In 2013, China luxury brands market growth slowed down due to economic and other factors. But, how would China secondhand luxury brands market perform? Institute Fortune Character, an institute of Fortune Character which is a luxury lifestyle publication in China, did a survey of more than 200 secondhand luxury stores in Beijing, Shanghai and Guangzhou and many secondhand luxury store owners and 573 luxury brands consumers.

Secondhand Market Scale

As the largest luxury brands consumer group, Chinese consumers had accumulated more luxury brands than they could use. It is estimated the secondhand luxury brands market would be 300 billion yuan (USD 48.95 billion), and the annual growth rate will be 20%.

Because of consumer attitudes and immature secondhand market, by the end of the first half of 2013, secondhand luxury transaction was merely 3 billion yuan (USD 489.5 million). However, the annual growth rate reached 30%, faster than luxury brands market. Though the growth was promising, most secondhand luxury brands stores were small and many were in net loss.

Tier One Cities

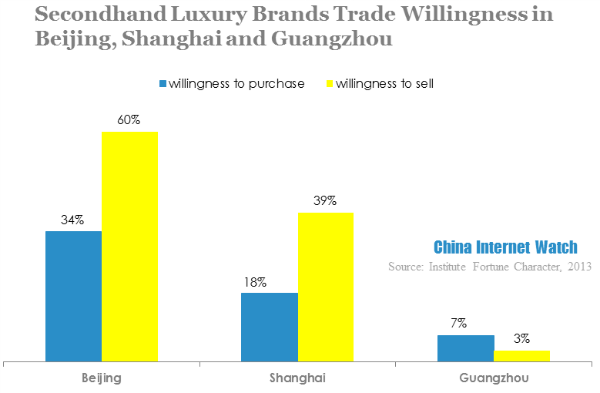

Tier one cities consumers were more likely to trade secondhand luxury brands, Beijing ranked the first, followed by Shanghai. 60% Beijing consumers expressed their strong willing to sell their luxury brands. However, Guangzhou consumers willingness to trade secondhand luxury brands obviously were lower than Beijing and Shanghai, it was due to the luxury brands market and consumer attitudes in Guangzhou.

Data showed that tier two and three cities consumers’ willingness to trade secondhand luxury brands was quite low. Rich people wouldn’t purchase secondhand luxury brands, and common consumers were still sensitive to price. Secondhand luxury brands were more expensive than fake luxury brands and non-luxury brands.

Tier Two and Three Cities

Secondhand luxury brands stores increased from 512 in 2012 to 823 in 2013, with 37.8% annual growth rate. The new stores were not only opened in tier one cities, but also in tier two cities such as Changsha, Hangzhou and Chengdou.

Tier one cities were still the main market of secondhand luxury brands with relatively mature and rational luxury consumers, and tier two and three cities were new markets that many began fighting for.

Fake Luxury Brands

Fake luxury brands in secondhand market were quite common. Most fake brands came from manufacturers and dealers, and some stores sold out the fake luxury brands on purpose.

Top 10 fake luxury brands were: LV, GUCCI, CHANEL, HERMES, PRADA, ROLEX, Cartier, BOTTEGA VENETA, Dior and BURBERRY.

Secondhand Luxury Consumers

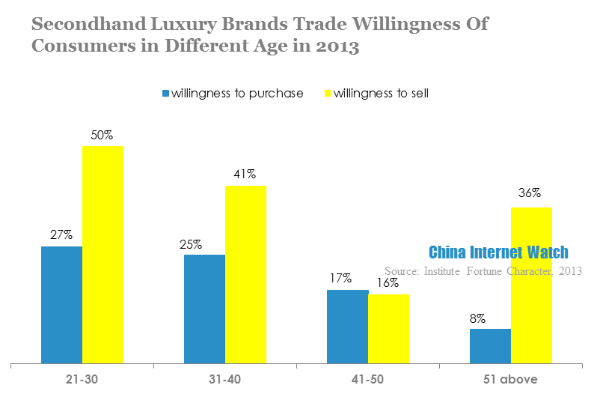

Consumers between the age 21-30 and 31-40 were the main consuming group in secondhand luxury brands market. 27% post 80s, whose ages were between 21-30, said they would purchase luxury brands from secondhand stores; 50% said they wanted to sell luxury brands to secondhand stores.

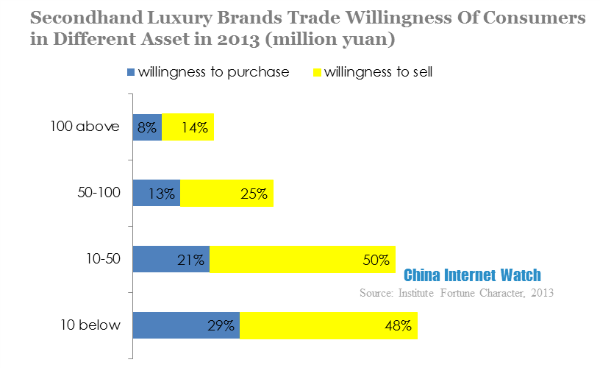

In 2013, consumers whose assets were below 10 million yuan (USD 1.6 million) and between 10-50 million yuan (USD 1.6-8.2 million) tended to sell their secondhand luxury brands more than last year. Their purchasing willingness dropped accordingly to 29% and 21%.

This means Chinese secondhand luxury brands market has expanded, however, 80% were not the main consumers who had relatively low income, unstable consuming power and high price sensitivity. It would be even more difficult for secondhand luxury stores to make profits, leading to the popularity of fake luxury brands dealers. According to Institute Fortune Character, the percentage of fake brands in secondhand luxury market reached 80%.

The main active consumers should have around 10-50 million assets, who desired the luxury lifestyle but limited to their finance status to buy luxury brands.

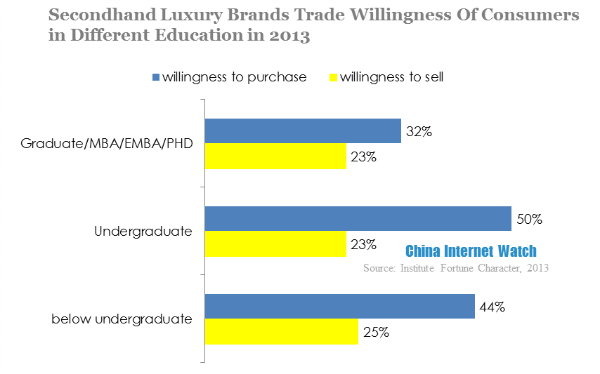

Most consumers in secondhand luxury market had bachelor degrees, and consumers with higher education background were more open-minded and more likely to trade secondhand luxury brands. In 2013, more consumers without bachelor degrees entered into secondhand luxury market, their willingness to purchase and sell increased to 25% and 44%.

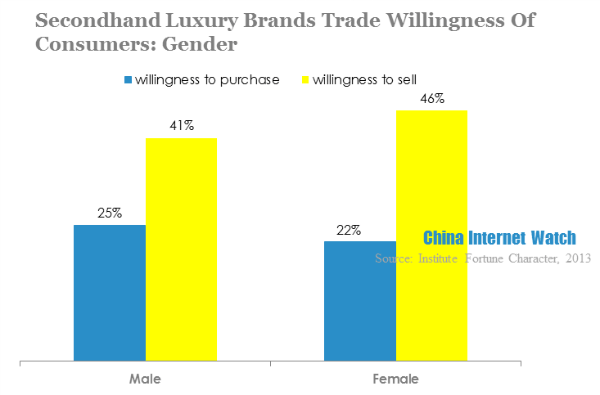

In 2013, male’s willingness to purchase secondhand luxury brands increased significantly to 25%, surpassing female’s willingness to purchase for the first time. Male consumers had a strong willing to sell luxury watches, leather products and autos.