Chinese consumers were expected to contribute 40% sales to the global luxury goods market and hence drive 75% of this market’s growth.

58% of luxury goods consumers were the youthful population. 58% of them located at tier-2, tier-3, and lower-tier cities. Mobile occupied 54% of luxury goods consumers’ attention. 58% of consumers prefer collecting information online and buy luxury goods through offline channels.

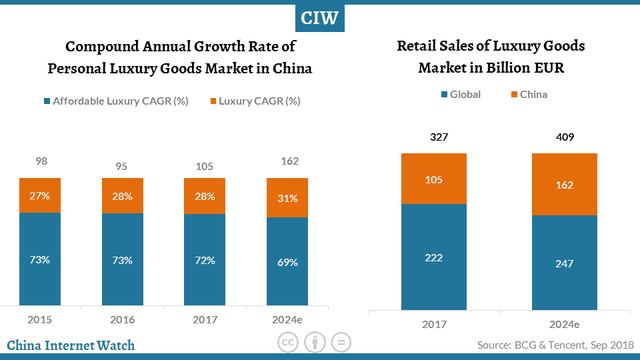

China’s personal luxury goods market is going to grow at a compound annual growth rate of 6%. Retail sales of luxury goods in China reached €105 billion (US$120.41 bn) in 2017, which was estimated to hit €162 billion (US$185.77 bn) by 2024, accounting for roughly 40% of the global luxury goods market, according to a joint report by BCG and Tencent.

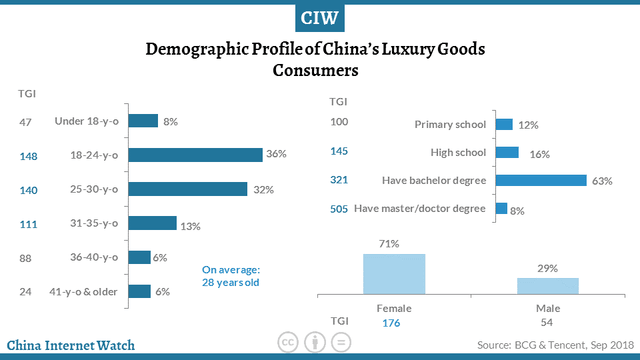

58% of luxury goods consumers were the youthful population who ages between 18 and 30 years. 71% of them at least held bachelor degrees. 71% of them were female.

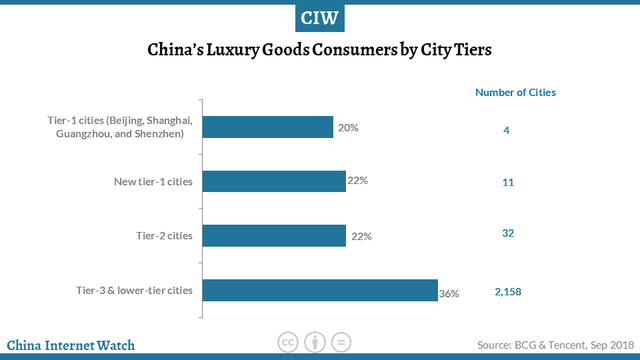

58% of them located at tier-2, tier-3, and lower-tier cities.

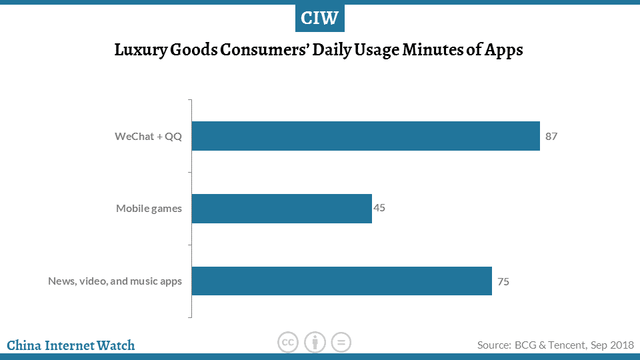

They were deeply influenced by digitalization and obtained a variety of news from smartphones. On average, they spent 87 minutes on WeChat or QQ, 45 minutes on mobile games, 75 minutes on video, news, and music.

The consumption path of luxury goods was highly digital and fragmented. They would collect relative information from various social media and online platforms once they find favorite luxury goods.

After that, they tend to buy the products via a set of channels not just limited to brick-and-mortar, if that works, such as Daigou (a freelance cross-border shopping agent), online mall, overseas e-commerce platforms, brand’s official accounts, and social media.

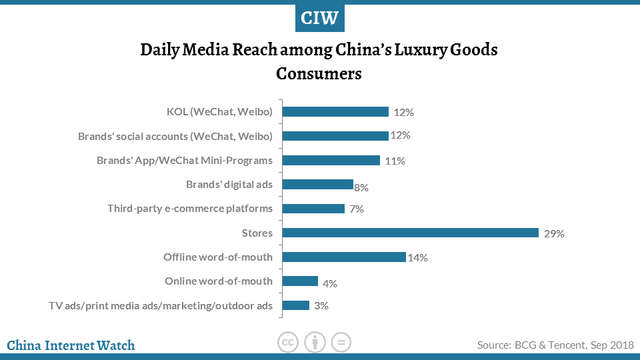

Mobile occupied 54% of luxury goods consumers’ attention. To break it down, KOL (WeChat and Weibo) for 12%, brands’ social accounts for 12%, brands’ official website/app/mini-programs for 11%, brands’ digital ads for 8%, third-party e-commerce platforms for 7%, and online word-of-mouth for 4%.

Tencent-affiliated mobile apps took 50% of users’ mobile usage time. By comparison, Facebook accounted for just 22% of American internet users’ mobile usage time.

KOL (Key Opinion Leader) played an essential role in reaching users. On average, every account of the top 30 online celebrities attracted 3.2% of consumers’ attention. Brands’ official accounts or mini-programs had its way to interact with consumers.

The average page view of articles could reach 20,000. Furthermore, the page views of some good content could occasionally exceed 100,000.

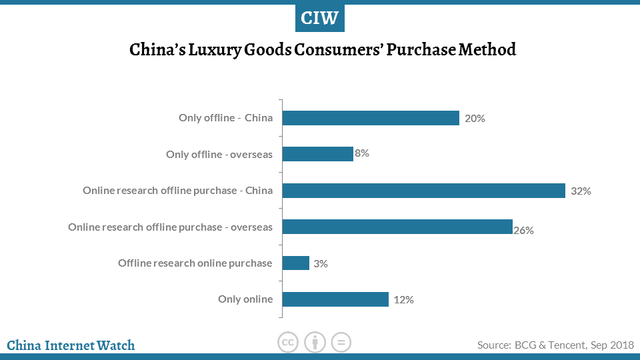

Speaking of purchasing method, 58% of consumers prefer collecting information online and buy it through offline channels.

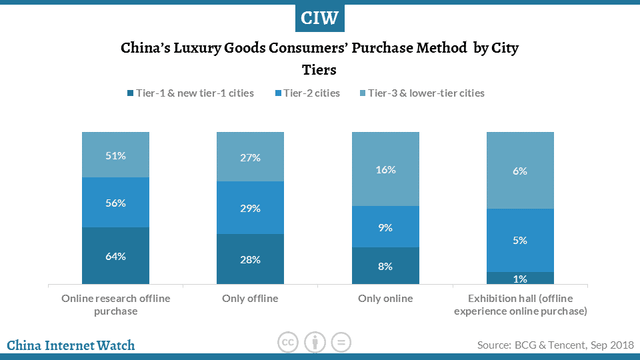

16% of consumers in tier-3 & lower-tier cities bought luxury goods online while that was 8% in tier-1 cities and 9% in tier-2 cities. On the other hand, 51% of consumers would make some comparisons online and go to nearby higher-tier cities to buy it.

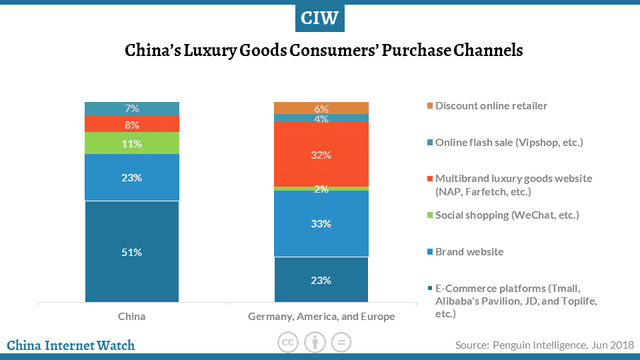

Though platform shopping is still the mainstream, social shopping has been rising quickly in the luxury goods market. 11% of Chinese consumers bought luxury goods through social shopping channels like WeChat while that was just 2% in Germany, America, and Europe.

Continue to read China’s luxury consumption trends in the new retail era