In a recent report, McKinsey pointed out five key trends shaping China’s economy, being accelerated by COVID-19 has accelerated.

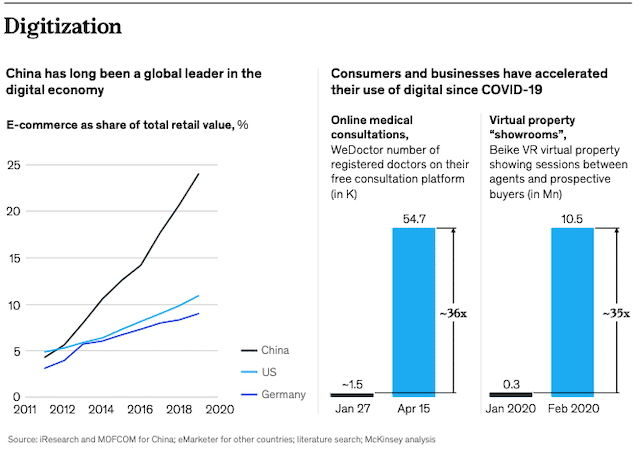

1. Digitalization

COVID-19 has also accelerated digitization of the traditionally less digitized part of the Chinese economy, such as areas requiring physical interactions, and B2B.

Before COVID-19, China was already a digital leader in consumer-facing areas— accounting for 45 percent of global e-commerce transactions while mobile payments penetration was three times higher than that of the US, according to McKinsey.

Based on McKinsey’s mobile surveys of Chinese consumers, about 55 percent are likely to continue buying more groceries online after the peak of the crisis.

Nike’s first-quarter digital sales in China increased 30% yoy after the company launched home workouts via its mobile app while real estate platform Beike said agent-facilitated property viewings on its virtual reality showroom in February increased by almost 35 times compared with the previous month.

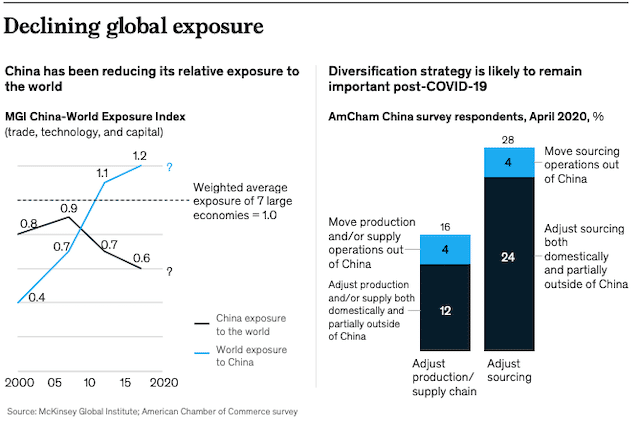

2. Declining global exposure

20% of companies surveyed by AmCham China believe COVID-19 may accelerate “decoupling”.

A paper published in February by the European Union Chamber of Commerce highlighted how diversification is now at the top of the agenda for many European companies in China. Global trade and investment has slowed sharply, and the movement of people has become highly restricted.

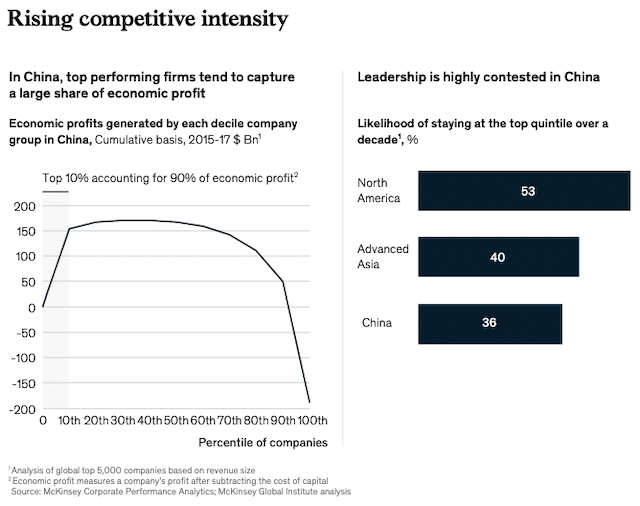

3. Rising competitive intensity

In China, the top decile of companies capture about 90% of total economic profit, while the ratio is about 70% for the rest of the world, according to McKinsey’s analysis of the world’s top 5,000 companies.

Alibaba’s Freshippo supermarkets surmounted supply constraints and met soaring online orders for fruit. Foxconn’s agility allowed it to switch factory operations to mask production, protecting employees, and enabling the resumption of production earlier than competitors.

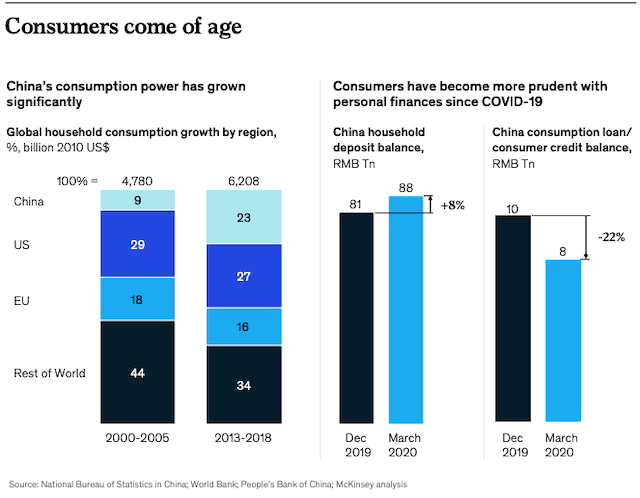

4. Consumers come of age

China’s affluent younger generation had never experienced a domestic economic downturn prior to COVID-19. The virus has forced them to think harder about spending, saving, and trade-offs in purchasing behavior.

One survey showed 42% of young consumers intend to save more as a result of the virus. Consumer lending has also declined, while four out of five Chinese consumers intend to purchase more insurance products post-crisis.

China’s post-90s start personal finance management 10 years earlier than their parents

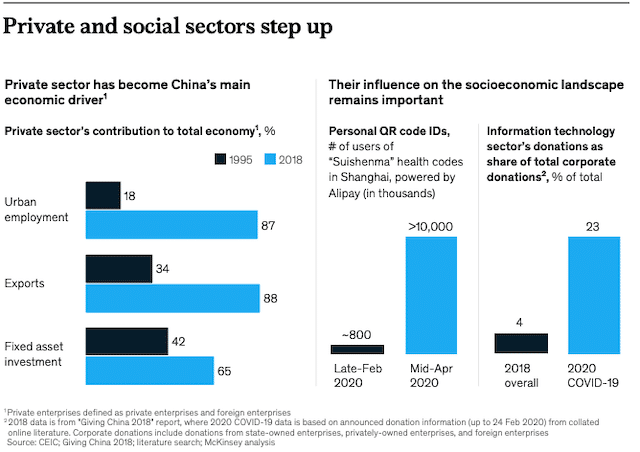

5. Private and social sectors step up

According to McKinsey, the private sector and leading technology companies are playing a more significant role, making large socioeconomic contributions amid the emergence of powerful social institutions that have donated millions to recovery efforts.

CIW Annual Subscribers can download the 158-page report here.