China’s leading internet companies such as Baidu, Alibaba, and Tencent, a.k.a. BAT, also compete in the investment. In 2018, companies received around 2.6 billion yuan investment from Baidu, over 12.7 billion yuan from Tencent, and near 40 billion yuan from Alibaba.

The 2.1 billion yuan ($302 million) strategic round in Xinchao Media, an elevator advertising firm, was Baidu’s biggest investment in this field.

Tencent joined US$2.5 billion round for WPP and co-led the US$1.9 billion series-F funding for Manbang Group, a truck-hailing platform dubbed “Uber for trucks”. It also invested 1.266 billion yuan and 1.267 billion yuan (US$199.24 million) in DHC Software and DHC Chengxin, respectively.

Alibaba led the 15 billion yuan (US$2.2 billion) investment for the digital advertising service provider Focus Media. It acquired ZTEsoft Technology from the telecommunications equipment manufacturer ZTE and C-SKY Microsystems the developer of embedded CPUs with a record amount of spending.

Furthermore, Alibaba invested several leading AI-focused companies, such as SenseTime Technology, Video++, and Face++ with no less than 4 billion yuan.

Overall, they are all focused on the technical fundamentals of industrial internet, such as artificial intelligence (AI), cloud computing, big data, and internet of things (IoT).

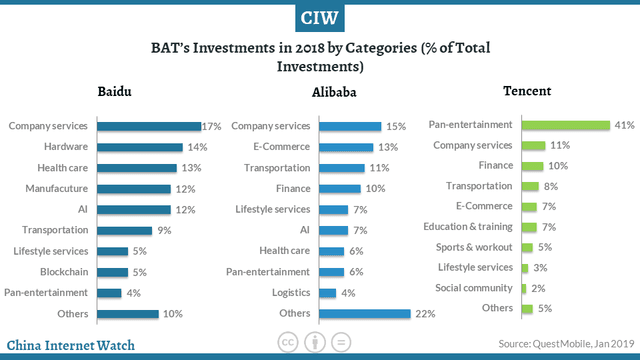

In 2018, company service (17%), health care (13%), manufacture (12%), AI (12%), and transportation (9%) made up 63% of Baidu’s total investments.

Company services (15%), transportation (11%), AI (7%), health care (6%) accounted for 39% of Alibaba’s total investments. Company services (11%) and transportation (8%) represented 19% of Tencent’s total investments.

Baidu has empowered AI technology in different industries to promote the smart industry. Alibaba integrates its e-commerce, finance, and cloud computing resources to help industries’ digitalization transformation. Tencent assists enterprises to digitalize infrastructure from cloud computing, AI, security, and LBS, etc.