.

The overall market dynamics for 2023 contrast with the final quarter, suggesting a nuanced recovery trajectory. While Apple and Honor lead the charge, with Huawei’s return signaling a potential market shakeup, companies like Vivo and OPPO may need to rethink strategies to maintain their footholds.

The Rise of Foldable Smartphones

In a notable development, IDC’s latest quarterly mobile phone tracker highlights the explosive growth of China’s foldable smartphone market, with shipments reaching approximately 2.77 million units in Q4 2023, a staggering 149.6% year-over-year increase.

This surge is propelled by new releases from Huawei, OPPO, and Honor, marking a continuous rapid growth trend for the fourth consecutive year, with a total of 7.01 million units shipped in 2023, up 114.5% from the previous year.

Improvements in hardware technology, software applications, and a drop in prices have enhanced the consumer experience and widened the foldable smartphone’s appeal. The price segment of $400-$600 is becoming increasingly populated, reflecting the segment’s potential for further growth.

Market Preferences and Performance

Consumers have shown a preference for horizontally folding devices over their vertically folding counterparts, despite the latter’s lower price points, due to the superior screen experience they offer.

Horizontally folding models, especially favored by the business sector for mobile office use, regained market share, reaching 68.1%, a 10.4 percentage point increase from the previous year.

In terms of market performance, Huawei dominated the foldable market with its Mate X5 series, capturing a 37.4% share.

OPPO followed with an 18.3% share, leading the vertically folding segment. Honor’s aggressive push in the second half of 2023 earned it third place, with a 17.7% share and the fastest growth rate of 467.0%. Samsung and Vivo rounded out the top five, facing stiff competition in the vibrant Chinese market.

Future Outlook

Arthur Guo of IDC China underscores the importance of balance between design and reliability in the foldable market.

As manufacturers vie for dominance in 2024, the foldable smartphone segment is set to continue its rapid expansion, driven by innovation and an increasing number of market players.

This evolving landscape suggests a dynamic future for China’s smartphone market, with foldable technology at the forefront of the next wave of mobile innovation.