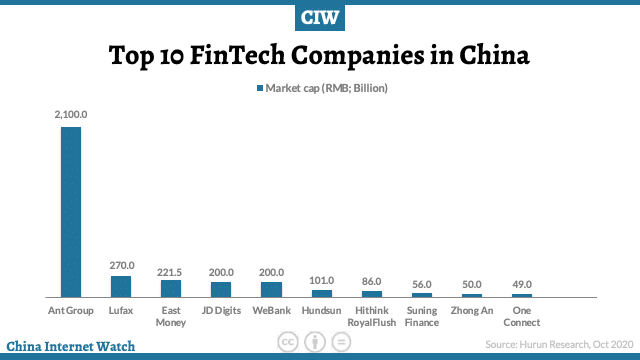

Ant Group has become the most valuable financial technology enterprise in China with a value of 2.1 trillion yuan. Credit Suisse expects Ant’s revenue to grow at 34% CAGR from 2019-2022e with digital fintech services as the key driver.

Lufax, a financial platform headquartered in Shanghai, ranked second with a value of 270 billion yuan, and East Money ranked third with a value of 221.5 billion yuan, according to Hurun China Top 10 Most Valuable Fintech Companies 2020 released last week.

Lufax is backed by major internet companies, such as Ant Group, WeBank and Tencent Licaitong.

JD.com’s affiliated JD Digital and WeBank ranked fourth with a value of 200 billion yuan.

- Ant Group

- Lufax

- East Money

- JD Digits

- WeBank (Tencent has an estimated 30 percent ownership share)

- Hundsun

- Hithink RoyalFlush

- Suning Finance

- ZhongAn (online-only insurance company)

Some highlights about the Top 10:

- The top ten fintech enterprises mainly cover financial management, microloans, payment, Internet financial information services, and other fields.

- Among the top ten companies, 2 are mainly B2B business and 8 are B2C business

- 7 of the top ten companies are in the Yangtze River Delta region, including three in Hangzhou and Shanghai and one in Nanjing; two in Shenzhen and one in Beijing

- Among the top 10 companies, 5 are public listed, 3 are in the process of IPO, and 2 are private

Financial services is the industry that has been transformed by unicorns. The traditional financial service industry is greatly influenced by these technology enterprises. For example, the market value of ICBC is 1.8 trillion yuan, and the market value of Ping An of China is 1.5 trillion yuan, which has been surpassed by Ant Group.

There are 63 fintech unicorn enterprises globally, including 21 in the United States, with a total value of $84 billion, and 18 in China, with a total value of US$239 billion.