Since the IPO of LightInTheBox in the U.S., Chinese e-commerce has turned their interest in international cross-border transactions. Besides, the new government policies supporting foreign e-commerce retailers might make it new highlight.

International e-commerce actually is a low cost and low risk business. Data from China, the UK and the U.S. all showed that international e-commerce developing speed and profit rate were higher than domestic e-commerce.

Although the offline market was sluggish recently, but international e-commerce was growing in many countries. One explanation for this is offline market is saturated. What’s more, online market pattern has gradually formed and e-commerce companies have entered into refinement operation stage.

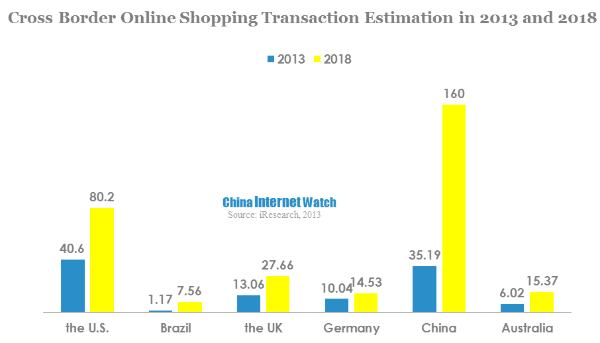

According to Nielsen’s research from May 27 to June 12 in 2013, which investigated more than 6,000 cross-border online shoppers from the U.S., Germany, the UK, Australia, China and Brazil, the online shopping transaction from the six countries with 93.7 million consumers would reach USD 105 billion. And by the end of 2018, consumers from the six countries will grow to 130 million and the online shopping transaction will hit USD 307 billion.

Key Findings:

- American sites were the most popular destinations, with 45%. Followed by the UK with 37% and China with 26%. 80% of interviewers said the main reason for shopping on a foreign website was to save money, and 79% believed it was difficult to find the product they wanted in local stores.

- Cross border online shopping’s main products were clothing, shoes and accessories. These three categories brought USD 12.5 billion sales. Followed by cosmetics and healthcare products, with USD 7.6 billion. Personal electronics and computer hardware each brought USD 6 billion, watch and jewelry brought USD 5.8 billion.

- 90% said they worried most about the safety, among which Chinese and Brazilian consumers worried most. 80% used paypal as cross border payment method.

When made in China swept away the U.S. and European countries around 2005, tt was also the emerge of eBay and Chinese major foreign e-commerce retailers. The strong manufacturing productivity made sure Chinese international e-commerce grew the fastest in the world.

In 2013, more and more Chinese e-commerce companies began developing B2C business. In contrast to the saturated B2B market, B2C drew more attention and investment. Not to mention that B2C could bring 30% profit rate, while B2B’s profit rate is around 5%.

For Chinese e-commerce company, the fastest way to open a new international market is to take advantage of eBay and Amazon. By the end of November 2012, about 7,500 eBay big sellers were from Hong Kong and Taiwan. The average annual sales reached USD 100,000. 598 among these big sellers achieved more than USD 1 million sales. Self-built vertical websites were only a supplement at present. 77% of the sales were from eBay, 23% were from other channels.

According to iResearch, cross border online retail market scale will increase from USD 1.7 billion in 2012 to USD 90 billion in 2015, with an annual growth rate of 75.8%.