Kuaishou started to lead the short video market by reaching over 200 million MAU in November 2017.

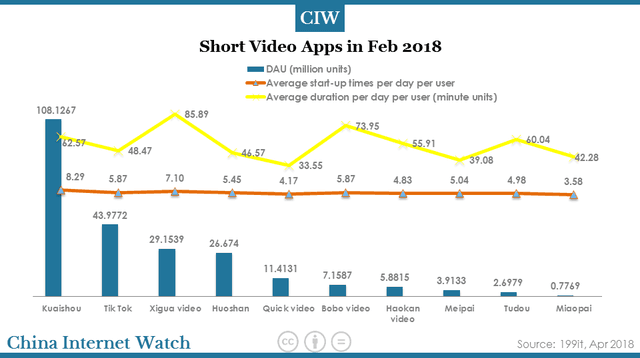

Tik Top, part of Toutiao, saw astonishing growth in MAU from September 2017. In February 2018, Kuaishou continued to dominate this market with DAU of exceeding 100 million, followed by Tik Tok.

Read our online entertainment market briefing to understand the latest about short video segment, Douyin, and Kuaishou.

Top traffic driver compared: TikTok/Douyin vs. Kuaishou vs. Bilibili vs. RED

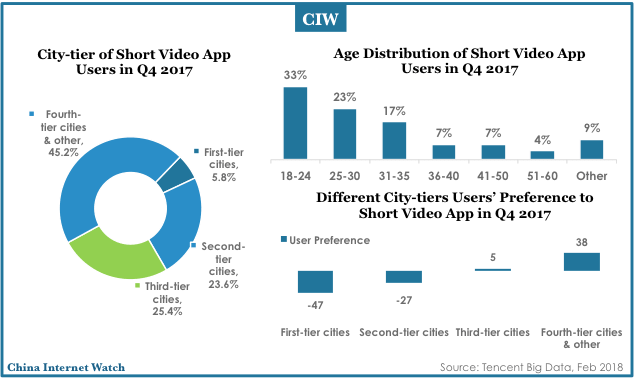

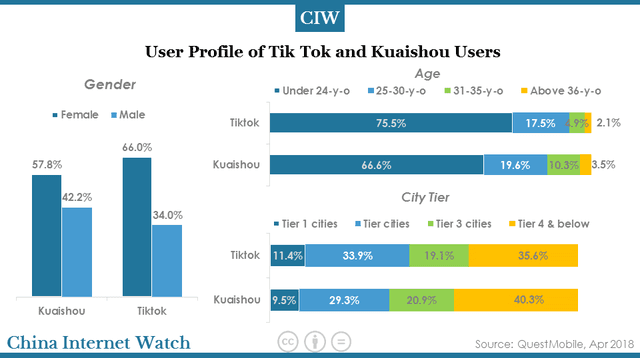

The majority of China’s short-video users (over 70%) is between 18 and 35 years-old and more are located in tier-3 and tier-4 cities than the top tier cities.

The DAU/MAU ratio of Kuaishou and Tik Tok both reached 0.45, which means each user equally launch Kuaishou/Tik Tok app almost every other day.

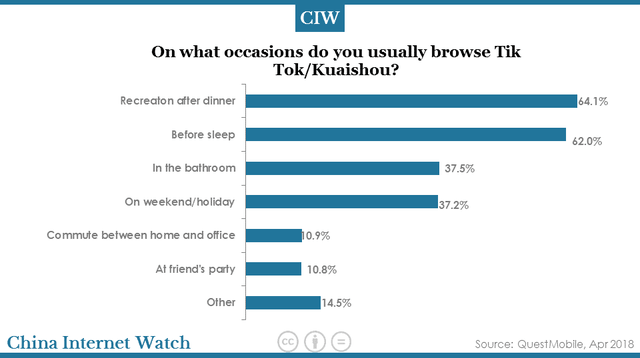

15 seconds short video is Tik Tok’s main product, which meets users’ need for fragmentation of the network transmission. Tik Tok users have a longer duration of the engagement. Around 30 million users opened Tik Tok at 9:00 and don’t turn it off until 23:00 at late night. It seems that only after they fell asleep did they stopped watching short videos.

In particular, after a meal and before sleep are peak periods for browsing Kuaishou and Tik Tok.

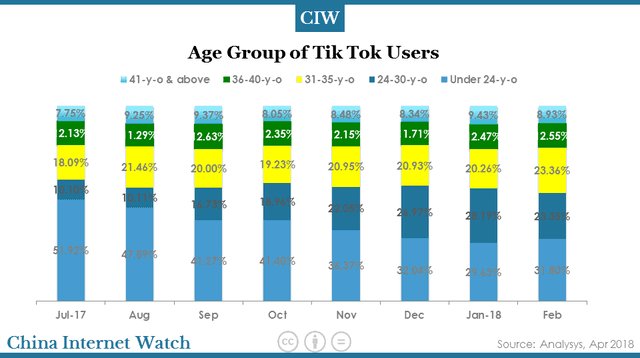

In February 2018, Tik Tok users aged 24-35 accounted for 46.71% of the total users on Tik Tok. Compared with users aged under 24 who were the majority in July 2017, they have higher income and consumption power. Moreover, users live in super tier 1 and tier 1 cities accounted for 63.87% of the total. Hence, it becomes easier for Tik Tok to achieve traffic monetization.

Female young users aged under 24 represent the majority of Kuaishou/Tik Tok users. Kuaishou had higher penetration rate than Tik Tok in fourth-tier cities or below while Tik Tok performed better in first and second tier cities than Kuaishou.

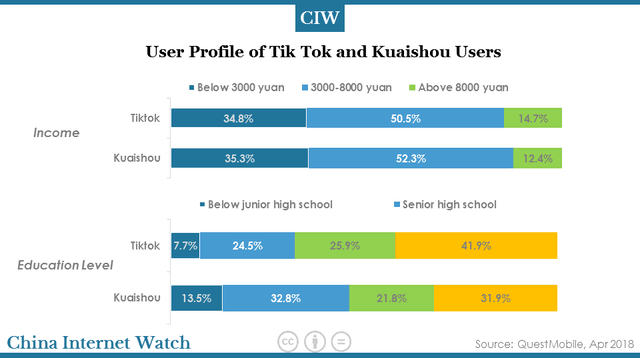

The number of users with a bachelor degree or above of Tik Tok was 10% more than that of Kuaishou. However, the income levels of the two short-video mobile apps were almost the same.

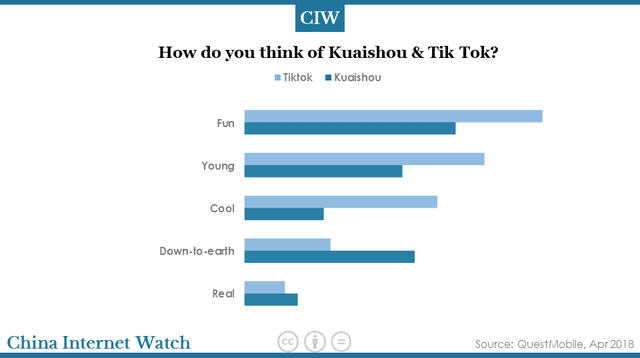

The most attractive elements of Kuaishou lie in its interesting and down-to-earth, versus fun, cool, and young elements of Tik Tok.

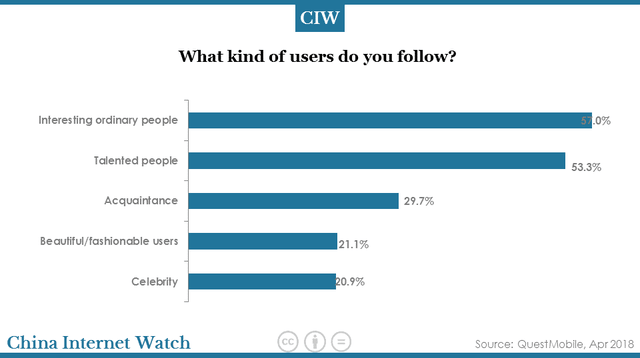

57% users of both apps follow interesting ordinary people; and, 53.3% users follow the talented. Currently, both Kuaishou and Tik Tok tend to offer more support and exposure to the interesting ordinary people.

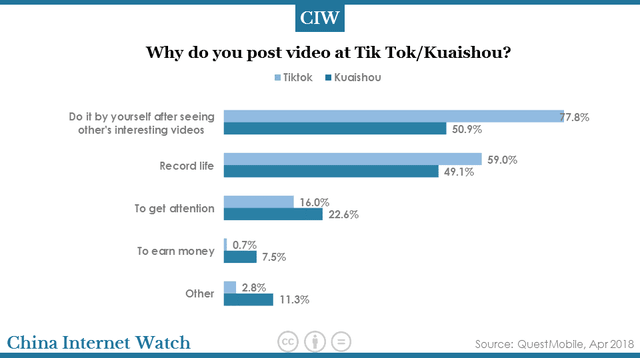

After seeing other users’ interesting videos, 77.8% of Tik Tok users would try to imitate the video by themselves compared with 50.9% Kuaishou users. The motivation of recording life on short video drives 59% Tik Tok users and 49.1% Kuaishou users to post a video.

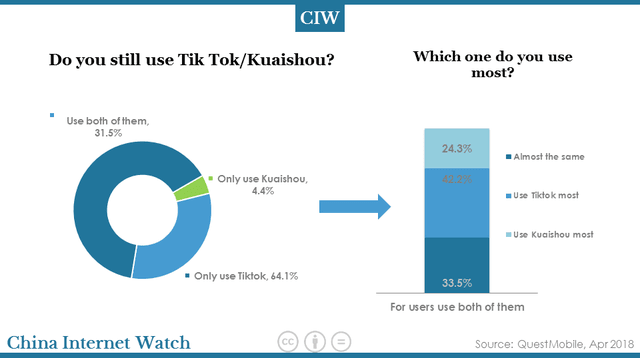

For users who had used both Kuaishou and Tik Tok, 15% of them uninstalled both of them. For users who have used both apps but eventually keep at least one of them, 4.4% of them choose Kuaishou while 31.5% of them choose Tik Tok.

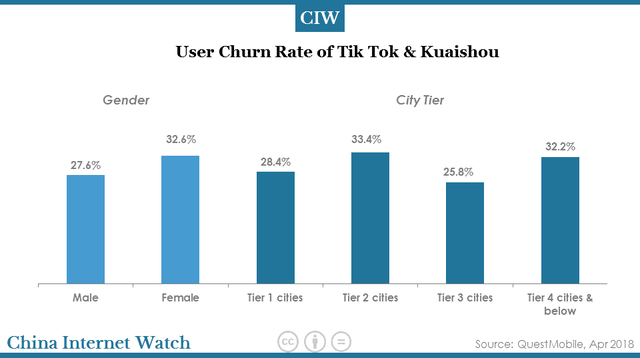

Both Kuaishou and Tik Tok saw higher user churn rate in female users than male ones, higher in the second- and fourth-tier cities or below than the first- and third-tier cities. Kuaishou loses most users in the second-tier cities compared with Tik Tok in fourth-tier cities or below.

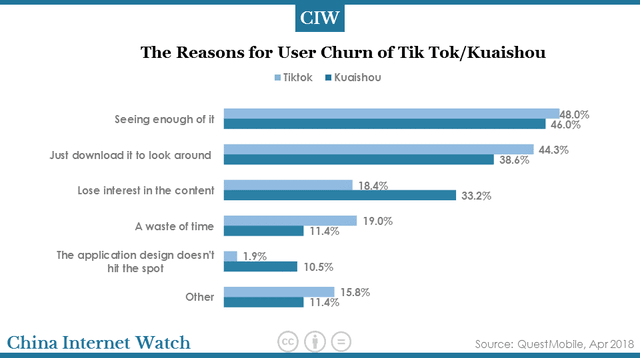

Compared with Tik Tok, users are more likely to leave Kuaishou for boring content or application design not hitting the spot.

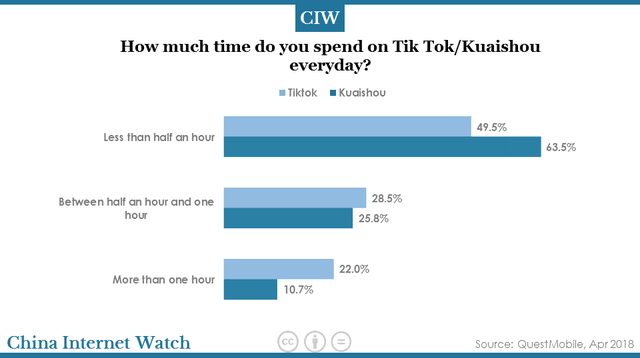

Users spend more time on Tik Tok.

Chinese influencer platforms: Weibo, Douyin, Kuaishou, Xiaohongshu