The number of connected devices (excluding smartphones and laptops) on Xiaomi’s IoT platform reached approximately 150.9 million units in 2018, a year-on-year increase of 193.2%. Xiaomi AI assistant Xiaoai had been installed and activated on more than 100 million smart devices as of December 31, 2018, and had over 38.8 million monthly active users in December 2018.

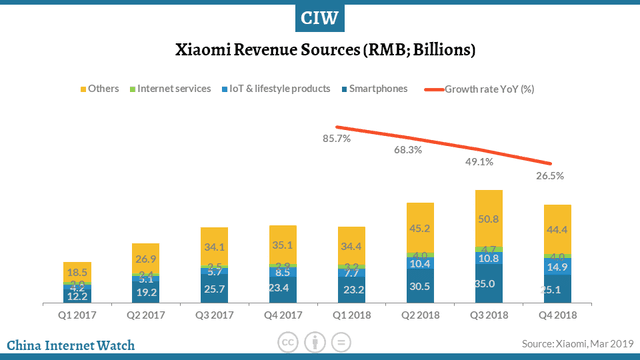

Xiaomi recorded 174.9 billion yuan (US$26.04bn) in revenue for the year ended December 31, 2018, a year-on-year increase of 52.6%. Revenue from international markets grew 118.1% year-on-year to 70.0 billion yuan (US$10.42bn), accounting for 40.0% of the total.

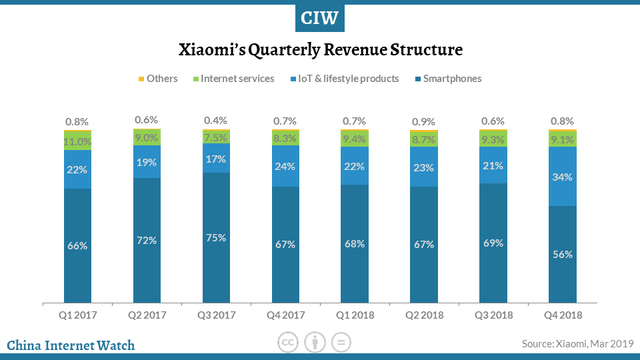

- 65.1% of revenues were from smartphones (US$16.94bn), an increase of 41.3% year-on-year;

- 25.1% of revenues were from IoT and lifestyle products (US$6.52bn), an increase of 86.9% year-on-year;

- 9.1% of revenues were from internet services (US$2.38bn), an increase of 61.2% year-on-year.

For the fourth quarter of 2018, revenue increased by 26.5% to 44.4 billion yuan (US$6.61bn) on a year-on-year basis.

Revenue from the smartphones segment increased by 7.0% year-on-year to 25.1 billion yuan, driven by growth in the ASP of smartphones.

Revenue from IoT and lifestyle products segment increased by 75.4% year-on-year to 14.9 billion yuan, primarily due to the rapid growth in demand of smart TVs and several sought-after ecosystem products such as Mi Band, Mi Electric Scooter, and Mi Robot Vacuum Cleaner.

Revenue from internet services segment increased by 39.3% year-on-year to 4.0 billion yuan, primarily due to growth in the advertising business.

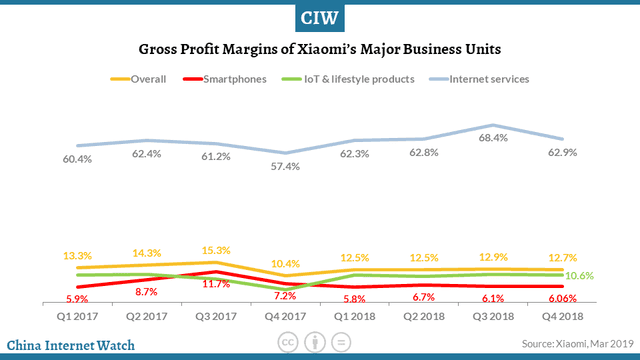

For the year ended December 31, 2018, Xiaomi’s gross profit increased by 46.4% to 22.2 billion yuan (US$3.31bn) from 15.2 billion yuan for the prior year. Overall, Xiaomi’s gross margin decreased from 13.2% to 12.7%.

- The gross profit margin from the smartphones segment decreased from 8.8% to 6.2%.

- The gross profit margin fromIoT and lifestyle products segment increased from 8.3% to 10.3%, mainly due to the improvement of gross margin in smart TVs.

- The gross profit margin from internet services segment increased from 60.2% to 64.4% as the percentage of revenue from higher margin advertising business was larger.

For the fourth quarter of 2018, gross profit increased by 55.5% to 5.7 billion yuan. The overall gross margin increased from 10.4% to 12.7%.

- The gross profit margin from the smartphones segment decreased from 7.3% to 6.1%.

- The gross profit margin from IoT and lifestyle products segment increased from 3.6% to 10.6%.

- The gross profit margin from internet services segment increased from 57.4% to 62.9%.

Smartphones

Smartphones segment generated approximately 113.8 billion yuan (US$16.94bn) in revenue, an increase of 41.3% year-on-year. Compared with the 4.1% year-on-year decline of shipments in the global smartphone market, according to IDC, Xiaomi smartphone sales volume reached 118.7 million units, an increase of 29.8% over the prior year period.

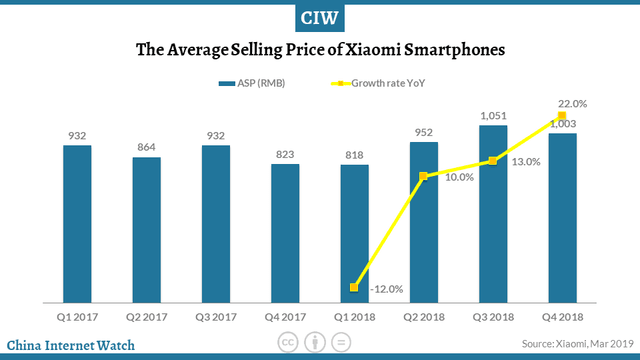

To strengthen its market position in the mid- to the high-end range smartphone market in mainland China, Xiaomi launched several flagship smartphones such as Mi 8 and Mi MIX 3, which enjoyed widespread popularity. The average selling price (ASP) of Xiaomi smartphones in mainland China increased by 17.0% year-on-year.

In the fourth quarter of 2018, the revenue generated by smartphones sold for 2,000 yuan or more accounted for 31.8% of the total revenue of the smartphones segment. As Xiaomi shipped increasingly more smartphones in developed markets, the ASP of smartphones in international markets also recorded a year-on-year 9.7% growth.

Xiaomi continued to focus on innovation with increasing investment in smartphone R&D and achieved great progress. Taking the smartphone camera as an example, the new flagship smartphone Mi 9, launched in February 2019, achieved a DxOMark score of 107 for its rear camera, ranking top three globally at the time of launch.

It also achieved a DxOMark score of 99 for the video category, which is the highest among all smartphones at the time of launch. Xiaomi is also one of the early movers in 5G, launching our first 5G smartphone, Mi MIX3 5G, at World Mobile Congress in February 2019.

China smartphone brand loyalty compared for Q4 2018: iPhone, Huawei, Oppo, Vivo, Xiaomi

IoT and lifestyle products

Revenue of the IoT and lifestyle products segment increased by 86.9% to 43.8 billion yuan (US$6.52bn) over the previous year. 2018 was the year when Xiaomi’s large home appliances emerged from a nascent vertical to a robust business unit. The global shipments of Xiaomi smart TVs were 8.4 million units, representing a 225.5% year-on-year growth. Xiaomi also entered the white goods market, launching the Mi Air Conditioner and the Mi Washing Machine in July and December 2018, respectively.

In addition to smart TVs and laptops, Xiaomi ecosystem products such as Mi Band, Mi Electric Scooter, and Mi Robot Vacuum Cleaner experienced robust sales growth. Xiaomi Mi Robot Vacuum Cleaner ranked second in terms of shipments in mainland China in 2018. Xiaomi was ranked second in terms of wearables shipments across the world in the fourth quarter of 2018 according to IDC.

Xiaomi received 43 international industrial design awards in 2018, including iF Design Awards, Red Dot Awards, International Design Excellence Awards, Good Design Awards, and Design for Asia Awards. Two such accolades went to Mi Sphere Camera which was awarded the iF Gold Award and Mi Rearview Mirror which was awarded the Red Dot: Best of the Best award.

2018 marked the commencement of its overseas IoT business expansion. Xiaomi launched smart TVs in India in February 2018 and were ranked first in terms of online TV shipments in this market.

As of December 31, 2018, there were about 2.3 million users who own more than five Xiaomi IoT devices (excluding smartphones and laptops), representing a 16.2% quarter-on-quarter growth and a 109.5% year-on-year growth.

Related: Xiaomi sold 100 million power banks as of Jan 2019

Internet services

Revenue from internet services segment grew by 61.2% year-on-year to 16.0 billion yuan (US$2.38bn).

- Advertising revenue grew by 79.9% year-on-year to 10.1 billion yuan.

- Revenue from value-added internet services also grew 36.7% year-on-year to 5.9 billion yuan, of which revenue from gaming accounted for 2.7 billion yuan, a 7.3% year-on-year increase. Revenue from other internet value-added services grew 79.9% year-on-year to 3.2 billion yuan, primarily due to an increase in revenue contribution from internet finance business and Youpin e-commerce platform.

In the fourth quarter of 2018, over 30% of internet services revenue was from internet

services outside of advertising and gaming from China smartphones. Xiaomi overseas internet services revenue accounted for 6.3% of all internet services revenue in the fourth quarter of 2018, growing 1,295.6% year-on-year.

Xiaomi continued to enhance its overseas internet services and launched popular internet services in international markets.

For example, it launched video, app store, and news feed services in India and Indonesia. The MAU of Xiaomi smart TVs and Mi Box achieved 55.3% year-on-year growth, reaching 18.6 million in December 2018.

TV internet services revenue accounted for 8.2% of the total internet services revenue in the fourth quarter of 2018, a 119.1% year-on-year increase.

The revenue from internet finance business and the Youpin e-commerce platform accounted for 11.9% and 4.1% of total revenue of internet services in the fourth quarter of 2018, with year-on-year growth rates of 80.5% and 427.6%, respectively.

The MAU of MIUI increased 41.7% from 170.8 million in December 2017 to 242.1 million in December 2018. ARPU for internet services increased from 57.9 yuan for the year ended December 31, 2017, to 65.9 yuan for the year ended December 31, 2018.

International markets

Revenue from international markets grew 118.1% year-on-year to 70.0 billion yuan (US$10.42bn), accounting for 40.0% of the total, compared with 28.0% for the prior year.

According to Canalys, Xiaomi smartphones achieved the number one market share position by shipments for six consecutive quarters in India, with year-on-year growth of 59.6%. In Indonesia, Xiaomi was ranked second in terms of smartphone shipments, with year-on-year growth of 299.6%.

Xiaomi smartphone shipments for Western Europe grew 415.2% year-on-year and ranked fourth. Xiaomi IoT business also achieved good progress in its expansion in international markets.

Xiaomi Business Strategy update

AIoT

As of December 31, 2018, the number of connected IoT devices (excluding smartphones and laptops) on Xiaomi IoT platform reached approximately 150.9 million units, a quarter-on-quarter increase of 14.7% and a year-on-year increase of 193.2%.

Xiaomi is encouraging more third-parties to join its open IoT platform. In December 2018, Xiaomi entered into a strategic partnership with IKEA, under which IKEA’s full range of smart lighting products will be connected to Xiaomi IoT platform.

Xiaomi IoT user base is diversified across smartphone platforms. Xiaomi Mi Home app had 20.3 million MAU in December 2018 and over 50% of the users are from non-Xiaomi smartphones.

Through the empowerment of AI, Xiaomi greatly enhanced the user experience of IoT devices.

As of December 31, 2018, Xiaomi AI assistant Xiaoai had been installed and activated on more than 100 million smart devices and had more than 38.8 million MAU, making it one of the most used AI voice interactive platforms in mainland China. Xiaomi AI speakers have accumulated shipment of over 9 million units.

Multi-brand Strategy

Xiaomi adopted a multi-brand strategy for its smartphones in 2018. Xiaomi and Redmi have become independent brands since January 2019. The Xiaomi brand will focus on pioneering advanced technologies, establishing itself in the mid- to high-end markets, and building online and offline new retail channels.

The Redmi brand will pursue the final price-performance ratio and focus on online channels. Also, XIaomi Black Shark, Meitu, and POCO brands will target games users, female users, and tech enthusiasts, respectively.

Efficiency

As of December 31, 2018, Xiaomi had 586 Mi Homes in mainland China, mainly in first-, second- and third-tier cities. Moreover, to establish its offline new retail presence in lower-tier cities and rural areas of China, Xiaomi has built a sizable authorized store network. As of December 31, 2018, Xiaomi had 1,378 authorized stores in total, comparing to 62 as of December 31, 2017.

Quality

Xiaomi won the Top Prize of “China Quality Technical Award” awarded by the China Association for Quality. Xiaomi received further prestigious awards including the “2018 People’s Ingenuity Product Award” and the “2018 China Quality Benchmark Prize”.

Xiaomi’s mainland China smartphone fault feedback ratio decreased by 43.7% year-on-year. Xiaomi redefined the quality standards of smartphones by providing an 18-month long warranty for its Redmi Note 7 series, 50% higher than the industry standard.

Xiaomi officially launched the “smartphones + AIoT” dual-engine strategy in 2019. It expects to invest over 10.0 billion yuan (US$1.49bn) in the development in AIoT in the next five years.

Read more: China’s smart speaker market insights