In Q3 FY18, Starbucks reported consolidated net revenues up 11% to a record $6.3 Billion from the prior year. The comparable store sales up 1% globally and in the U.S., driven by a 3% increase in average ticket. China comparable store sales decreased 2%.

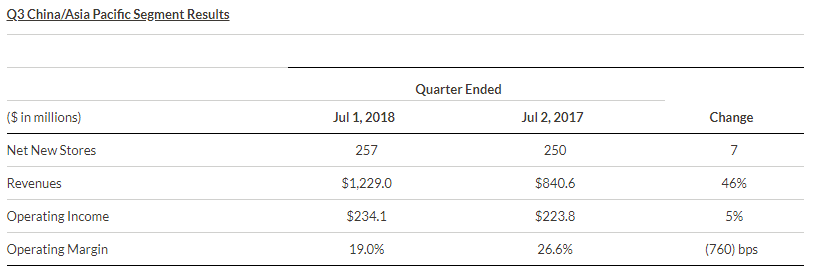

Net revenues for the China/Asia Pacific segment grew 46% over Q3 FY17 to $1,229.0 million in Q3 FY18, primarily driven by incremental revenues from the impact of its ownership change in East China, incremental revenues from 746 net new store openings over the past 12 months, and favorable foreign currency translation, partially offset by the absence of revenue related to the sale of its Singapore retail operations to a licensed partner in Q4 FY17 and a 1% decrease in comparable store sales.

Q3 FY18 operating income of $234.1 million grew 5% over Q3 FY17 operating income of $223.8 million. Operating margin declined 760 basis points to 19.0%, primarily due to the impact of its ownership change in East China.

Key activities in China

Starbucks hosted its first-ever China Investor Day in Shanghai on May 16, where the company announced plans to build 600 net new stores annually over the next five years in Mainland China – a goal that will double the market’s store count from the end of FY17 to 6,000 across 230 cities by FY22.

Check out details of Starbucks’ partnership with Alibaba here.