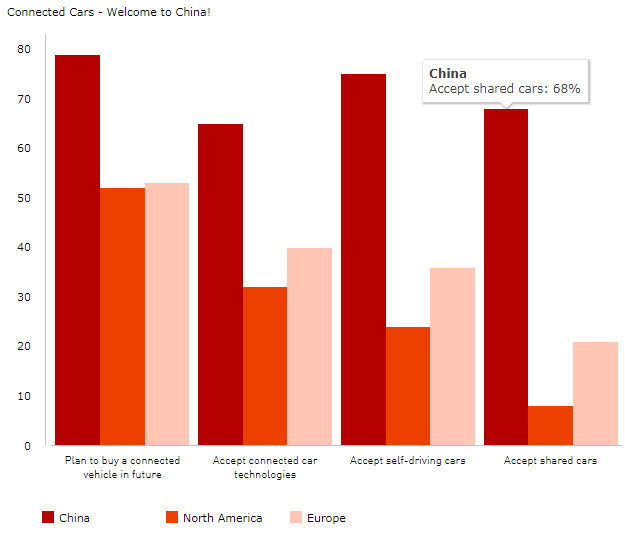

Kantar TNS Auto survey shows Chinese consumers are more willing to buy connected cars as well as more ready to accept self-driving cars, shared cars and new energy cars.

Chinese consumers have the strongest appetite for connected vehicle purchases: 79% of surveyed Chinese consumers said they plan to buy a connected vehicle in future, higher than North America’s 52% and Europe’s 53%. Both in America and Europe, 64% of those potential buyers will look to their car dealers for guidance on emerging technologies.

However, only 25% of Chinese consumers will consult dealers. Apparently, online communication is pivotal to the connection between Chinese car buyers and auto brands. China is one of the most digitally advanced countries in the world, so brands have to draft their multi-channel marketing strategies here.

China is the most promising land for connected vehicles: 65% of Chinese consumers accept connected car technologies, compared with 40% in Europe and 32% in North America. Chinese consumers are also more willing to try out entertainment and information services, such as social media as well as video and music in their vehicles.

Other formats of connected car features are also more welcomed in China. For example, 75% Chinese accept self-driving cars, compared with only 24% in North America and 36% in Europe; 79% Chinese accept pure electronic vehicle or hybrid vehicle, compared to 53% in Europe and 29% in North America. Shared car services are accepted by 68% of Chinese consumers, while only 21% in Europe and 8% in North America.

A gap too far

Though the prospect looks promising, there is a big gap between the future and the reality: Globally, our survey has found that 25% of car owners are not actively using their connected car’s features, and 11% don’t even know if their vehicle has them.

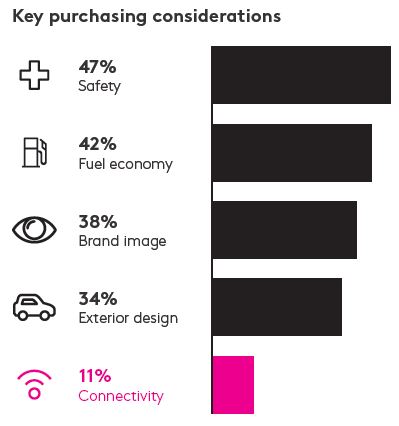

Currently, traditional elements still dominate the ranking of key car purchasing considerations, such as “safety” (47%) and “fuel economy” (42%). Only 11% global surveyed consumers mention “connectivity”.

In fact, more than half (56%) of drivers who accessed these services at the time of car purchase either don’t plan to, or are unsure whether they will renew them in the future.

Connection failure

The findings make clear that auto brands are struggling to convince owners of “connected” benefits despite having invested vast amounts of capital to embed new technologies and services into their vehicles.

For many owners, new tech offerings are still seen as an optional extra and not an intrinsic part of the vehicle. This highlights a perception gap given the role that technology and connectivity can play in the vehicle’s performance, safety and the driving experience.

The study also finds that 52% of respondents would pay for driver-related services such as navigation features – a figure which falls drastically to 26% for entertainment features where buyers often prefer to use well-known apps on smartphones.

Globally, premium brand owners appear to be early adopters of connected features, with a higher proportion of premium owners willing to pay for connected features when compared with mainstream brand vehicle owners. For example, 52% of all car owners said they’d be willing to pay for navigation features. Among premium car owners that number rises to 72%

The trust equation

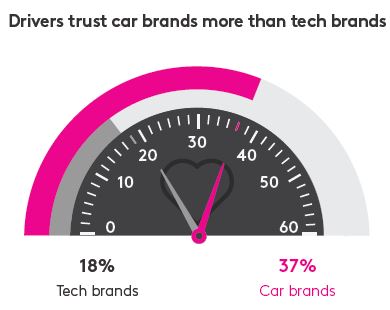

Auto brands are in a strong position when it comes to perceptions of safety and security, as they enjoy significantly more trust than other tech companies – 40% of consumers trust car brands with their data compared with 10% for companies such as Google and Facebook.

Aside from security and privacy, demonstrating how technology can improve driver and passenger safety will also appeal to consumers – with 43% of the users of connected features globally saying it is an attractive feature.

Show the benefit

In the minds of many car owners, connectivity is complex. Rather than following the “build it and they will buy” model, auto brands have an opportunity to grow their market share by simplifying their features, aligning them with the core customer wish list and by communicating the benefits more effectively within their existing marketing channels.

In mature markets such as the United States, it’s clear that for now, dealer networks still have a big role to play here as trusted players in the path to purchase. But in China, consumers are more comfortable with a multiple touchpoint purchasing path. So brands have to give online channel higher priority to secure a place in future China.

This article was originally published on Kantar.com