60.47 million people traveled to China in 2017, which was decreased by 0.4% year-on-year in H1 2018. Residents in Hong Kong, Macau, and Taiwan accounted for around 80% of the total. The mainland China generated US$32.6 billion from international inbound visitors in 2017, less than Hong Kong’s US$33.3 billion.

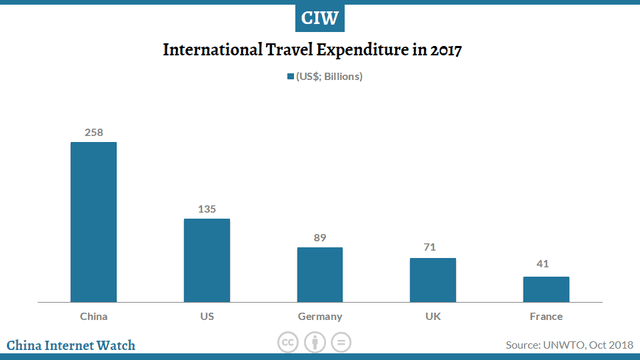

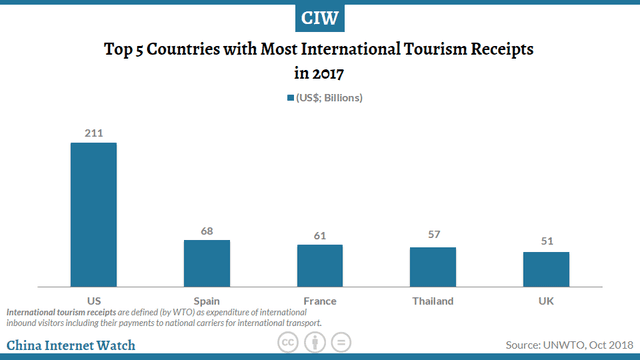

China has been the largest source market for outbound travel in terms of population and travel spending. By comparison, there are lots of rooms for the development of international tourism receipts – defined by WTO as the expenditure of international inbound visitors including their payments to national carriers for international transport.

There were 60.47 million people traveled to China in 2017, a much lower increase of 2% compared with 2016. The number of inbound tourists was decreased by 0.4% year-on-year in H1 2018.

Residents in Hong Kong, Macau, and Taiwan accounted for around 80% of the total inbound tourists. Except that, South Korea, Vietnam, Japan, Myanmar, and the US were the top four biggest source market for inbound travel.

Along with the sluggish growth in the number of inbound tourists, the international tourism receipts were also declined. The mainland China generated US$32.6 billion from international inbound visitors in 2017, less than Hong Kong’s US$33.3 billion.

It might be influenced by visa-free policy and scheduled flight number. For example, Hong Kong has signed visa-free agreements with over 150 countries and regions while mainland China had such agreement with only 20 countries and regions. Surrounding countries like Japan, Thailand, and South Korea were all several times higher than mainland China in visa-free agreements.

The overseas tourists might choose to travel across visa-free Asian countries. Comparative speaking, the 72-hour visa-free policy that several cities in mainland China provided was less attractive.

What’s worse, influenced by air traffic control, Chinese flights was one of the worst when it comes to punctuality. Therefore, China lost quite a lot of revenue from transfer tourists.

The inbound tourism only contributed 13% to China’s overall tourism revenue in 2017, which was 18% in 2016. The global average ratio between inbound tourism and outbound tourism was 27.3 vs. 72.7.

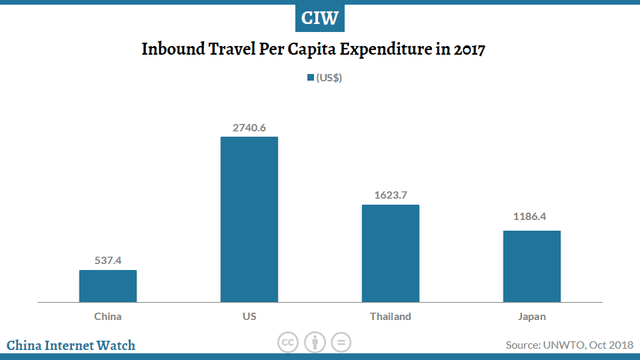

Considering there were 60.47 million inbound tourists, the per capita expenditure was US$537.4. That was only one half that of Japan, one-third that of Thailand, and around one-fifth that of the US. The figure was even lower than US$866 in 2012.

Revenue from visitor export was only increased by 0.6% in 2017, a large drop compared with 9.6% in 2016, according to WTTC. Furthermore, foreign exchange earning from tourism receipts only grew by 3%, much less than 6% in 2016.

The tourism deficit reached nearly US$225.4 billion in 2017, according to the report from UNWTO. The same figure was US$110.4 billion in H1 2018, according to CNTA.

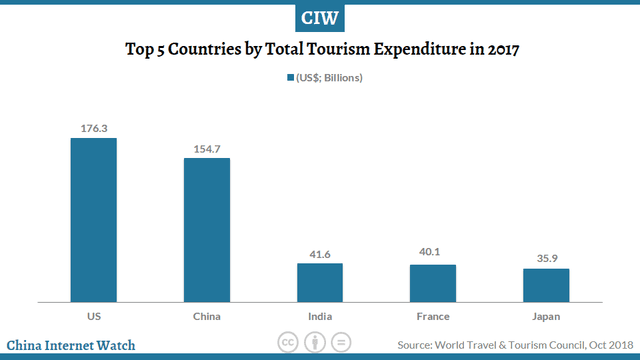

Nevertheless, China had invested US$154.7 billion in tourism and the related industries in 2017. Such investment was only behind that of the US (US$176.3 billion). The investment in tourism was expected to grow at 6.5% annually in the next 10 years.

Thailand generated US$57 billion in the international tourism receipts in 2017, the biggest earner across Asia. That contributed 21.2% to GDP, directly and indirectly. China is the biggest tourist source for Thailand.

China golden week travel insights 2018; decline in flights & expenses