The gap between residents of second-tier and third-tier cities and those from first-tier cities is rapidly narrowing in terms of per capita outbound destinations, travel expenditure, and travel budget according to a report from Nielsen.

On per capita outbound destinations, there was virtually no difference between those in second-tier and first-tier cities.

In terms of per capita annual overseas travel expenditure, the difference between residents in third-tier and first-tier cities significantly dropped from USD 1,7241 in 2018 to USD606 in 2019.

On travel budget for the year 2020, the gap between residents in third-tier and first-tier cities shrank sharply from USD 1,859 in 2018 to USD 614 in 2019. The Nielsen survey also found that Chinese tourists from lower-tier cities had more definite future travel plans.

In 2019, the number of transactions Chinese tourists made via mobile payment continued to increase. On average, Chinese tourists paid via mobile payment 3.4 times out of every 10 payments in 2019, up from 3.2 times in 2018.

Chinese tourists’ focus on shopping had transformed because of more abundant forms of promotional and marketing activities provided by Chinese mobile payment.

European Merchants Accelerated Adoption of Chinese Mobile Payment

92% of Chinese tourists traveling to Europe said they are more likely to pay with mobile phones if more local merchants supported Chinese mobile payment solutions, and 89% said that they are more likely to shop and spend locally.

In the U.K. and France, the percentage of Chinese tourists who used mobile payments increased to 65% in 2019, with per capita mobile spending increased by about 10%.

Mobile Payments Facilitates Digital Operations of Merchants

88% of merchants in the Nielsen survey who have used additional services on Chinese payment platforms recognized that these solutions helped market their stores, and 63% believed that mobile payment and related services improved the efficiency of store management.

Nearly 70% of the U.K. merchants surveyed have begun utilizing services beyond payment on Alipay. 82% witnessed an increase in sales and customer traffic after connecting to the Chinese mobile payment platforms.

The integration of online and offline retail with a more digitized operation has further enhanced the consumer experience for Chinese tourists when traveling overseas and has resulted in a new experience for overseas merchants in their digital transformation.

More Overseas Merchants May Deepen Their Use of Chinese Mobile Payment Platforms

South Korea and Singapore, when it comes to their future store operation and management, 66% of surveyed merchants hope to carry out more digital store operations through Chinese mobile payment, and 66% of them hope to further store promotional and marketing activities leveraging Chinese mobile payment platforms.

Integrated in Alibaba’s ecosystem, Alipay helped merchants realize traffic monetization from both online and offline channels, which is appealing to regions that have embraced Chinese mobile payments.

78% of the U.K. merchants surveyed said that they are likely to recommend Alipay to their industry peers in the future.

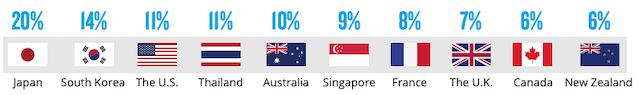

Top Travel Destinations

In 2019, destinations within a four-hour flight are still the most popular choices for Chinese tourists. Countries including Japan, South Korea, Thailand, and Singapore are still their favorites. And, the U.S., Australia, the U.K., and Canada are also among the top 10 countries.

Turkey rose to the top 20 destinations for Chinese tourists for the first time in 2019.

Top 5 countries where Chinese tourists love to use mobile payments are Singapore, South Korea, Japan, Australia, and Thailand.

And, the top 10 destinations in 2020 according to Nielsen’s survey are Japan, South Korea, the U.S., Australia, Singapore, New Zealand, France, Thailand, Maldives, and Italy.

The report also shows that lower-tier cities provide more driving force in the Chinese outbound tourism market, niche destinations gradually gained popularity among all age groups, young tourists spent more on a single trip.

CIW subscribers (annual membership) can download the report here.