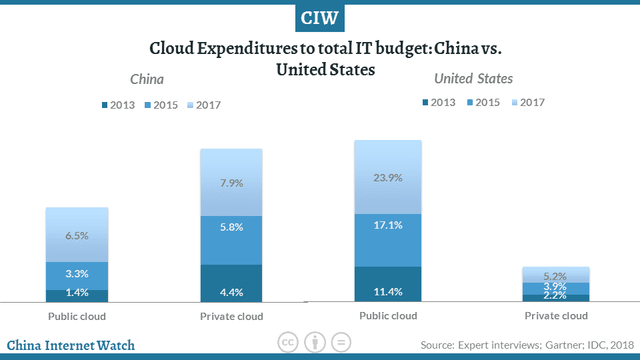

China devoted almost the same amount of expenditures to the public and private cloud in 2017. That differs a lot from the United States where public cloud took far more IT budgets versus private cloud.

But the public cloud is capturing market shares rapidly, the public-usage rates could rise more than 20% annually in the next three years running, according to McKinsey.

The revenue of China’s cloud market was 51.49 billion yuan (US$7.54 bn) in 2016, an increase of 35.9%, according to MIIT. Specifically, 34.48 billion yuan (US$5.05 bn) was from the private cloud (up by 25.1%) and 17.01 billion yuan (US$2.49 bn) was from the public cloud (up by 66.0%).

This market is estimated to reach 136.6 billion yuan (US$19.99 bn) by the end of 2020, largely driven by the two growth engines – IaaS and Saas.

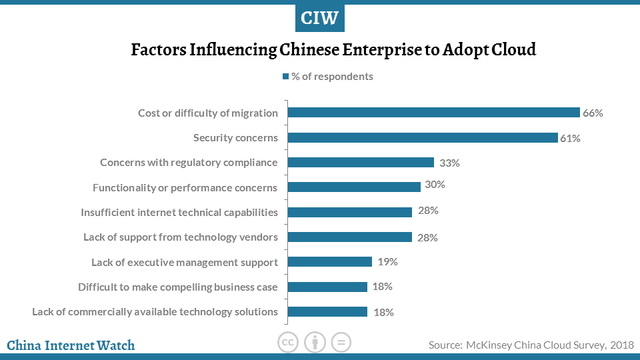

It’s not easy for Chinese enterprises to just move to cloud usage, most of them took the cost/difficulty of migration and security into top considerations.

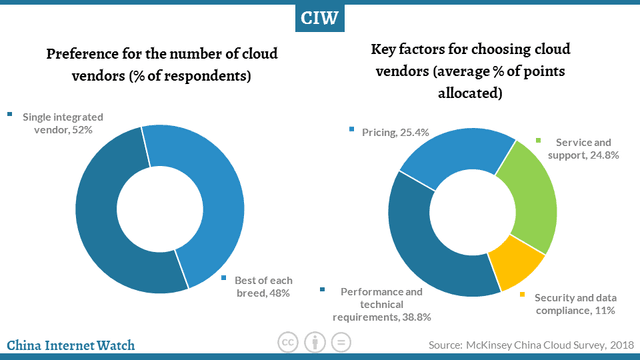

When selecting cloud vendors, 52% of respondents preferred a single integrated cloud vendor while 48% of them like the best of each breed. With regards to the factors that influence enterprises to choose cloud vendors, performance and technical requirements were the most important, pricing ranked second, closely followed by service and support.