China’s cloud infrastructure services market grew by 45% to US$27.4 billion in 2021 according to Canalys.

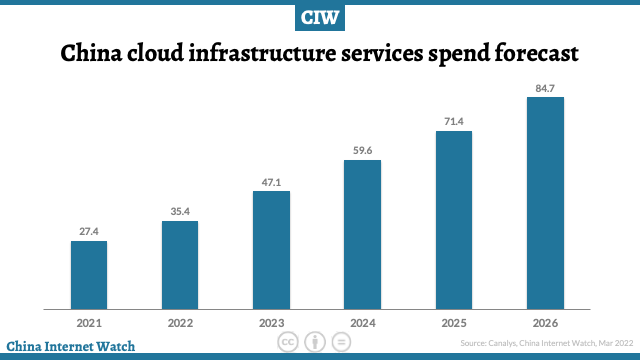

The fourth quarter of 2021 saw a year-on-year increase of 33% to US$7.7 billion. Canalys predicts that by 2026, the scale of the cloud infrastructure market in the mainland will reach US$85 billion, and the five-year compound annual growth rate will be 25%.

Visit here for AI Cloud market share.

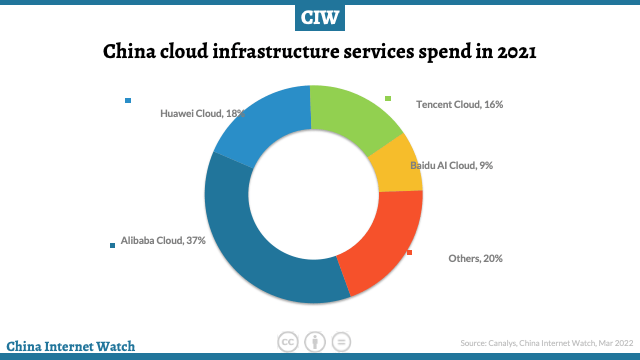

Alibaba Cloud remains the leader with a 37% market share, ranking first in the cloud market in 2021, Huawei Cloud and Tencent Cloud second and third respectively, and Baidu AI cloud fourth. In 2021, the four cloud providers jointly accounted for 80% of the market share.

Huawei Cloud reached an 18% market share in 2021, with an annual growth of 67%. The rapid growth has widened the gap between Huawei cloud and Tencent Cloud, ranking second in the market.

Tencent cloud, the third-largest provider, accounted for 16% of the market share, an increase of 55%. Tencent Cloud grew steadily as a whole in 2021, with diversified growth in multiple sectors.

Baidu AI Cloud, the fourth-largest vendor, accounted for 9% of the market share, an increase of 55%.

Top 10 forecasts for China cloud computing market 2021-2024

China’s Public Cloud Services Market to Grow to 10.5% of global share by 2024

In 2020, the overall market size of global public cloud services (IAAs/PAAS/SaaS) reached US$312.42 billion, with a year-on-year growth of 24.1%, according to IDC.

The overall market size of China’s public cloud services reached US$19.38 billion, with a year-on-year growth of 49.7%, with the highest growth rate in all regions of the world. IDC predicts that the global share of China’s public cloud service market will increase from 6.5% in 2020 to more than 10.5% by 2024.

Check out market share of IaaS and PaaS markets in China here.

CIW Subscribers (Annual) can download the chart here to see the comparison of the cloud platforms in China.

Download China Internet Overview whitepaper here.