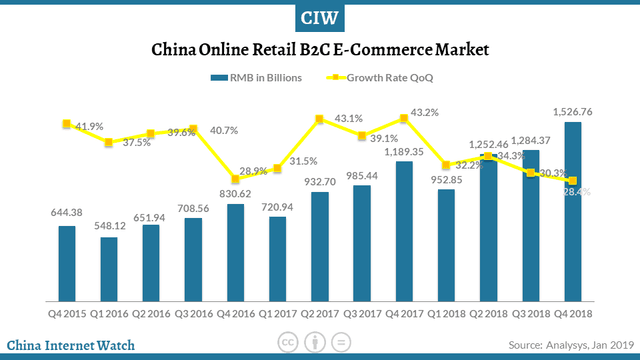

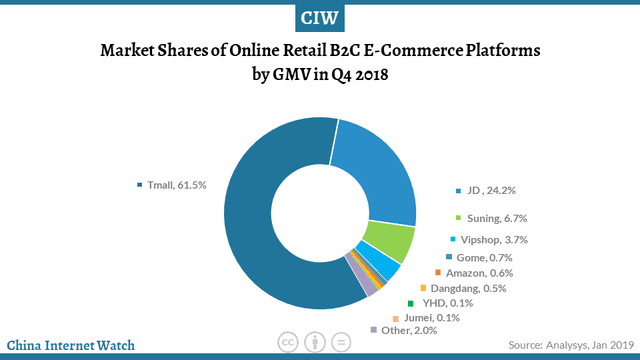

In China, the online retail B2C e-commerce grew by 28.4% to a US$226.38bn market in Q4 2018. Tmall took the lead, followed by JD, Suning, Vipshop, and Gome.

China’s online retail B2C e-commerce market reached 1,526.76 billion yuan (US$226.38bn) in Q4 2018, an increase of 28.4% year-on-year.

Revenue from Alibaba’s core commerce grew by 40% year-over-year to 102,843 million yuan (US$14,958 million) as of Q4 2018. Its annual active consumers on the China retail marketplaces reached 636 million.

Related: China e-commerce market overview

Tmall took a market share of 61.5%, with a GMV increase of 29.5% year-on-year. JD ranked in the second place with a share of 24.2%, whose GMV grew by 21.1% year-on-year. Suning, Vipshop, and Gome listed third, fourth, and fifth with a share of 6.7%, 3.7%, and 0.7%, respectively.

71 brands exceeded 100 million yuan (US$14.37 million) in GMV in the pre-sale period of Double 11. Among that, 15 brands came from Tmall apparel, i.e. Nike, Adidas, Puma, Lining, Converse, Anta, Fila, Skechers, New Balance, Underarmour, Uniqlo, Eifini, Only, Vero Moda, and Bosideng. The same figure was only 40 in last year’s Double 11. You can find out the top statistics of Double 11 2018 here.

In 2018, the online retail sales of goods and services totaled 9,006.5 billion yuan (US$1,328.59 billion), up by 23.9% year-on-year. China’s retail market is estimated to hit US$6.77 trillion by 2019 with e-commerce representing 14.46% of this market.

Individual agents (Daigou), who frequently promote products on WeChat Moment or sell products in live streaming and short videos, are facing a new e-commerce policy on the first day of 2019. Under this new regulation, they need to make market entity registration and perform the obligation of tax payment.

In order to meet the ever-changing consumer preferences, companies should adjust their products and marketing based on people’s shopping motives, methods, time and results. Read more on Chinese digital consumer trends here.

China’s US$16bn cross-border e-commerce market overview in Q4 2018