New energy vehicle is the hottest theme of this year’s Beijing Auto Show. Kantar TNS Auto expert summarizes major trends in this sector.

China is the world’s largest auto market. Its annual auto show, which is held in Shanghai and Beijing in turns, has become one of the most important events for the world’s auto industry. This year’s show is being held in Beijing’s China International Exhibition Centre, New Venue from April 25 till May 4.

Given that new energy vehicle is increasingly becoming mainstream in China, I noticed some major trends in this sector during my trip to the mega exhibition.

Many traditional automakers launched new plug-in hybrid electric vehicle (PHEV) models for today’s China market. Apparently, PHEV has become the main route towards the next phase of the new energy revolution in China.

Ford, for example, launched its first new energy vehicle for the Chinese market: Plug-in hybrid version New Mondeo. Chinese car maker Geely also unveiled plug-in hybrid sedan Borui GE, which is due to hit the market within this year. Compared with previous hybrid cars using gasoline engines to recharge batteries or to power the electric drive motors, plug-in hybrid vehicle represents a step towards a pure electricity driven car era.

Compared with plug-in hybrid electric vehicles, pure electric vehicles have made more noteworthy progress in designing. Previously, automakers have kept the external designs of new energy vehicles similar to gasoline versions – in some cases even exactly the same.

Now, pure electric vehicles, regardless from traditional car makers or disruptive newcomers, have more distinct exterior designs compared with fossil fuel-based vehicles.

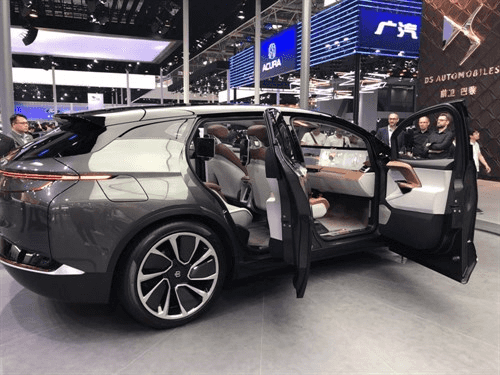

The body design and interior styling of electric cars distinctively emphasize on simplicity, streamlining and futuristic design, as well as fully loaded technology features, such as intelligent user-interface, connectivity, and self-driving features. Car makers wish to impress car buyers to provide them with easier, simpler, smarter but at the same time more customized services.

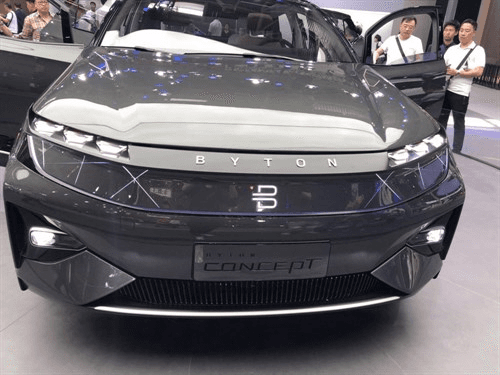

BYTON, one of the high-profile disruptive car makers and founded by a team led by former BMW senior executives, unveiled its CONCEPT car and became one of the most attractive new launches during the show.

In fact, traditional car makers are also rolling out sexy concept cars, such as ICON from Geely:

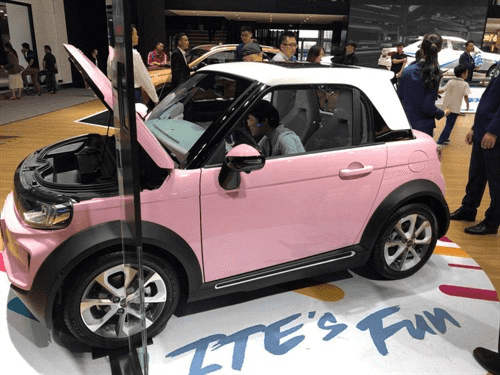

Pure electric vehicles have become more personalized: automakers are not rolling out just one or two models, but various models designed for very specific car buyer segments. BAIC, for example, displayed its two-seat pure electric LITE in 12 colors for 12 zodiac signs. It will also roll out models with different driving ranges to cater for the needs of different buyers, such as single buyers, the family of two or family with a small child.

Many businesses in China are expanding outside of their “native” industry, automakers are no exception. I have seen many automakers promoting their vehicles’ connectivity with “smart home” devices, as showcasing the benefits of automobiles connected with Internet of Things.

Dongfeng Motor displayed their vehicles’ ability to turn on air conditioners and water heaters at home within a certain pre-set distance. Geely displayed apps that could be installed on their in-car operating system and control devices at home and other locations. The examples demonstrated these automakers’ vision as how a connected car-home ecosystem can enhance life quality.

Many companies also displayed their solutions to tackle the biggest bottleneck preventing electric cars from taking off in China: power charging.

BAIC displayed a model “battery station” solution which can swap a used battery pack for a fully charged one within 2’30”. This echoes the direction of start-up Chinese pure electric maker NIO is taking. According to this model, electric car buyers won’t be buying battery packs. Instead, they pay for the usage of these batteries or rent it. It is possible that people will be charged at “battery stations” based on how much power they’ve used or distance they’ve driven on the battery packs being taken down.

For the pure electric vehicle, the latest models now can be charged up to 80% within 30 to 40 minutes in quick charging mode and fully charged to 100% within 6 – 8 hours in slow charging mode. Both modes are considerably shorter, especially quick charging mode, which used to take 1 to 2 hours. At the same time, most newly launched pure electric vehicles will have at least 500 kilometers of driving range.

At every major auto show in China, we can see many cool and sexy concept cars. But after quite a few “PPT auto start-up” busts here, which refers to start-ups trying to win investment and early buyers with nothing other than a nice presentation deck, we need to be more cautious. Let’s take a step back and think twice before being carried away.

It is true that China has gone a long way in new energy vehicle development, with traditional and disruptive automakers launching new concepts, new ecosystems or new theories one after another. But we also need to check how many of these fancy models eventually hit the streets.

A newcomer announced a pure electric SUV for 300,000 yuan. Another one promises to start to sell a pure electric racing car at 600,000 yuan to 1 million yuan range this June. We have to be patient and scrutinize which ones of these big promises are in the end delivered.

It doesn’t matter whether this automaker is new or long-existing, what matters is if this company can produce safe and efficient new energy cars that brings value to Chinese consumers. They are the true “new energy” to bring Chinese auto market forward.

This post was originally published on Kantar.com.