The import and export of China’s cross-border e-commerce in the first quarter of 2021 totaled 419.5 billion yuan (US$63.83 billion), a year-on-year increase of 46.5%, according to China’s The General Administration of Customs.

The export cross-border e-commerce totaled 280.8 billion yuan (US$42.73 billion), an increase of 69.3%; the import totaled 138.7 billion yuan (US$21.10 billion), an increase of 15.1%.

The General Administration of Customs works with relevant ministries and commissions to continuously innovate and optimize the regulatory system and support the healthy and orderly development of cross-border e-commerce and other new formats.

There are more than 600,000 cross-border e-commerce related enterprises in China, with more than 42,000 newly registered companies since the beginning of 2021, according to Tianyancha data.

In 2021, in addition to the North American and European markets, there are also countries and regions in Latin America, Southeast Asia, South Korea, Japan, the Middle East, Africa, etc. where many cross-border sellers are ready to reach.

Top e-commerce mobile shopping platforms in China 2021

E-commerce in 2021

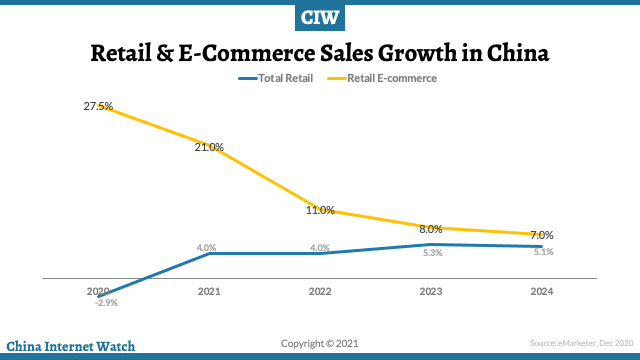

Retail e-commerce sales in China will grow by 21.0% in 2021, versus the 4.0% growth in total retail sales. As a proportion of total retail, retail e-commerce will jump more than 7 percentage points year over year to 52.1%, according to eMarketer.

Live streaming e-commerce, online grocery, and local group buying are well-positioned to gain further traction.

According to preliminary customs statistics, in 2020, cross-border e-commerce imports and exports totaled 1.69 trillion yuan, an increase of 31.1%. Exports were 1.12 trillion yuan, an increase of 40.1%, and imports are 0.57 trillion yuan, an increase of 16..5%.

In 2020, China’s top five trading partners will be ASEAN, EU, United States, Japan, and South Korea in order. Imports and exports to these trading partners will be 4.74, 4.5, 4.06, 2.2 and 1.97 trillion yuan, an increase of 7%, 5.3%, 8.8%, 1.2%, and 0.7% respectively.

Live streaming e-commerce to account for over 20% of China’s online shopping GMV by 2022