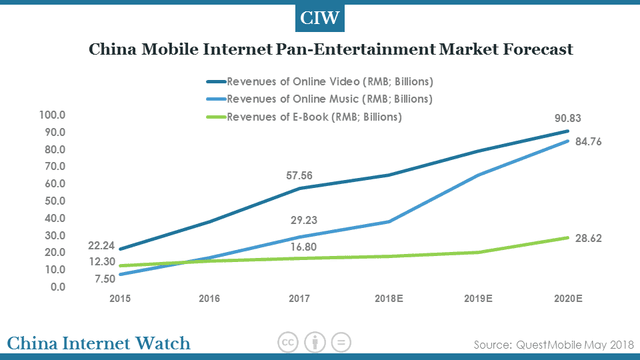

Online pan-entertainment market refers to online music, e-books, and online videos. The revenues of the online pan-entertainment market in China are derived primarily from paid users.

The Latest Data on China Online Entertainment Market

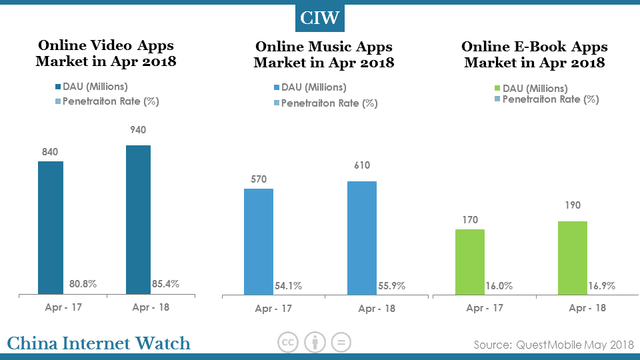

Comparing with online music and e-book, online video had the largest user base. The daily active users of online video reached 940 million, up by 11.9% from the same period last year.

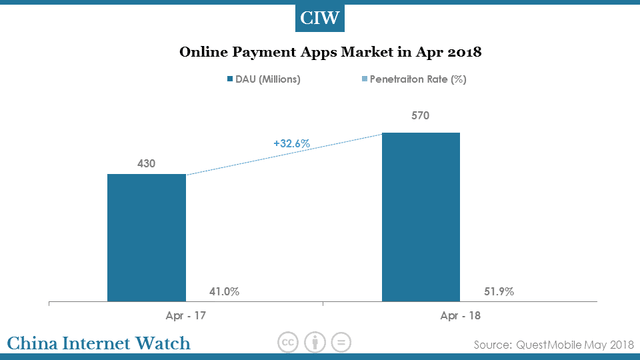

Online payment had 570 million active users.

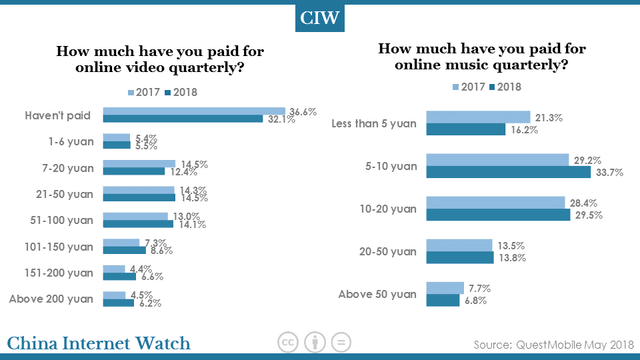

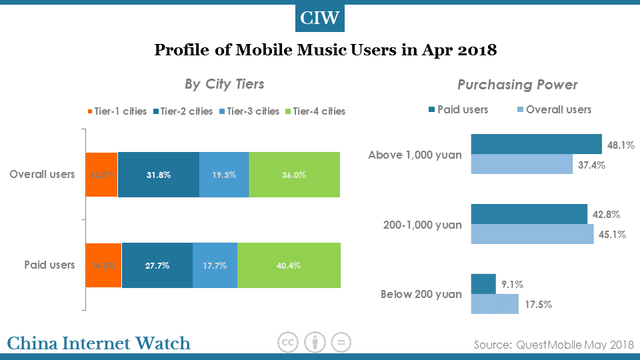

Online music users have a stronger willingness to pay for copyrighted music than online video users.

As of 2017, the revenues of online video reached 57.56 billion. Online music also shows a high growth trend with revenues up from only 7.5 billion in 2015 to 29.23 billion yuan.

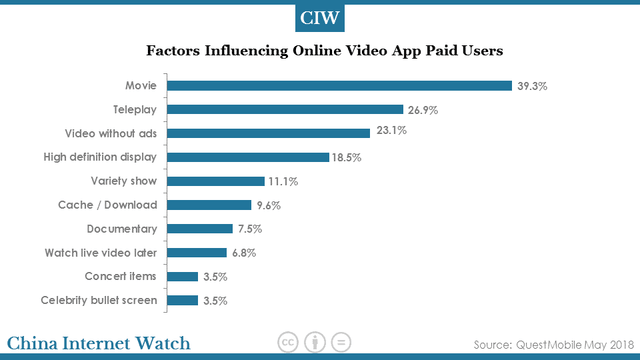

Movie, teleplay, and video with ads are three main factors to attract paid users.

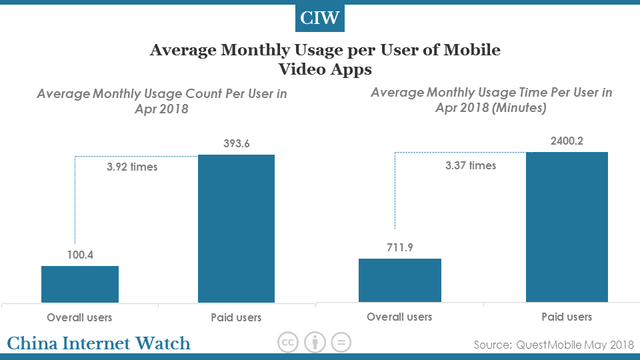

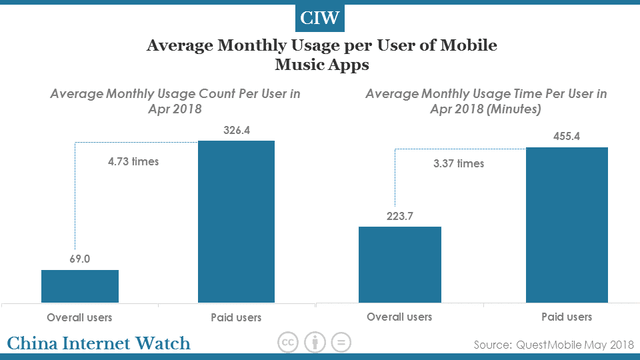

Paid users of mobile video apps show higher user stickiness than overall users. The average time spent of paid users on mobile video apps every month is 3.37 times higher than that of overall users.

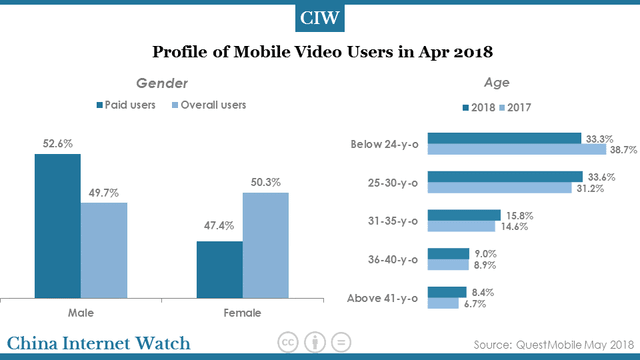

Young users are more willing to pay for favorite videos.

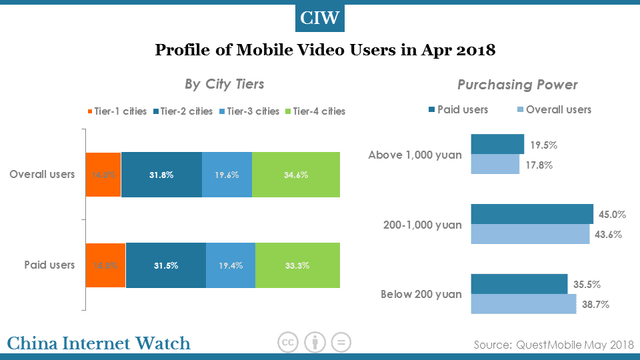

Users from tier-1 cities have higher purchasing power and are more likely to pay for videos.

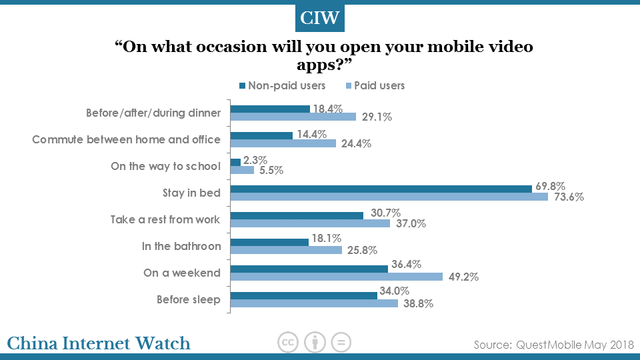

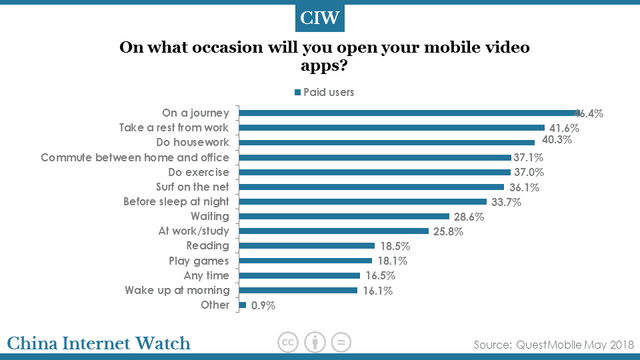

Apart from complete leisure time, users mainly use the fragmented time to watch videos. Paid users spend more time on watching videos on weekends than non-paid users.

Within this market, paid users equally open their mobile music apps 326.4 times, 4.73 times higher than that of overall users. Moreover, they equally spend 455.4 minutes on mobile music apps a month.

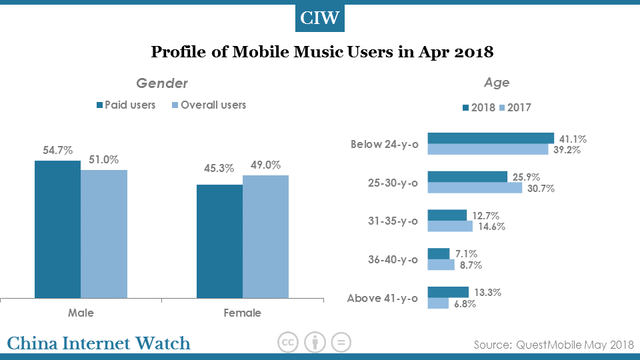

Male users and users aged under 24 or above 42 all tend to pay for favorite and high-quality music.

Paid users mainly come from tier-1 cities. However, users from tier-4 cities also show higher likeliness to pay for music.

Listening to music can be very relaxing and easy, hence, there are many usage scenarios for people to listen to music.

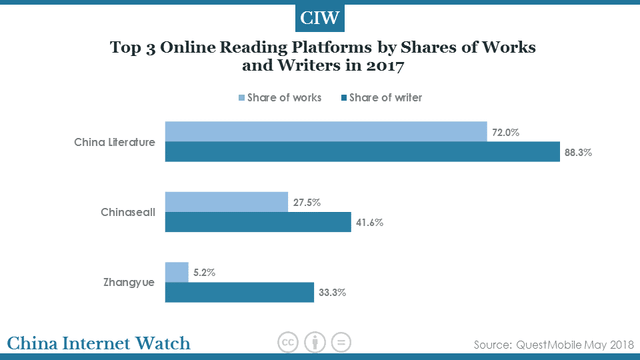

In order to acquire more literature content and IP, online reading platforms adopt a “revenue-sharing + buy out” model to earn copyright and good authors.

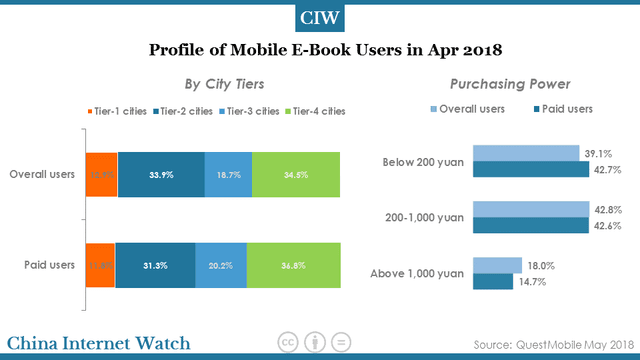

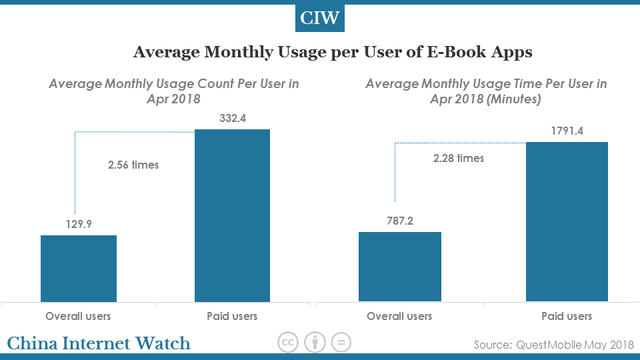

From the perspective of usage count and usage time, paid users of e-book apps show a higher user stickiness than overall users.

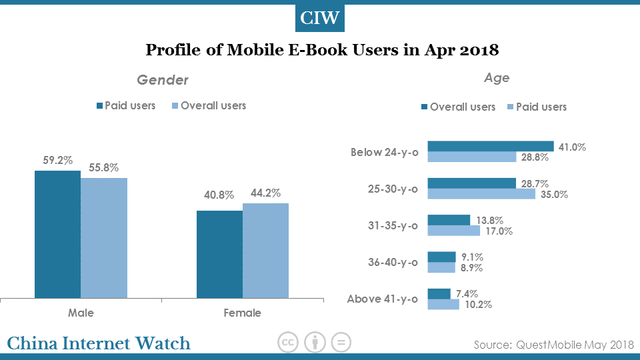

Nearly 60% of male users are paid users of e-book apps. Young users are more interested in binge-watching while elder users are more keen on reading.

Unlike users living in tier-1 and tier-2 cities, users from tier-3 and tier-4 cities have more leisure time and they are more interested in reading.