China’s growth of FMCG sales is weaker in Q1 2018 compared with previous quarters, while new retail accelerates the online and offline integration.

Kantar Worldpanel reports that the fast-moving consumer goods (FMCG) market in the first quarter of 2018 was relatively weak with value growing by just 2.3% in the latest 12 weeks compared to the same period in 2017. China’s GDP grew by 6.8% in the first quarter of 2018, which is consistent with the last two quarters in 2017.

In the full year of 2017, FMCG growth rate reached a three-year high of 4.3%.

Modern trade (including hypermarkets, supermarkets, and convenience stores) grew by only 0.9% in the first quarter of the year in China. Across city tiers, provincial capitals, prefecture-level cities, and county level cities enjoyed faster growth, up by 2.8% collectively. Across regions, the West region has seen the strongest growth, up by 4.6%.

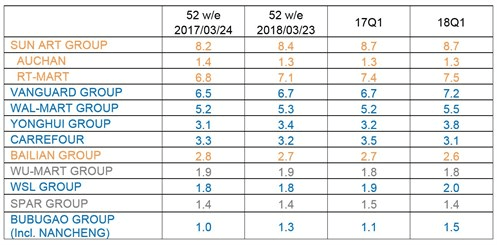

Leading Grocery Share of Modern Trade – National Urban China (%)

Note: Retailers in orange color are from Alibaba camp; retailers in blue are from Tencent camp.

Leading retailers taking sides either with Alibaba or Tencent

Among the top 5 retailers, Sun Art, Vanguard, and Walmart all strengthened their leading position and Yonghui surpassed Carrefour to be the No. 4 retailer in China.

As the only retailer in top 5 that enjoyed double-digit penetration growth, Yonghui’s share rose from 3.2% a year ago to 3.8% in the past 12 weeks in 2018. This performance has further been supported by the opening of 77 new stores in the first quarter of 2018. Yonghui has announced a bold plan to open 100 Yonghui Super Species and 1,000 Yonghui Life stores during 2018, with its O2O APP covering all its retail formats and 50% of overall business.

The first quarter of 2018 also witnessed the two Internet giants’ accelerated move into the offline world with various partnerships and acquisitions of key retailers.

The trend has continued into April when Vanguard Group announced its partnership with Tencent/JD. This would mean that the Tencent/JD camp would represent 21.7% share of the modern trade of FMCG. Further acquisitions are also being witnessed beyond the grocery sector, such as Alibaba’s full acquisition of Ele.me, the leading food delivery service, and investment into Easyhome, a home furnishing chain to broaden its offline reach and touch more areas of Chinese consumers’ lives.

E-commerce players trying to reinvent traditional trade

Kantar Worldpanel reported 26% growth in FMCG spends through e-commerce platforms in the first quarter of 2018. Both Tmall and JD.com are neck and neck in the B2C camp, yet YHD (acquired by JD.com in June 2016) experienced a continued loss of shoppers, with penetration falling from 1.5% last year to 0.6% in the latest quarter.

As e-commerce looks for new ways to drive traffic online, the key players are also turning to small format neighborhood stores and grocery stores.

In January, Tmall announced the opening of its first Tmall CVS in Hangzhou, transformed from a mom and pop shop. Alibaba applied big data and modern retail management system to help those traditional stores better optimize product procurement and assortment. JD.com also accelerated its pace in transforming the sector, with the ambitious plan in place to open 1,000 stores every day. Both are trying to extend their physical footprint to tap into lower-tier cities and rural areas where e-commerce penetration is still relatively low.

Check out new retail trend in China here or China’s luxury consumption trends in the new retail era.

This post was originally published on Kantar.com.