By the end of 2018, the global media investment industry is set to be worth over US$550 billion, according to GroupM. With this number growing and fast-moving consumer goods (FMCG) brands making up a quarter of that spend, understanding the impact of advertising is crucial.

Media investment vs sales

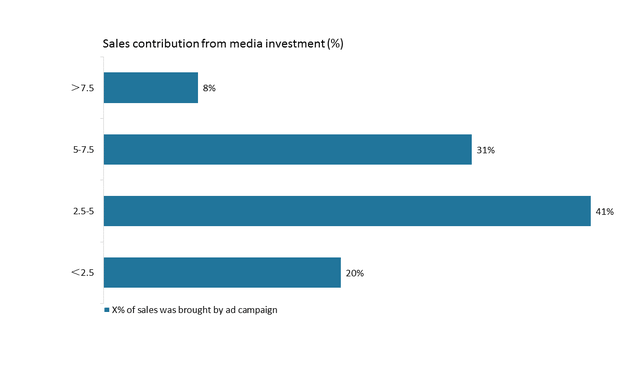

Kantar Worldpanel’s recent report Changing Media Success Measures showed that the short-term impact of any successful media campaign should be an uplift in sales. From our studies concentrating on the impact of media investment, we can see that, during a campaign, the average impact of advertising campaigns is 4.5% of the total sales of the FMCG brand during this period of time.

Or in other words, without the influence of the campaign, the sales of the brand during this period would have been 4.5% lower. (All effects are controlled by the presence of promotions, as well as the underlying equity or loyalty associated with each brand analyzed.)

Globally, only 8% of our researched ad campaigns had contributed more than 7.5% of total sales of their brands during campaigns.

How about the benchmarks in China? Kantar Worldpanel’s Consumer Mix Modelling has found that from 2016 till 2017, campaigns of FMCG brands have contributed an average of 4.0% of sales for their brands, lower than the global average. In 2017, the ratio was only 3.8%.

Category matters

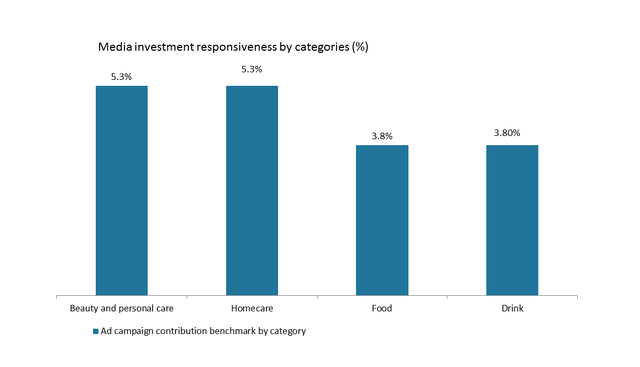

The contribution to sales provides key benchmarks—particularly at the sector level, where we see the biggest differences. With an average uplift 20% higher than the global benchmark, beauty, and personal care, and homecare brand campaigns are the most responsive to advertising. Food and drink brands, on the other hand, see an average uplift of 3.8%—14% lower than the global figure.

When looking at media campaigns, considering your sector benchmark is key.

New vs existing shoppers

Advertising’s effectiveness should be measured not just by financials, but on how many new shoppers it has brought into the brand.

Two campaigns that generate the same level of sales might appear identical, but when we look through the shopper lens we can understand its true success. By knowing how many new shoppers a brand campaign has attracted, we can see advertising’s long-term impact.

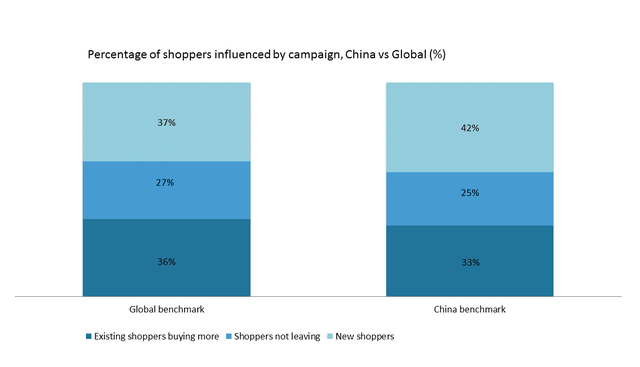

From the shoppers who have been influenced by a campaign, more than one in three (37%) are new*. New shoppers attracted to the brand because of its advertising are likely to be lighter buyers initially. They may be testing the brand against a competitor they usually buy or entering a category for the first time. Therefore, the long-term gain comes in the opportunity to keep them in the brand.

Alongside attracting the all-important new shoppers, media spending also benefits a brands penetration through stopping existing ones from leaving. We see on average over a quarter of shoppers not leaving a brand due to the ad campaign that person has seen.

This means that in total 64% of shoppers are having a positive impact on brand penetration when we combine the new with those not leaving.

The third element we capture is existing shoppers increasing their spend, with 36% of people during a campaign behaving this way.

In China, new shoppers’ proportion is higher than the global average (42% vs 37%), while not-leaving consumers (25% vs 27%) and buying-more consumers (33% vs 36%) are both lower than global benchmark. It means that keep recruiting new shoppers are especially important in China.

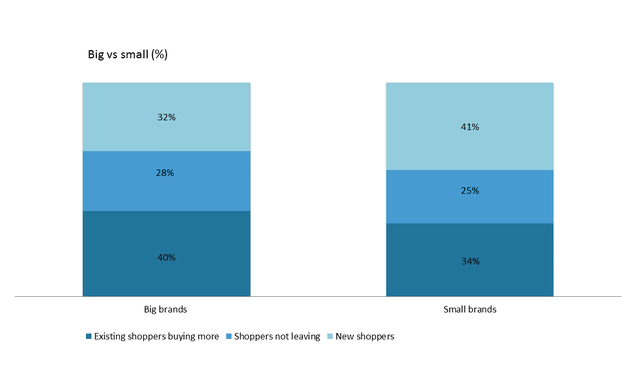

The mix of new versus retained shoppers is particularly important when we look at the differences between big and small brands, which have an almost identical sales uplift coming from media. Our data shows that big brands tend to get a much higher proportion of their media sales from existing shoppers buying more, whilst smaller brands benefit more from attracting new shoppers.

When benchmarking the success of a campaign, as well as considering the sector you play in, it’s important to think about the size of your brand.

Find out top-selling Taobao brands in 2017 here.

This post was originally published on Kantar.com.