Kantar Worldpanel, in partnership with Bain & Company, has recently released China Shopper Report this year, presenting a second look on what shoppers really do rather than what they say they do.

The 2013 analysis is a continue of 2012 research, which confirms and refines the previous findings. Their findings are crucial to marketers who seek to grow their brands in Chinese market.

Kantar Worldpanel tracked shoppers real time actual purchases in 40,000 households, covering 373 cities in 20 provinces and four major municipalities participated. It surveyed 26 consumer goods categories, and a refined analysis of 10 categories worthy of further focus.

Key findings on China Shoppers:

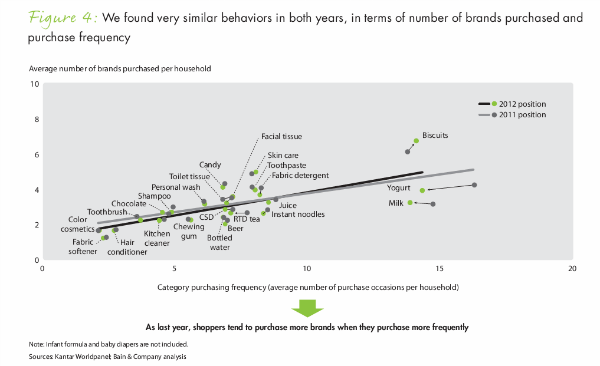

- Shoppers showed similar behaviors from year to year across the 26 categories in terms of purchase frequency and number of brands purchased

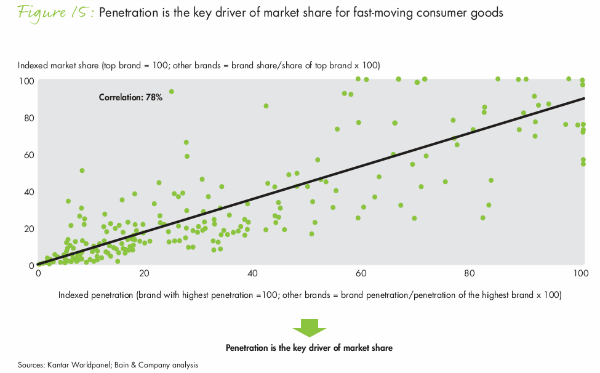

- Penetration is the most important driver of mar-ket share for each of the 26 categories, regardless of where it falls on the continuum from repertoire to loyalist

- The shopper base experiences a high level of churn for all the brands we studied, regardless of a brand’s size

Shopper behavior is consistent in both years

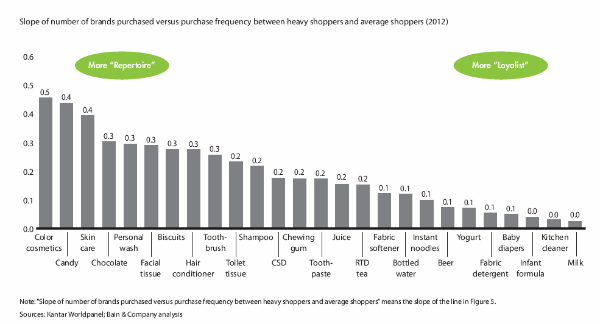

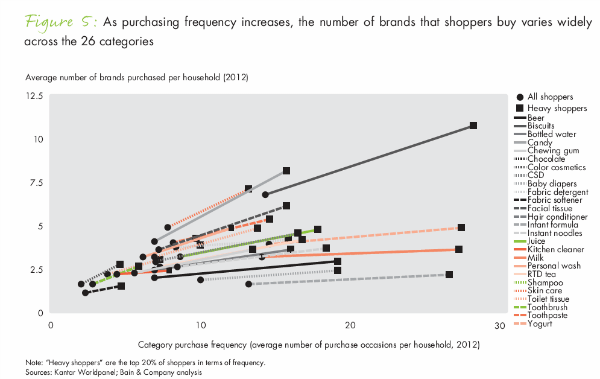

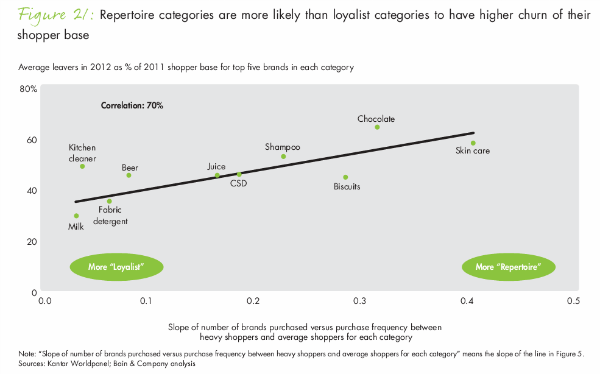

The more frequently that shoppers buy in a repertoire category, the more brands they tend to buy in that category. And heavy shoppers of a particular brand tend to be heavy shoppers of other brands in that category. Strong repertoire categories include skin care, biscuits and chocolate.

The 26 categories have different levels of repertoire and loyalist behaviors across a continuum

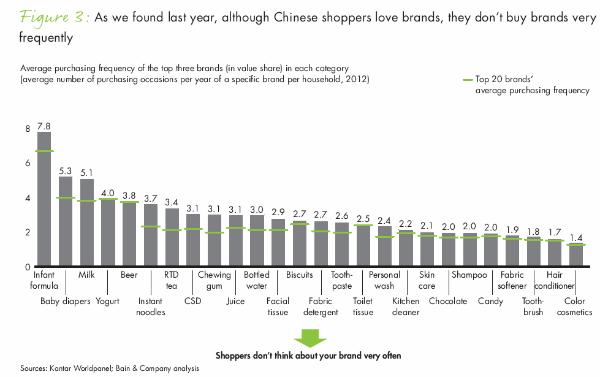

The average purchase frequency of any particular brand is very low: less than five times per year.

In both years, shoppers tended to purchase more brands when they purchased more frequently—that is, they tend to exhibit repertoire behavior.

As frequency increases,the variation in the number of brands that shoppers buy across the 26 categories widens, which means shoppers who increase their purchasing within most categories also try different brands in the category.

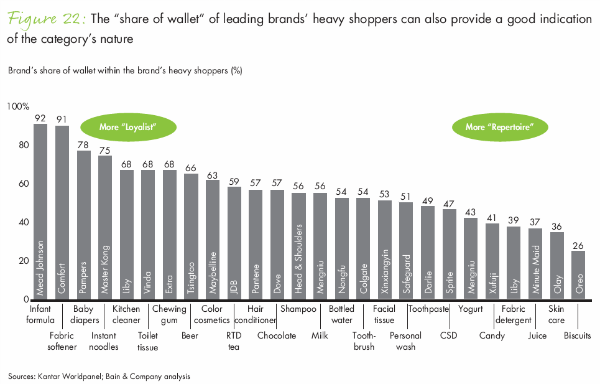

In categories with stronger repertoire behaviour, brands’ heavy shoppers are often heavy shoppers of competing brands as well. However,in categories with stronger loyalist behaviour, a brand’s heavy shoppers allocate most of their category spending to that brand.

Penetration is paramount

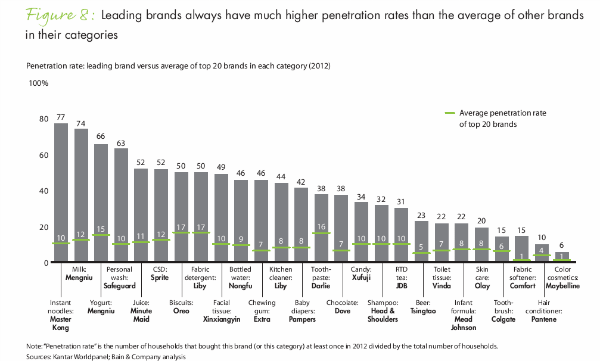

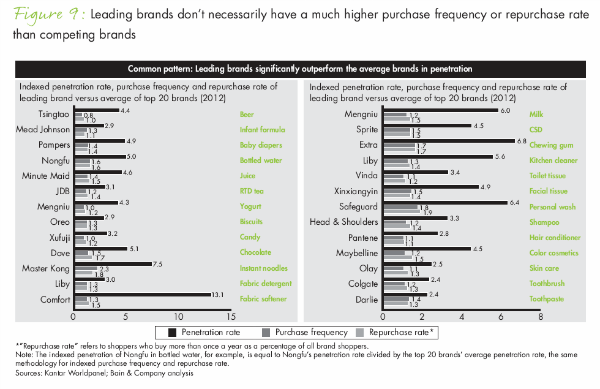

Leading brands always have much higher penetration rates than the average rate for brands in their category. Specifically, they found that the leading brand’s penetration rate is approximately 3 to 10 times higher than the average penetration rate of the top 20 brands in the category.

The difference in penetration rates is significantly larger than the difference in purchase frequency and repurchase rate for the leading and top 20 brands in the same categories.

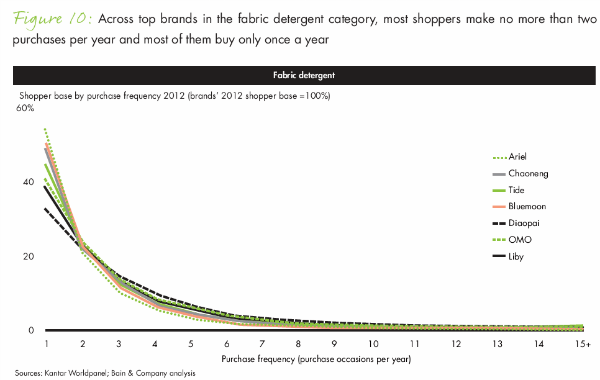

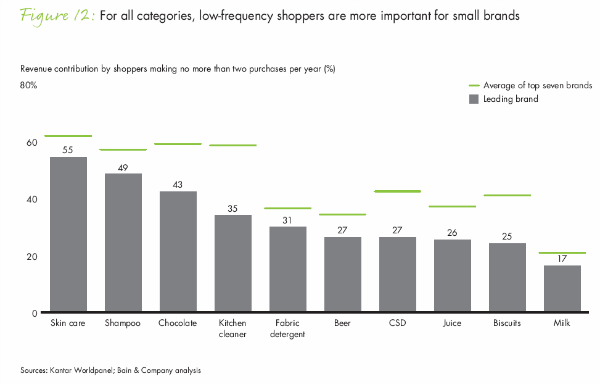

When refined analysis to 10 focus categories, Kantar Worldpanel found out within each category, low-frequency shoppers are very critical to the shopper base and contribute significantly to revenue. This is true for both leading and smaller brands.

Low-frequency shoppers are even more critical to revenue for smaller brands.

The correlation between market share and penetration is very high.

A brand’s shopper base is a “leaky bucket”

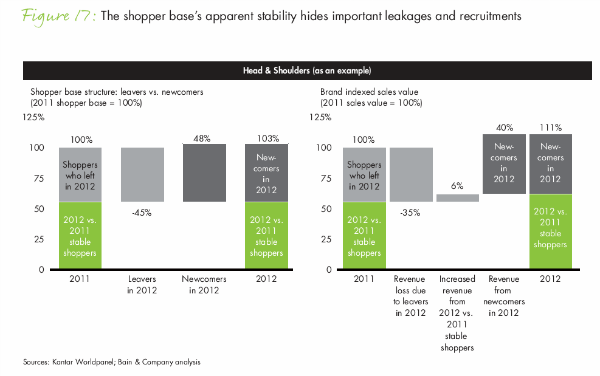

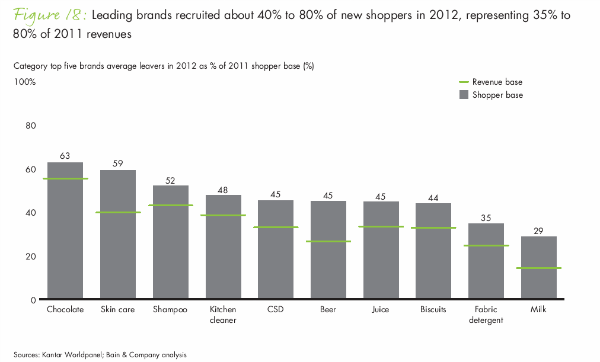

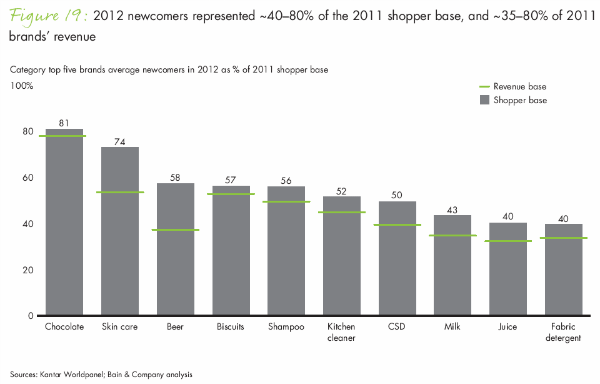

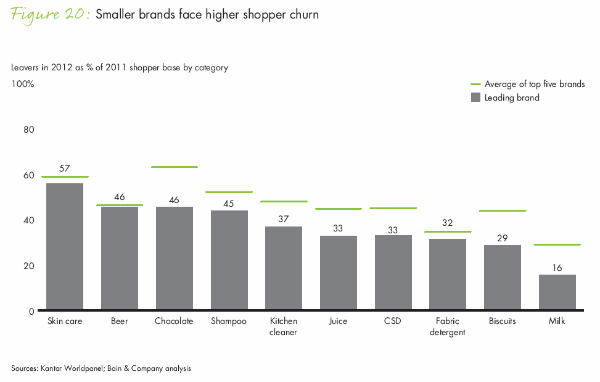

They found out that brands’ shopper bases are not stable. The shopper base of all brands we studied experiences a high level of churn, regardless of a brand’s size.

We also found that smaller brands tend to have higher churn rates than leading brands. This suggests that “niche brands” with an exceptionally loyal shopper base don’t really exist—brands with a small shopper base are simply small brands, whose buyers usually buy less frequently and churn more often. However,the churn rate in loyalist categories, on average, appears to be lower than in repertoire categories.

This analysis demonstrates that a brand’s shopper base is like a “leaky bucket.” For a brand to grow, a company needs to recruit new shoppers every year to compensate for those it loses, further emphasizing the importance of penetration.

Knowing a brand’s place on the repertoire-to-loyalist continuum is vital

A company must identify a brand category’s position on the continuum between “heavy repertoire” and “more loyalist” before deciding how to grow penetration for that brand.

The most heavy repertoire categories were also more likely to have a higher level of churn.

A leading brand’s share of wallet (“Share of wallet” is the percentage of a shopper’s spending in a category that’s devoted to a given brand) for heavy shoppers is typically higher for loyalist categories.