Spending on fast moving consumer goods (FMCG) in China grows by 4.3% from a year ago, which is 0.7 percentage point higher than that in 2016 and the fastest in three years.

Kantar Worldpanel reports the spending in fast moving consumer goods (FMCG) in 2017 grew by 4.3% year on year, which is 0.7pt faster than 2016. This signals the end of the slowdown China has experienced over the recent years and gives optimism to FMCG manufacturers and retailers looking to expand their footprint and recruit even more shoppers in 2018.

Across all regions, the West and North regions reported a more upbeat trend, up by 6.0% and 4.7% respectively, contributing to the overall growth of China. Modern trade (including hypermarkets, supermarkets, and convenience stores) grew by 2.6%, while last year this channel grew only 1.6%. Leading modern trade retailers strived to introduce new business models as well as O2O (online to offline) initiatives to actively meet the demand of Chinese shoppers in the “New Retail Era”.

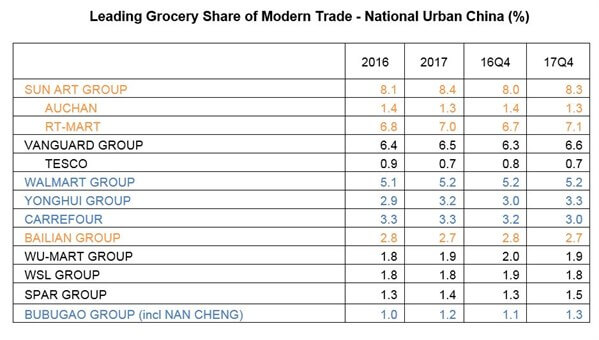

Most top players getting stronger

Most of the top retailers in China performed strongly in 2017, thanks to both new store openings and expanding their format portfolio. Sun Art group continued to strengthen its position, growing their share from 8.1% to 8.4% on annual basis, while Yonghui remained the fastest growing player, with 0.3 share point increase year on year.

Armed by its new Super Species format (supermarket + fine dining) and YH Life (neighborhood store + O2O delivery), Yonghui went from strength to strength, overtaking Carrefour and becoming the fourth largest retailer on the Chinese mainland in the last quarter of 2017. Amongst the regional players, Bubugao Better Life, Wumart and SPAR continued to outperform their peers through aggressive regional expansions and their embracing of new retail initiatives. International retailers as a group further weakened in 2017, with share reduced from 11.1% in 2016 to 10.3% in 2017.

Last year, tech giants Alibaba and Tencent were moving from the online world to the offline world by putting their investment into the heated retail battle between supermarkets. By end of 2017, the Tencent/JD camp (including Yonghui, Carrefour, BuBuGao, and Walmart) reported 12.8% share, higher than 11.1% recorded by Alibaba camp (Sun Art and Balian). Both giants are embarking on the active transformation of the Chinese retail infrastructure in a number of different ways.

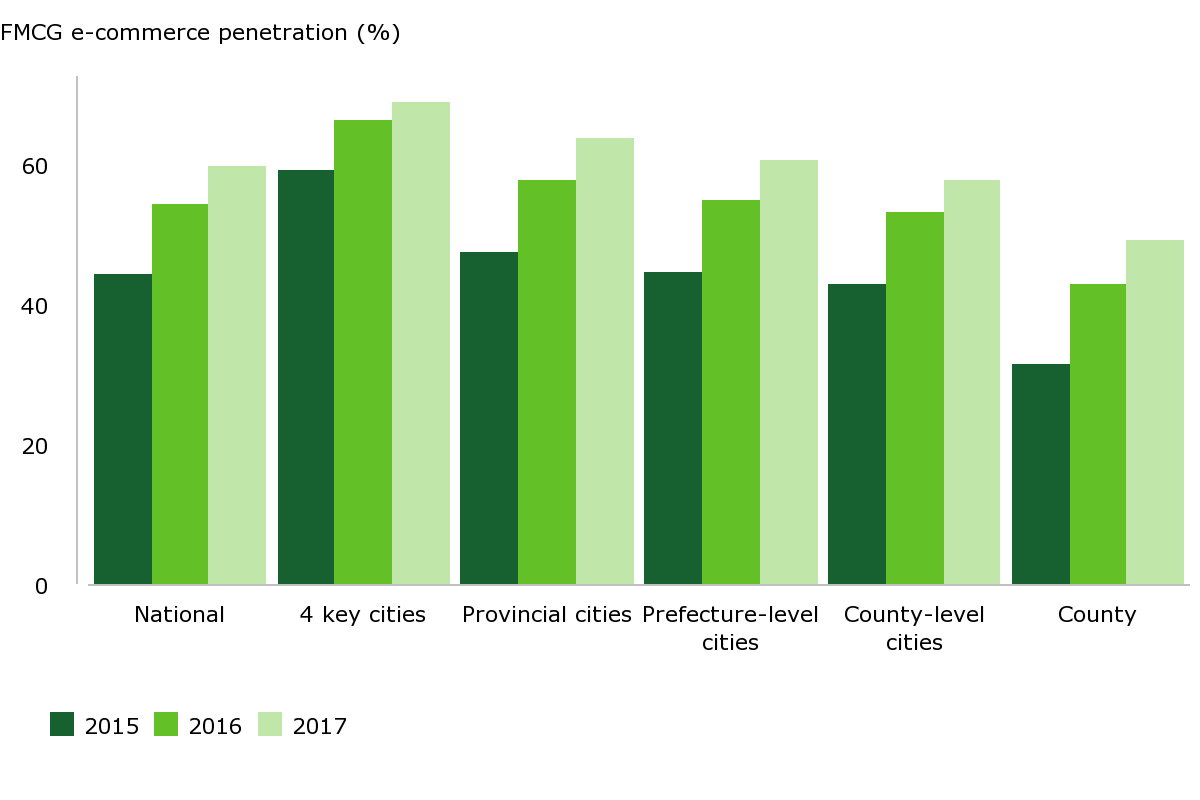

60% of urban families buy FMCG online

Kantar Worldpanel reported a strong growth of 29% in FMCG spend by e-commerce year on year. In 2017 60% of China urban families purchased FMCG online, 5.4 percentage points higher than the previous year. In Key cities, almost 70% of households purchase FMCG online. Furthermore, higher frequency also contributed to the growth as online shopping becomes more of a routine in consumers’ lives, fuelled by the rapid growth of mobile e-commerce. In 2017, shoppers purchased FMCG from e-commerce on average 7 times a year.

What is in store for 2018?

1. Further integration between online and offline

The China retail market will see more equity investments from e-commerce & tech giants such as Alibaba, Tencent, and JD. The integration is set to help accelerate the recovery of modern trade, by directing consumer traffic back to the brick and mortar stores and utilizing the distribution network to deliver to consumers in a faster and more cost-efficient manner. The integration will also see offline stores carrying the best-selling merchandise from e-commerce platforms, as is evident from RT-mart’s recent listing of best-selling items from Tmall, as well as the optimization of assortment in grocery stores empowered by Tmall and JD.

2. Fresh food as super entry point and growth engine

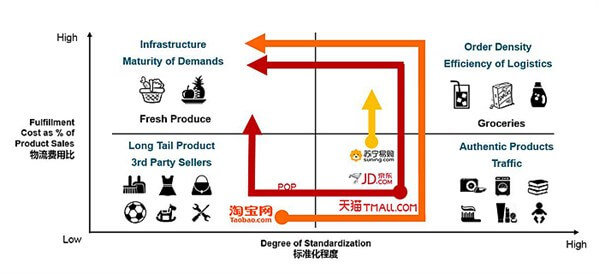

According to Kantar Retail’s analysis, e-commerce’s expansion roadmap should follow this logic:

1) Start from categories of a low degree of standardization and the low proportion of fulfillment cost against total product sales (such as long tail products sold by massive numbers of small third-party online sellers). This was marked by the birth of Taobao.com, also now the expansion direction of JD.com;

2) Enter categories of a high degree of standardization and preference for authentic products as well as a low proportion of fulfillment cost against total product sales (such as digital gadgets, home appliances, cosmetics, parenting and infant products). This was marked by the birth of Tmall, JD.com, and Suning.com;

3) Expand to categories of a high degree of standardization as well as a high proportion of fulfillment cost against total product sales (such as packaged foods, especially high frequency purchasing items like drinks, which require efficient logistics system). This was where Yihaodian began its business and where Tmall and JD.com are both fighting for;

4) The last categories are those of low degree of standardization as well as a high proportion of fulfillment cost against total product sales, which means fresh groceries. At this phase, the logistics infrastructure and consumers’ demands are mature.

Kantar Worldpanel reports that the spend in fresh food in the latest 52 weeks ending November 2017 grew by 38% in e-commerce channels, as more fresh food specialists are expanding their logistic capability and assortment to attract more online shoppers. Given its high frequency and essential role in the grocery basket, fresh food is a key destination category for both brick & mortar retailer and e-commerce giants. As Hema aggressively expanded its franchise nationally and JD launched its 7 Fresh formats, more traditional retailers are following suit to fight for the most resilient consumer demand. The battle will intensify in 2018, as more focus is put on fresh to fight for a bigger slice of pie.

3. Innovative store formats to be deployed and expanded

The pure big-box format in China struggled to grow amongst younger middle-class shoppers as the result of an increase in the more appealing hybrid concept formats. While the Hema model will be increasingly duplicated, unmanned stores are the new favorites with investors although scalability and profitability remain questionable. Dmall APP + physical store network will expand to more retailers, helping them to capitalize existing store assets through tech empowerment.

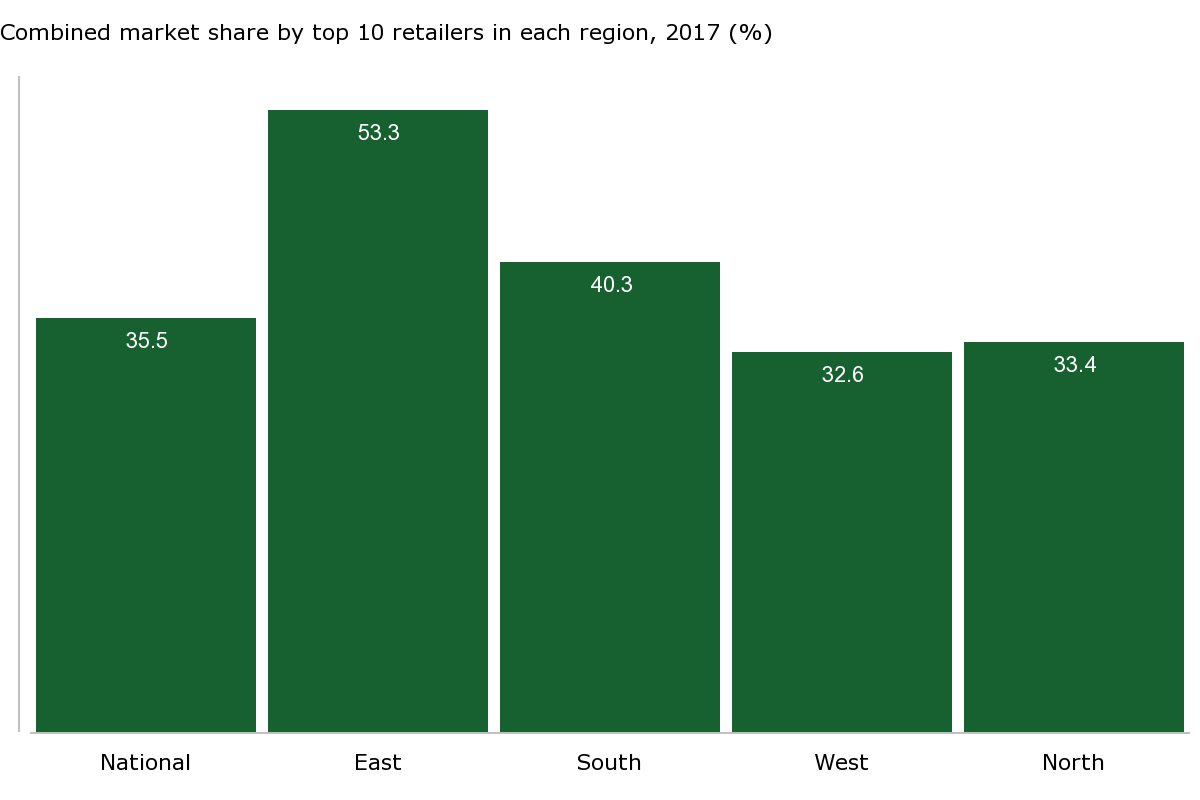

4. Regional players will seek more alliance

At regional or provincial level, the FMCG market remained fragmented and this indicates more room for cross-provincial expansion and acquisition. With its investment in Zhongbai and Hongqi, Yonghui was able to expand its presence into adjacent provinces where local market leaders dominate. SPAR, on the other hand, developed more franchises in Hebei and Yunnan over the past two years, as well continuing its organic expansion within its existing partners’ territories. In China, the West and North regions see more opportunities for further consolidation.

5. Social commerce will drive content-based shopping

The rise of WeChat, not just as a messaging app, but as a place where people shop online, is one to watch in 2018. In 2017, the WeChat channel achieved a staggering 52% growth and accounted for 1.4% of FMCG spending according to Kantar Worldpanel.

Though still relatively small, it represents a promising growth engine as Tencent began a serious push to open up its platform for developers to build e-commerce stores and a wide range of online services. As WeChat’s wallet allows users to seamlessly make an in-app purchase and social networking allows users to influence each other’s buying decisions, social commerce is also expected to facilitate sales conversion for all stores.

Cross-border online shopping trends in China 2018

This article was originally published on Kantar.com