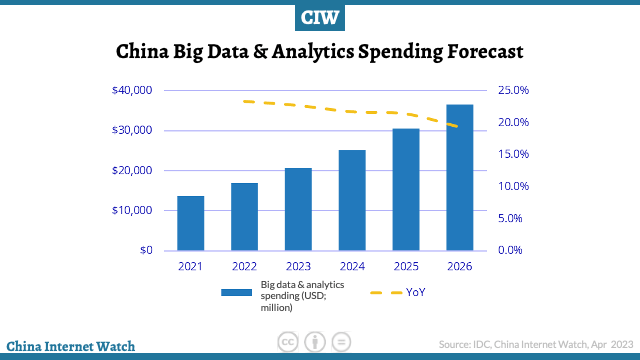

China’s big data and analytics market’s total IT investment in 2022 is approximately $17 billion, doubling to $36.49 billion by 2026, according to an IDC report.

China’s market share is predicted to grow within the five-year forecast, surpassing the Asia-Pacific region (excluding China and Japan) by 2024, and approaching 8% of the global total by 2026.

China’s big data and analytics market maintains strong growth due to new policies like Digital China, Data Elements, Big Data Initiatives, post-pandemic business project demands, and various industries seeking to leverage data value after completing basic information technology infrastructure.

IDC has observed that vendors are actively investing in foundational computing and storage, data middle platforms, and big data analytics services, particularly focusing on industries such as finance, government, energy, and manufacturing.

Customers are also embarking on a new round of investment. Notably, the success of ChatGPT has drawn significant capital attention to the data computation and storage sectors, pushing the big data market towards larger scale, increased computing power, and more specialized services.

China’s big data IT investment will continue to flow into the hardware market in the short term, with hardware accounting for nearly 40%, according to IDC.

Read more: China’s AI Market Booms with Focus on Professional Services, Government, and Finance

In the long run, the software shows strong performance, with a five-year compound annual growth rate (CAGR) close to 28%, and is expected to surpass the hardware market in size by 2026, becoming the dominant technology sector.

The integration of data intelligence and AI with the big data market leads to spiraling growth and mutual promotion, with the popularity of ChatGPT and AIGC driving investments and updates in data governance, business query, and predictive analytics platforms.

Improvements in underlying data quality and scale, as well as secure sharing and circulation, will promote the upgrading of upper-level intelligent application services. The data middle platform is experiencing a new wave of development.

Vendors are actively creating full-cycle data governance and development platforms for specialized business scenarios and domains, such as graph and voice/text data. The overall trend for the services market remains relatively stable, with the total market size expected to exceed $11 billion by 2026.

Government, finance, professional services, and telecommunications are the main industry users of big data-related IT expenditures in China, accounting for over 60% of the total market. Among them, professional services have the largest share, surpassing 15% by 2026.

Internet companies possess massive user and internal/external data, including various dimensions such as time, space, and user information. As recommendation, prediction, decision-making, and risk management services face demands for more accurate and faster identification and response, CIOs will place increasing importance on underlying data investments and middle platform construction.

Local governments rank second with an 11.7% share and a five-year CAGR of nearly 23%. Digital China drives further upgrades in government construction, with significant room for improvement in unified data governance and automated service dispatch development.

In the future, government data will need to circulate more securely and traceably among enterprises and universities, inevitably promoting more significant investments in big data and its deep integration with artificial intelligence, cloud computing, and blockchain.

From a growth rate perspective, seven industries, including healthcare, discrete manufacturing, and local governments, have a five-year CAGR exceeding the average growth rate of China’s market, indicating promising development prospects.

As society’s data literacy improves, government policies, international environments, underlying support, and application services provide better development opportunities and market space for the big data market.

Scenario specialization, high scalability, loose coupling, and security and stability have become the keywords for developing the big data market.