For 12 weeks ending May 18, 2018, consumer spending on FMCG in China grow by 10.0% compared to the same period last year. Hypermarkets, supermarkets, and convenience stores are showing strong signs of recovery. Consumer spending grew by 10% YoY.

For 12 weeks ending May 18, 2018, consumer spending on FMCG in China grew by 10.0% compared to the same period last year, latest Kantar Worldpanel data showed. Modern trade (including hypermarkets, supermarkets, and convenience stores) is showing strong signs of recovery, with a growth of 4.1%, 1.2 points up compared to last year. In terms of regions, the East and West regions enjoyed a healthy growth at 11.0% and 11.3% respectively, whilst growth in the North remaining sluggish.

Kantar Worldpanel China continuously measures household purchases over 100 product categories including cosmetics, food and beverages, and the toiletry/household sector through its 40,000 sample families. Its national urban panel covers 20 provinces and four municipality cities (Beijing, Tianjin, Shanghai, and Chongqing).

The channels within its monitoring scope modern trade (supermarket, hypermarket, convenient stores), traditional trade (grocery, free market, wholesale), e-commerce, overseas shopping, direct sale, work unit/gifting etc. The goods under monitoring are those obtained for in-home consumptions.

Among the top retailers in modern trade, Walmart and Yonghui enjoyed the fastest growth on market share, up by 0.8 and 0.4 points respectively in the 12-week period compared to the same period last year. Both Walmart and Yonghui accelerated their progress on new retail format trial. Walmart deepened its cooperation with Tencent to optimize payment processes while Yonghui Super Species tested a drone delivery service in Guangzhou City, Guangdong Province.

The e-commerce channel grew by 32.0%, with 37.2% of households in urban China purchased FMCG online over the 12-week circle. Recently, RT-Mart together with Hema opened their first middle sized new retail store “HeXiaoMa” (盒小马) in Suzhou City, Jiangsu Province. The simplified Hema format has removed in-shop dining services.

Kantar Worldpanel’s data shows that there is a big potential to develop e-commerce business in lower-tier cities: 35.0% of households in county-level cities and 27.8% of households in counties purchased FMCG online in the latest 12 weeks, which is much lower than the 46.3% online penetration in key cities.

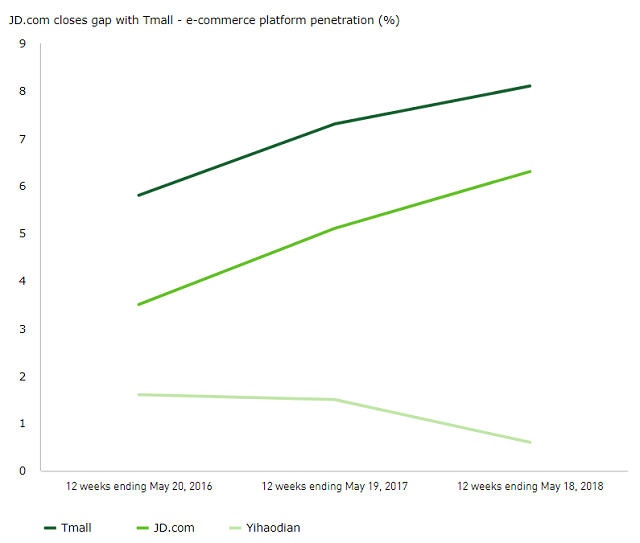

JD.com continued to narrow its gap with Tmall in penetration, with 6.3% of households shopping on JD in the 12 weeks. As e-commerce retailers have developed over the past few years, it’s become harder to gain a massive sales growth through purely price discounts.

Kantar Worldpanel has observed more campaigns to emphasize premiumization and joint online/offline activation during the recent mid-year “618 (June 18) Online Shopping Festival”. This will create new themes to engage consumers and stimulate consumer demands. Please watch this place for future FMCG data and reports.

This post was originally published on Kantar.com.