China’s passenger electric vehicle (EV) market continues to grow at an impressive rate, with EV sales rising by 87% YoY in 2022, according to the latest research from Counterpoint.

One in four cars sold in China was an EV, highlighting the country’s vibrant EV market. Interestingly, plug-in hybrid EVs (PHEVs) increased their share to 24%, while battery EVs (BEVs) saw a decrease.

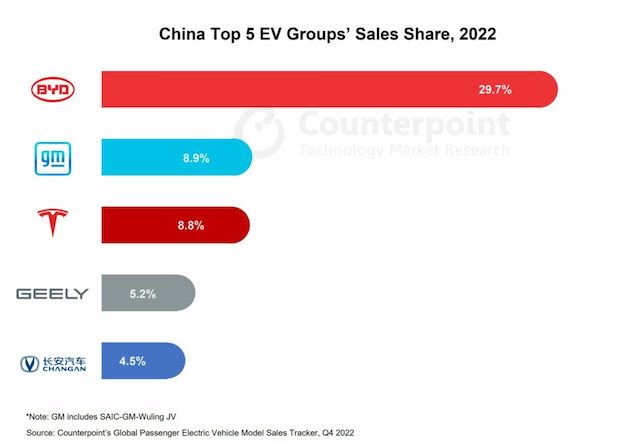

BYD, Wuling, Chery, Changan, and GAC are some of the top Chinese brands that dominate the EV market, with local brands commanding 81%.

Furthermore, the study shows that China accounts for nearly 59% of the global EV sales volume, making it the second fastest-growing market among the world’s top 10 EV markets. In contrast, Japan was the fastest-growing market, with a YoY growth of 119%.

Counterpoint forecasts that EV sales will exceed eight million units in 2023. However, phasing out subsidies and EV players’ wealth could lead to a price war as brands fight for market share.

Meanwhile, in 2022, BYD increased its market share by over 11% YoY, with six out of the top 10 EV models in the Chinese market coming from the brand. In comparison, Tesla’s market share dropped by nearly 5% YoY due to production halts in April and May 2022.

Moreover, the availability of a limited product mix, increased costs due to a problematic supply situation, competition from affordable options offered by EV start-ups, and domestic sentiment hindered Tesla’s efforts to solidify its position in the Chinese market.

In Q4 2022, the BYD Song overtook the Wuling Hongguang MINI EV as the top-selling EV model, ending the latter’s eight-quarter reign in the market. The top 10 EV models accounted for almost 45% of the total EV sales, indicating that new start-ups are offering intense competition to established players.