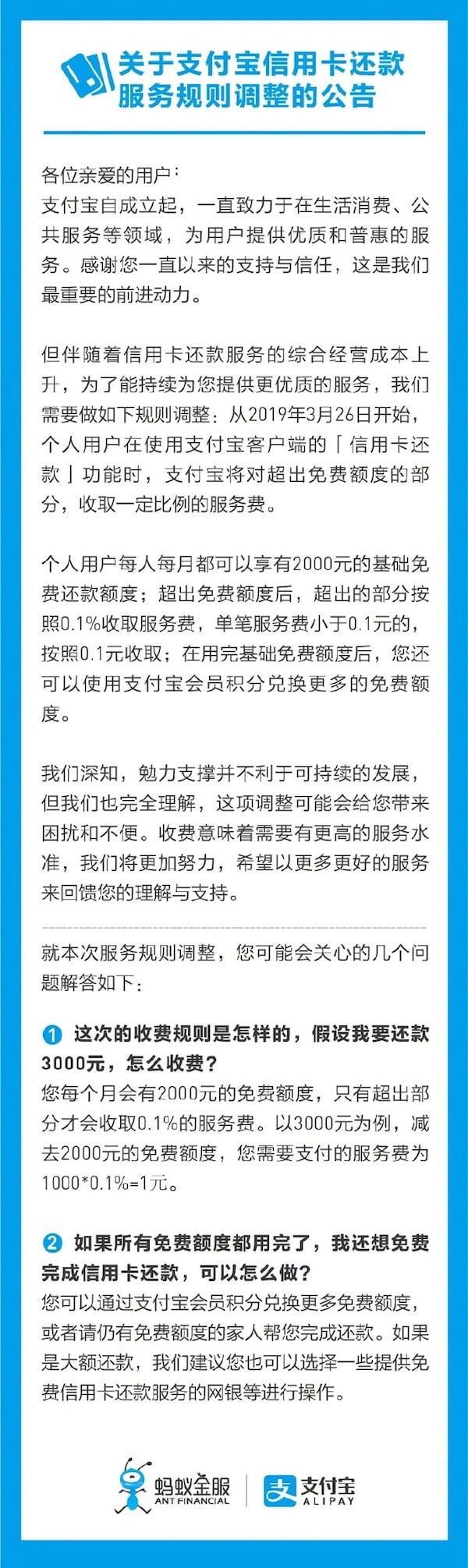

Alipay announced yesterday it will start charging for its service of credit card repayment from 26 March. Alipay users can still enjoy the service for free for up to 2,000 yuan credit card repayment every month.

Alipay will charge 0.1% service fee for credit card repayments service for the monthly amount over 2,000 yuan with a minimum of 10 cents per transaction. Its members can increase the 2,000 free quota with their rebate points.

The decision is due to the increasing comprehensive operating costs of credit card repayment services according to Alipay. WeChat Pay made a similar announcement last July. A common understanding regarding the cost is the fee charged by banks in China for using the repayment channels.

Quick case study: SPD Bank’s credit card WeChat mini-program

Wang Pengbo, a senior analyst of Analysys, said that “the behavior of third-party payment institutions charging users for the increase in comprehensive costs is related to the direct deposit and the centralized deposit of reserves. Because the regulators implement strong supervision, after sorting out the third-party payment industry, and adding to the central bank’s rectification of the custody channels, the channel fees for the three-party payment will increase. ”

The reserve fund is centrally deposited. In the past, the reserve fund was a bargaining chip between the third-party payment institution and the bank. But now it is gone, and the cost of the bank’s own capital is also increasing, so the bank will pass the cost to the third-parties by increasing the channel cost.

It won’t affect most users who don’t spend on huge credits every month. For those who care about the cost can use some online banking free services for credit card repayments. Some are utilizing Alipay’s announcement as an opportunity to offer free services too such as UnionPay’s Flashpay, U51, Suning Finance, etc. You can get an overview of China’s digital payment ecosystems here.