Danke Apartment, an apartment rental platform in China, filed its IPO with SEC in the U.S. to apply to list the ADSs on the New York Stock Exchange under the symbol “DNK.”

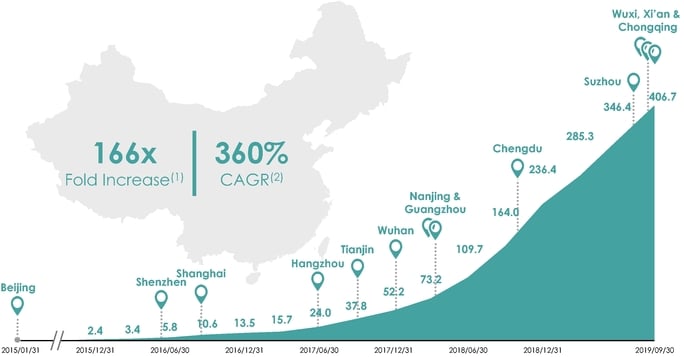

Danke has 407 thousand apartment units operated in 13 tier-1 and tier-2 cities in China. Its Compound Annual Growth Rate (CAGR) is 360% over the three years period of 2015 to 2018.

China’s residential rental market is expected to nearly double its size from 2018 to reach RMB3.0 trillion in 2023 according to iResearch. Danke provides solutions to both property owners and renters through its “new rental” business model, which is defined by the following features:

Centralization. Danke centrally operates the apartments sourced from property owners and rents them out to its residents.

Standardization. It standardizes the design, renovation, and furnishing of its apartment units, and provides high-quality, reliable one-stop services.

Online. Their entire business process is empowered by technology to enable seamless online experience for both property owners and residents. Danke doesn’t have any physical storefront since inception.

History of Danke Apartment

Danke started operations in China through Zi Wutong (Beijing) Asset Management Co., Ltd, or Zi Wutong, in January 2015.

In June 2015, it incorporated Phoenix Tree Holdings Limited under the laws of Cayman Islands, which became its ultimate holding company through a series of transactions.

In March 2019, Danke acquired 100% equity interest in Hangzhou Aishang Danke Technology Co., Ltd., or Aishangzu, a residential rental apartment operator that primarily operated in Hangzhou, through its wholly-owned subsidiary, Qing Wutong Co., Ltd. Danke primarily operates its business through the subsidiaries, consolidated VIEs and their subsidiaries in China.

As of September 30, 2019, Danke has a total of 5,205 employees.

Danke Brands

Danke Apartment operates two branded products, “Danke Apartment” and “Dream Apartment”.

Danke Apartment has been the primary focus of its business since its inception in 2015.

Danke source and lease apartments from individual property owners on a long-term basis, design, renovate and furnish such apartments in a standardized and stylish manner, and rent them out to individual residents, either as private rooms within an apartment or an entire apartment.

Leveraging its experience in operating Danke Apartment, Danke introduced Dream Apartment in November 2018 to target the large but underserved blue-collar apartment segment.

It leases entire buildings or floors in a building, transforms them into dormitory-style apartments, and rent them to corporate clients for employee accommodation. For all of its residents, Danke provides high-quality one-stop services, including cleaning, repair, and maintenance, WiFi as well as 24/7 resident support.

Danke Business Model

It runs Danke like a data science company.

As its founders are technology veterans, technology is deeply rooted in the DNA. At the core of its technology system is its proprietary artificial intelligence decision engine, or “Danke Brain,” which makes real-time and unbiased decisions based on data analytics to guide each step of its business operations and generate valuable business intelligence.

Pricing decisions represent a core competency for a co-living platform, yet pricing is complex due to the heterogeneous nature of apartments, neighborhoods, and cities. Its technology system enables to make tens of thousands of pricing decisions each day with an approximately 95% accuracy rate of the estimated lease-out price, without the need to rely on the local expertise of individual agents.

Danke can effectively manage an extensive network of renovation contractors to simultaneously renovate 50,000 apartment units scattered in thousands of neighborhoods across 13 cities and maintain consistent quality according to its filing files.

They use proprietary technologies to achieve precise budgeting, accurate time estimates, and seamless workflow coordination across Danke supply chain.

Danke currently generates revenues primarily from rents and service fees. Its revenues increased by 307.3% from RMB656.8 million in 2017 to RMB2,675.0 million (US$374.3 million) in 2018, and by 198.8% from RMB1,673.0 million in the nine months ended September 30, 2018 to RMB4,999.7 million (US$699.5 million) in the nine months ended September 30, 2019.

There are massive opportunities for co-living platforms that centralize the leasing and operation of rental properties. In particular, affordability is the biggest issue for young renters today, particularly in tier 1 and tier 2 cities in China.

In the conventional residential rental market, the smallest unit available for rent is often an entire apartment, as individual property owners are generally unable or otherwise unwilling to bear the burden and risk of renting out private rooms.

Co-living platforms reduce the smallest unit available for rent to a private room, thereby providing an affordable alternative. For instance, Danke enables renters to enjoy substantial savings by offering private rooms at less than half of the price of renting a studio or one-bedroom apartment in the same neighborhood in Beijing in the nine months ended September 30, 2019.

Co-living platforms are rapidly gaining popularity in China, benefiting from the sharing economy, online consumption, consumption upgrade and increasing acceptance by property owners.

Currently, properties operated by co-living platforms offering standardized renovation, furnishing and services only accounted for approximately 2% of all residential rental properties in China as of December 31, 2018.

In the United States and Japan, the percentage of renovated or serviced rental apartments operated by institutions was around 57% and 80%, respectively.

As co-living platforms achieve scale, they accumulate a large, captive pool of renters to whom value-added services can be provided. Typical renters spend more than ten hours each day at home, and during their stay, they may demand a wide range of services including cleaning, repair and maintenance, laundry, relocation, food delivery, smart home, and online insurance, among others. These services represented a nearly RMB2.4 trillion market in China in 2018, according to iResearch.